Microstructure trading focuses on exploiting short-term price patterns and liquidity dynamics within financial markets by analyzing order flow, bid-ask spreads, and transaction costs. Momentum trading relies on identifying and capitalizing on sustained trends by purchasing assets showing upward price momentum or selling those with downward momentum. Explore the distinct strategies, risks, and tools involved in microstructure and momentum trading to enhance your market approach.

Why it is important

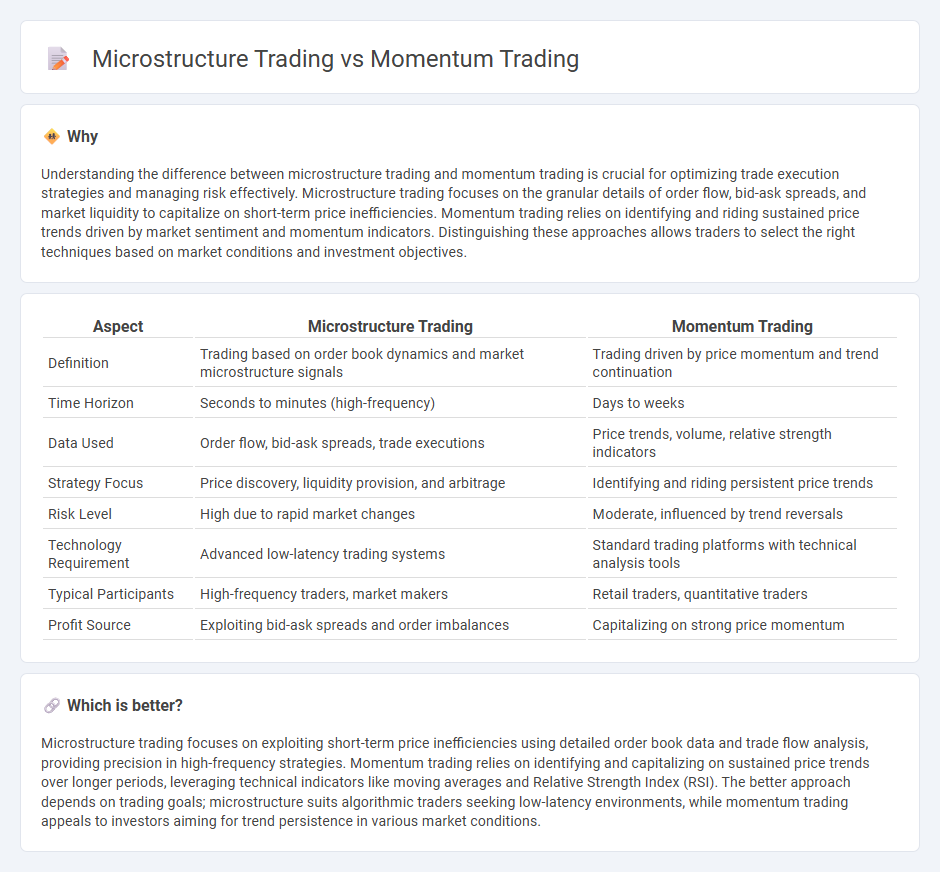

Understanding the difference between microstructure trading and momentum trading is crucial for optimizing trade execution strategies and managing risk effectively. Microstructure trading focuses on the granular details of order flow, bid-ask spreads, and market liquidity to capitalize on short-term price inefficiencies. Momentum trading relies on identifying and riding sustained price trends driven by market sentiment and momentum indicators. Distinguishing these approaches allows traders to select the right techniques based on market conditions and investment objectives.

Comparison Table

| Aspect | Microstructure Trading | Momentum Trading |

|---|---|---|

| Definition | Trading based on order book dynamics and market microstructure signals | Trading driven by price momentum and trend continuation |

| Time Horizon | Seconds to minutes (high-frequency) | Days to weeks |

| Data Used | Order flow, bid-ask spreads, trade executions | Price trends, volume, relative strength indicators |

| Strategy Focus | Price discovery, liquidity provision, and arbitrage | Identifying and riding persistent price trends |

| Risk Level | High due to rapid market changes | Moderate, influenced by trend reversals |

| Technology Requirement | Advanced low-latency trading systems | Standard trading platforms with technical analysis tools |

| Typical Participants | High-frequency traders, market makers | Retail traders, quantitative traders |

| Profit Source | Exploiting bid-ask spreads and order imbalances | Capitalizing on strong price momentum |

Which is better?

Microstructure trading focuses on exploiting short-term price inefficiencies using detailed order book data and trade flow analysis, providing precision in high-frequency strategies. Momentum trading relies on identifying and capitalizing on sustained price trends over longer periods, leveraging technical indicators like moving averages and Relative Strength Index (RSI). The better approach depends on trading goals; microstructure suits algorithmic traders seeking low-latency environments, while momentum trading appeals to investors aiming for trend persistence in various market conditions.

Connection

Microstructure trading analyzes market mechanisms and order flow to exploit short-term price patterns, which directly inform momentum trading strategies by identifying persistent price trends. Momentum trading capitalizes on the continuation of asset price movements, relying on microstructure insights about liquidity and trade execution to time entry and exit points effectively. Together, they integrate real-time market data and behavioral patterns, enhancing the accuracy of momentum signals in high-frequency trading environments.

Key Terms

Momentum Trading:

Momentum trading capitalizes on the continuation of existing market trends by analyzing price movements and volume data to identify securities with strong upward or downward momentum. Traders using this strategy rely heavily on technical indicators such as moving averages and relative strength index (RSI) to time entry and exit points, aiming for rapid gains during trend persistence. Explore more about momentum trading techniques and how they compare to microstructure trading to refine your trading strategy.

Trend

Momentum trading capitalizes on existing price trends by identifying and following strong directional movements in the market, often relying on technical indicators such as moving averages and relative strength index (RSI). Microstructure trading, however, focuses on the granular details of market dynamics, including order flow, bid-ask spreads, and trade execution patterns, aiming to exploit short-term inefficiencies within the trend. Explore this detailed comparison to enhance your strategy knowledge and optimize your trading approach.

Relative Strength Index (RSI)

Momentum trading leverages the Relative Strength Index (RSI) to identify overbought or oversold conditions, aiming to capitalize on sustained price trends by entering trades when RSI crosses key thresholds like 70 or 30. Microstructure trading utilizes RSI within the context of order flow and market depth, refining signals to optimize entry and exit points based on short-term price momentum and liquidity nuances. Explore detailed strategies and comparative analyses to deepen understanding of RSI applications in both trading styles.

Source and External Links

Momentum Trading: Types, Strategies and More - Part I - Momentum trading involves buying or selling assets based on recent price trends, primarily using two types: time-series momentum, where assets are bought if they exceed a profit threshold over a set period, and cross-sectional momentum, where assets are ranked and selected based on relative performance within a group.

Momentum Trading: Types, Strategies, and More - QuantInsti Blog - This source explains momentum trading as buying or selling based on strong recent trends, differentiating between time-series momentum (focused on individual asset historical gains) and cross-sectional momentum (focused on relative asset ranking), both aiming to capitalize on price trends.

Momentum Trading for Beginners (What They Don't Teach You) - A practical video guide to momentum trading that covers key concepts such as why momentum trading works, technical indicators like RSI and MACD, momentum candle strategies, and risk management for trading momentum-based setups in stocks, crypto, and forex.

dowidth.com

dowidth.com