Risk reversal involves buying a call option and selling a put option to hedge or speculate on upward price movement without upfront cost, offering asymmetric risk-reward. Synthetic long positions replicate the payoff of owning the underlying asset through options strategies, typically by combining a long call with a short put at the same strike and expiration. Explore the nuances of risk reversal versus synthetic long to enhance your options trading strategies.

Why it is important

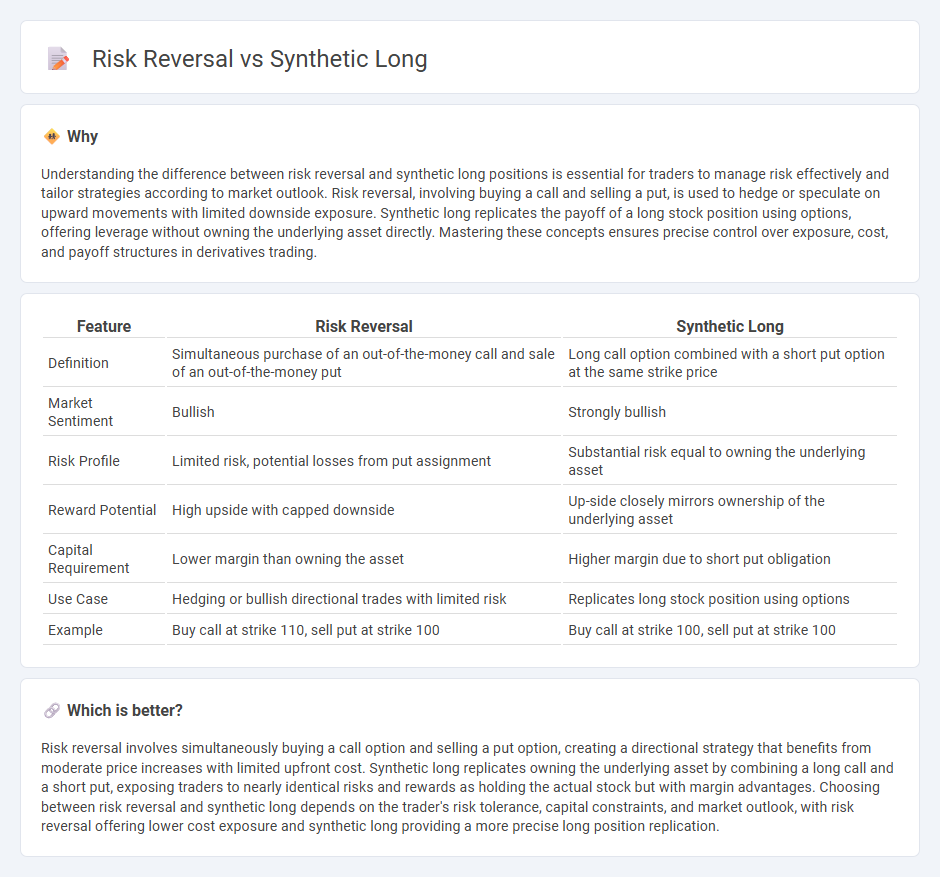

Understanding the difference between risk reversal and synthetic long positions is essential for traders to manage risk effectively and tailor strategies according to market outlook. Risk reversal, involving buying a call and selling a put, is used to hedge or speculate on upward movements with limited downside exposure. Synthetic long replicates the payoff of a long stock position using options, offering leverage without owning the underlying asset directly. Mastering these concepts ensures precise control over exposure, cost, and payoff structures in derivatives trading.

Comparison Table

| Feature | Risk Reversal | Synthetic Long |

|---|---|---|

| Definition | Simultaneous purchase of an out-of-the-money call and sale of an out-of-the-money put | Long call option combined with a short put option at the same strike price |

| Market Sentiment | Bullish | Strongly bullish |

| Risk Profile | Limited risk, potential losses from put assignment | Substantial risk equal to owning the underlying asset |

| Reward Potential | High upside with capped downside | Up-side closely mirrors ownership of the underlying asset |

| Capital Requirement | Lower margin than owning the asset | Higher margin due to short put obligation |

| Use Case | Hedging or bullish directional trades with limited risk | Replicates long stock position using options |

| Example | Buy call at strike 110, sell put at strike 100 | Buy call at strike 100, sell put at strike 100 |

Which is better?

Risk reversal involves simultaneously buying a call option and selling a put option, creating a directional strategy that benefits from moderate price increases with limited upfront cost. Synthetic long replicates owning the underlying asset by combining a long call and a short put, exposing traders to nearly identical risks and rewards as holding the actual stock but with margin advantages. Choosing between risk reversal and synthetic long depends on the trader's risk tolerance, capital constraints, and market outlook, with risk reversal offering lower cost exposure and synthetic long providing a more precise long position replication.

Connection

Risk reversal and synthetic long positions are connected through their similar payoff profiles in options trading. A risk reversal strategy involves simultaneously buying a call option and selling a put option, mimicking the payoff of owning the underlying asset without actual ownership. Synthetic long positions replicate this by combining options contracts to create exposure equivalent to holding the asset, providing traders with alternatives to direct stock investment.

Key Terms

Options Strategies

Synthetic long consists of buying a call option and selling a put option at the same strike price, replicating the payoff of owning the underlying asset with limited capital outlay. Risk reversal involves simultaneously selling a put option and buying a call option at different strike prices, often used to hedge downside risk while maintaining upside potential in volatile markets. Explore detailed comparisons and strategic applications to optimize your options trading approach.

Delta Exposure

Synthetic long positions replicate the payoff of owning the underlying asset by combining options, typically a long call and a short put, resulting in positive delta exposure similar to holding the stock. Risk reversal strategies involve simultaneously buying an out-of-the-money call and selling an out-of-the-money put, creating directional exposure that varies with strike prices but generally maintains a bullish delta profile. Explore further insights into delta hedging and risk management techniques to optimize options trading strategies.

Hedging

Synthetic long positions combine long call and short put options to replicate stock ownership, providing leveraged exposure with limited capital outlay. Risk reversal strategies involve buying a call and selling a put to hedge downside risk while maintaining upside potential, commonly used to protect portfolios during volatile markets. Explore comprehensive guides to understand how these hedging techniques can optimize risk management in your investment strategy.

Source and External Links

Synthetic Long Asset - A synthetic long asset is an options trading strategy that mimics a long stock position by buying at-the-money calls and selling an equivalent number of at-the-money puts with the same expiration, offering unlimited profit potential and significant risk with less capital required than buying shares outright.

Guide to Synthetic Longs - A synthetic long combines a long call and a short put at the same strike price and expiration to replicate a long stock position, allowing bullish investors to gain upside leverage with less capital but entails substantial downside risk if the stock falls.

Synthetic Long Stock - This strategy simulates a long stock position by holding a long call and short put with the same strike and expiration, offering similar risk and reward to holding the stock but without shareholder rights and is limited by the options' expiration.

dowidth.com

dowidth.com