Smart Money Concepts focus on analyzing institutional trader behavior and market manipulation patterns, leveraging order flow and liquidity zones to anticipate price movements. Elliott Wave Theory, on the other hand, relies on identifying repetitive wave patterns and market cycles driven by investor psychology to predict trend reversals and continuations. Discover more about how these powerful trading methodologies can enhance your market analysis and decision-making strategies.

Why it is important

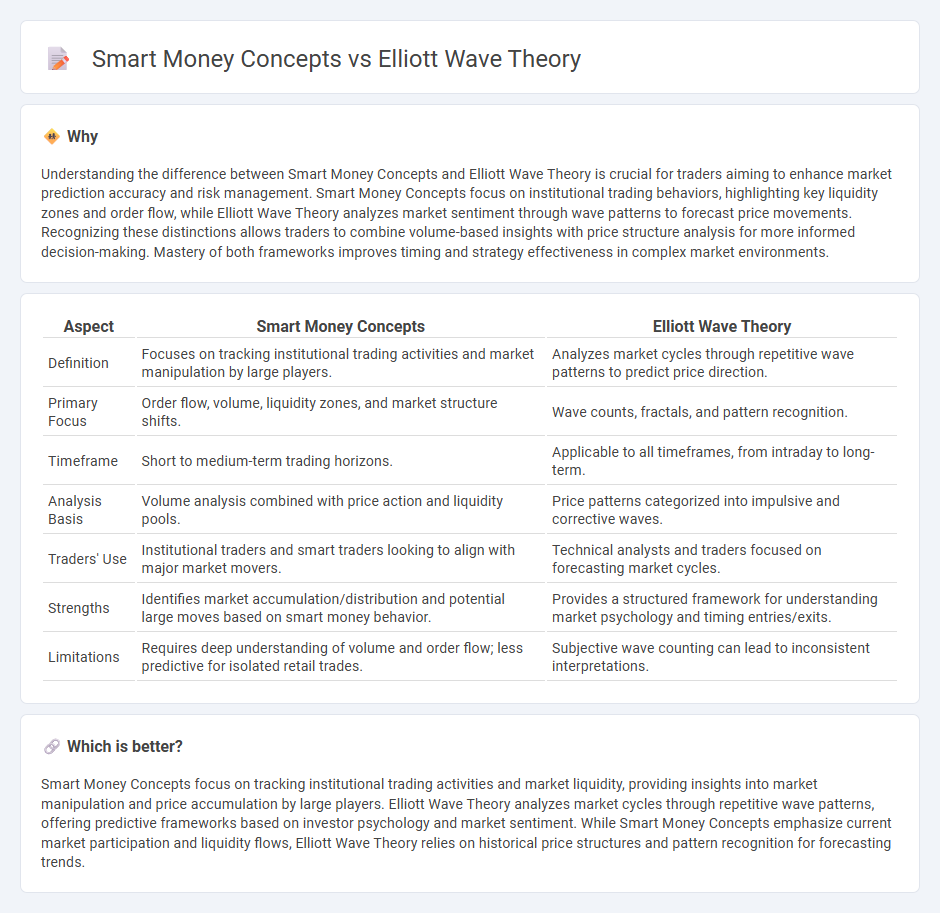

Understanding the difference between Smart Money Concepts and Elliott Wave Theory is crucial for traders aiming to enhance market prediction accuracy and risk management. Smart Money Concepts focus on institutional trading behaviors, highlighting key liquidity zones and order flow, while Elliott Wave Theory analyzes market sentiment through wave patterns to forecast price movements. Recognizing these distinctions allows traders to combine volume-based insights with price structure analysis for more informed decision-making. Mastery of both frameworks improves timing and strategy effectiveness in complex market environments.

Comparison Table

| Aspect | Smart Money Concepts | Elliott Wave Theory |

|---|---|---|

| Definition | Focuses on tracking institutional trading activities and market manipulation by large players. | Analyzes market cycles through repetitive wave patterns to predict price direction. |

| Primary Focus | Order flow, volume, liquidity zones, and market structure shifts. | Wave counts, fractals, and pattern recognition. |

| Timeframe | Short to medium-term trading horizons. | Applicable to all timeframes, from intraday to long-term. |

| Analysis Basis | Volume analysis combined with price action and liquidity pools. | Price patterns categorized into impulsive and corrective waves. |

| Traders' Use | Institutional traders and smart traders looking to align with major market movers. | Technical analysts and traders focused on forecasting market cycles. |

| Strengths | Identifies market accumulation/distribution and potential large moves based on smart money behavior. | Provides a structured framework for understanding market psychology and timing entries/exits. |

| Limitations | Requires deep understanding of volume and order flow; less predictive for isolated retail trades. | Subjective wave counting can lead to inconsistent interpretations. |

Which is better?

Smart Money Concepts focus on tracking institutional trading activities and market liquidity, providing insights into market manipulation and price accumulation by large players. Elliott Wave Theory analyzes market cycles through repetitive wave patterns, offering predictive frameworks based on investor psychology and market sentiment. While Smart Money Concepts emphasize current market participation and liquidity flows, Elliott Wave Theory relies on historical price structures and pattern recognition for forecasting trends.

Connection

Smart Money Concepts focus on identifying institutional investor actions and market manipulations, which often align with Elliott Wave Theory's wave patterns reflecting collective market psychology. Elliott Wave Theory detects repetitive market cycles driven by investor sentiment, while Smart Money Concepts track the moves of large market players within these cycles. Together, they provide a comprehensive framework for forecasting market reversals and trend continuations by combining behavioral dynamics with institutional trading footprints.

Key Terms

**Elliott Wave Theory:**

Elliott Wave Theory analyzes market cycles through repetitive wave patterns, identifying trends and corrections across five-wave impulsive and three-wave corrective structures, making it essential for forecasting price movements in forex and stock markets. This theory emphasizes fractal market behavior and wave degree hierarchies, enabling traders to anticipate turning points and trend reversals with greater precision. Explore in-depth how Elliott Wave principles can enhance your trading strategy and timing accuracy.

Impulse Waves

Impulse waves in Elliott Wave Theory represent strong, directional price movements typically consisting of five sub-waves that indicate the dominant trend's continuation. Smart Money Concepts analyze these movements by tracking institutional order flow and liquidity zones to identify when large players drive market trends. Explore how combining impulse wave analysis with smart money flow can enhance trading strategies and market timing.

Corrective Waves

Corrective waves in Elliott Wave Theory represent price retracements within a prevailing trend, often displaying patterns like zigzags, flats, or triangles that indicate temporary market pauses or reversals. Smart Money Concepts analyze corrective waves by identifying institutional trading activity, focusing on liquidity pools and stop hunts during these retracements to anticipate price direction changes. Explore the detailed mechanisms behind corrective waves in both frameworks to enhance your trading strategies.

Source and External Links

What is Elliott Wave Theory? Rules and Principles | IG International - Elliott Wave Theory posits a market moves in a repetitive 5-wave impulsive sequence followed by a 3-wave corrective sequence, reflecting a fractal pattern where every impulsive wave is followed by a corrective reaction within larger trends.

Elliott Wave Theory: Introduction to the Wave Principle - The Elliott Wave Principle reveals that crowd psychology creates recurring five-wave patterns in the market's trend direction, interspersed by two countertrend waves, forming the structural basis to predict price movements.

Elliott Wave Theory - NYU Stern - Developed by Ralph Nelson Elliott, this theory explains stock market movements as a series of repetitive 5-wave trends and 3-wave corrections, forming nested cycles that reflect underlying collective human behavior and market psychology.

dowidth.com

dowidth.com