Flash loan arbitrage leverages instant, uncollateralized loans to exploit price differences across decentralized exchanges for rapid profit without initial capital. Copy trading enables investors to replicate the trades of experienced traders automatically, offering a hands-off approach to market participation. Explore the intricacies and benefits of both strategies to enhance your trading portfolio.

Why it is important

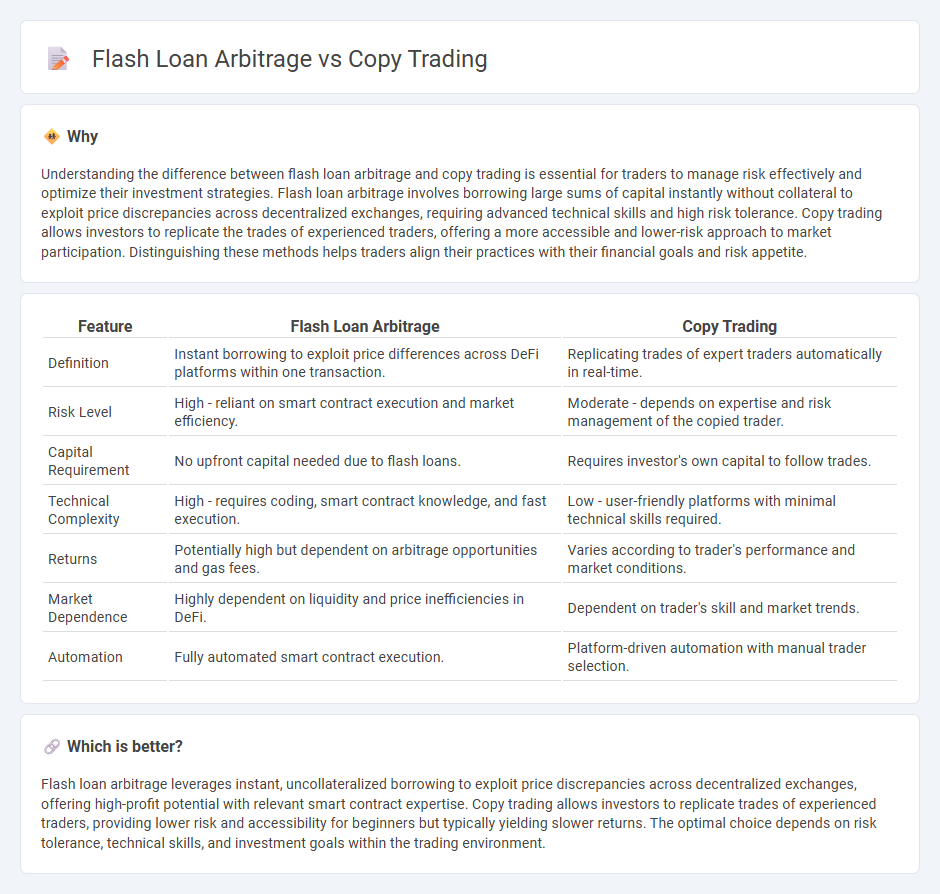

Understanding the difference between flash loan arbitrage and copy trading is essential for traders to manage risk effectively and optimize their investment strategies. Flash loan arbitrage involves borrowing large sums of capital instantly without collateral to exploit price discrepancies across decentralized exchanges, requiring advanced technical skills and high risk tolerance. Copy trading allows investors to replicate the trades of experienced traders, offering a more accessible and lower-risk approach to market participation. Distinguishing these methods helps traders align their practices with their financial goals and risk appetite.

Comparison Table

| Feature | Flash Loan Arbitrage | Copy Trading |

|---|---|---|

| Definition | Instant borrowing to exploit price differences across DeFi platforms within one transaction. | Replicating trades of expert traders automatically in real-time. |

| Risk Level | High - reliant on smart contract execution and market efficiency. | Moderate - depends on expertise and risk management of the copied trader. |

| Capital Requirement | No upfront capital needed due to flash loans. | Requires investor's own capital to follow trades. |

| Technical Complexity | High - requires coding, smart contract knowledge, and fast execution. | Low - user-friendly platforms with minimal technical skills required. |

| Returns | Potentially high but dependent on arbitrage opportunities and gas fees. | Varies according to trader's performance and market conditions. |

| Market Dependence | Highly dependent on liquidity and price inefficiencies in DeFi. | Dependent on trader's skill and market trends. |

| Automation | Fully automated smart contract execution. | Platform-driven automation with manual trader selection. |

Which is better?

Flash loan arbitrage leverages instant, uncollateralized borrowing to exploit price discrepancies across decentralized exchanges, offering high-profit potential with relevant smart contract expertise. Copy trading allows investors to replicate trades of experienced traders, providing lower risk and accessibility for beginners but typically yielding slower returns. The optimal choice depends on risk tolerance, technical skills, and investment goals within the trading environment.

Connection

Flash loan arbitrage leverages rapid, unsecured loans to exploit price discrepancies across decentralized exchanges within a single transaction, maximizing profit potential in cryptocurrency markets. Copy trading enables investors to replicate the strategies of successful traders, which may include flash loan arbitrage techniques, allowing less experienced users to benefit from complex arbitrage strategies. The connection lies in copy trading platforms often incorporating flash loan arbitrage strategies as part of their portfolio offerings, thus democratizing access to high-frequency, algorithm-driven trading tactics.

Key Terms

Copy Trading:

Copy trading allows investors to replicate the trades of experienced traders in real-time, minimizing the need for market analysis and trading experience. This method leverages advanced algorithms and social trading platforms to automatically mirror positions, reducing risk through diversification and expert strategy execution. Discover how copy trading can enhance your investment portfolio and simplify trading strategies today.

Signal Provider

Signal providers in copy trading offer curated and real-time trade alerts based on proven strategies, enabling followers to replicate profitable trades with minimal effort. Flash loan arbitrage requires advanced technical knowledge and instant execution, where signal providers may supply arbitrage opportunities but the complexity and risk are significantly higher. Discover how signal providers shape success in these trading models by exploring detailed comparisons and expert insights.

Auto-execution

Auto-execution in copy trading enables investors to automatically replicate trades of experienced traders, ensuring real-time alignment with market movements without manual intervention. Flash loan arbitrage leverages instant, unsecured loans within a single blockchain transaction to exploit price discrepancies across decentralized exchanges, executing complex multi-step trades within seconds. Explore how automated mechanisms revolutionize passive income generation and high-frequency DeFi strategies.

Source and External Links

Copy trading - Wikipedia - Copy trading enables individuals to automatically replicate positions opened and managed by selected investors, linking a portion of the copier's funds to the account of the chosen trader, allowing automated copying of trades with the ability to disconnect at any time.

Copy Trading | Copy the Best Traders in 2025 - Copy trading allows one trader to automatically replicate the trades of a more experienced trader, providing a hands-off, time-saving way for beginners to benefit from experts' trading skills while maintaining some degree of customization.

What is Copy Trading, How Does it Work ... - Copy trading lets novice or busy traders automatically copy trades of experienced ones by allocating capital to them and matching their trades proportionally, helping users earn profits without deep market analysis and offering customizable risk settings per trade.

dowidth.com

dowidth.com