Synthetic positions replicate the payoff of other financial instruments by combining options and underlying assets, often used to mimic long or short stock positions without directly trading the stock. A bear spread is an options strategy designed to profit from a moderate decline in the price of the underlying asset by simultaneously buying and selling options at different strike prices. Explore the nuances of synthetic positions and bear spreads to enhance your trading strategy and risk management techniques.

Why it is important

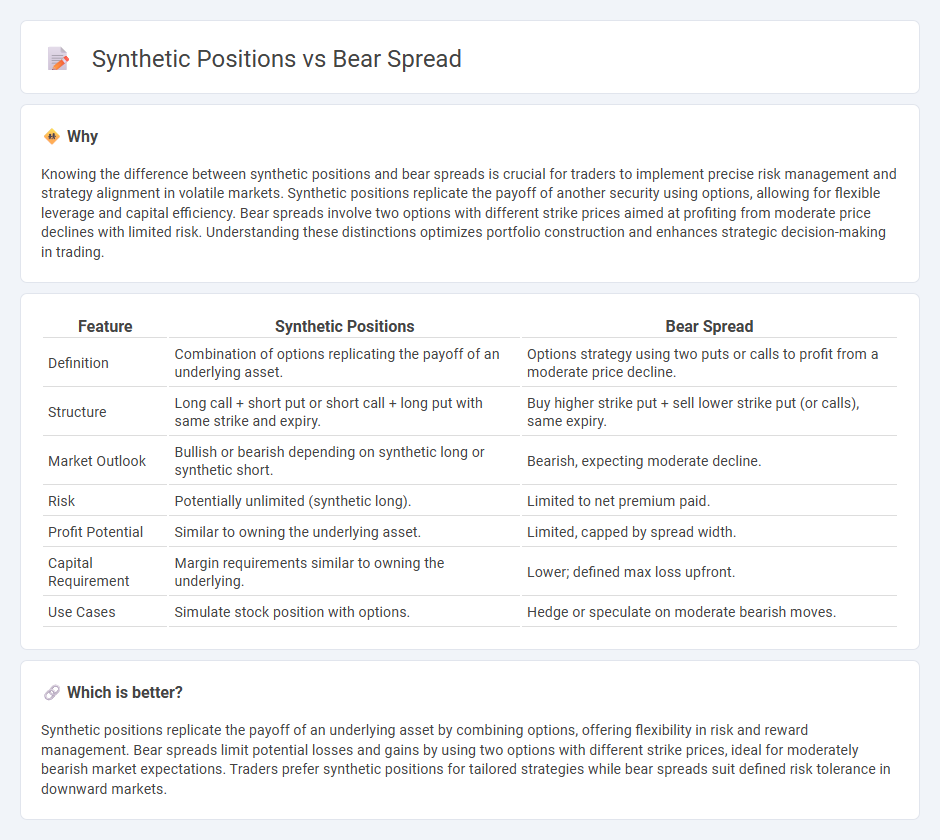

Knowing the difference between synthetic positions and bear spreads is crucial for traders to implement precise risk management and strategy alignment in volatile markets. Synthetic positions replicate the payoff of another security using options, allowing for flexible leverage and capital efficiency. Bear spreads involve two options with different strike prices aimed at profiting from moderate price declines with limited risk. Understanding these distinctions optimizes portfolio construction and enhances strategic decision-making in trading.

Comparison Table

| Feature | Synthetic Positions | Bear Spread |

|---|---|---|

| Definition | Combination of options replicating the payoff of an underlying asset. | Options strategy using two puts or calls to profit from a moderate price decline. |

| Structure | Long call + short put or short call + long put with same strike and expiry. | Buy higher strike put + sell lower strike put (or calls), same expiry. |

| Market Outlook | Bullish or bearish depending on synthetic long or synthetic short. | Bearish, expecting moderate decline. |

| Risk | Potentially unlimited (synthetic long). | Limited to net premium paid. |

| Profit Potential | Similar to owning the underlying asset. | Limited, capped by spread width. |

| Capital Requirement | Margin requirements similar to owning the underlying. | Lower; defined max loss upfront. |

| Use Cases | Simulate stock position with options. | Hedge or speculate on moderate bearish moves. |

Which is better?

Synthetic positions replicate the payoff of an underlying asset by combining options, offering flexibility in risk and reward management. Bear spreads limit potential losses and gains by using two options with different strike prices, ideal for moderately bearish market expectations. Traders prefer synthetic positions for tailored strategies while bear spreads suit defined risk tolerance in downward markets.

Connection

Synthetic positions replicate the payoff of other trading strategies using combinations of options or futures, allowing traders to mimic the risk and reward of asset ownership or shorting without directly holding the underlying asset. A bear spread, typically constructed with options, benefits from a decline in the underlying asset's price and can be represented synthetically through combinations of long and short positions in calls or puts. Both strategies leverage options to manage risk and express bearish market views, highlighting their interconnected use in derivative trading for hedging and speculative purposes.

Key Terms

Options (Call and Put)

A bear spread using options involves buying and selling call or put options at different strike prices to profit from a moderate decline in the underlying asset's price, with limited risk and reward. Synthetic positions replicate the payoff of one option type using combinations of the other, such as creating a synthetic short call by holding a long put and the underlying asset, enabling strategic flexibility in bearish market expectations. Explore more to understand risk profiles, margin requirements, and practical setups in options trading.

Strike Price

Bear spreads utilize two options with different strike prices to capitalize on a moderate decline in the underlying asset's price, typically involving a higher strike price short option and a lower strike price long option. Synthetic positions mimic the payoff of these bear spreads by combining long and short positions in the underlying asset and options, carefully selecting strike prices to replicate the same risk and reward profile. Explore further to understand how strike price selection influences risk management and potential profits in these strategies.

Payoff Structure

A bear spread involves buying and selling options with different strike prices, creating a defined risk and reward profile that profits from a moderate decline in the underlying asset's price. Synthetic positions replicate option payoffs using combinations of underlying assets and options, often allowing traders to mimic the payoff structure of a bear spread while potentially reducing upfront costs. Explore the nuances of these strategies to optimize your trading approach and manage risk effectively.

Source and External Links

Bear Put Spread - The Options Industry Council - A bear put spread involves buying a put option at a higher strike price and selling another put at a lower strike price within the same expiration, aiming to profit from a decline in the underlying stock with limited risk and capped profit.

Bear Call Spread (Credit Call Spread) - The Options Industry Council - A bear call spread consists of selling a call option at a lower strike while buying another call at a higher strike with the same expiration, profitably betting on neutral to bearish moves for limited risk and limited reward.

Bear spread - Wikipedia - A bear spread is a vertical spread strategy used by options traders moderately bearish on a security, often executed by buying higher strike puts and selling lower strike puts (bear put spread) to capitalize on price declines with defined risk and reward.

dowidth.com

dowidth.com