A gamma squeeze occurs when options market makers rapidly buy shares to hedge positions as the underlying stock price rises, causing a sharp price increase. A bear trap happens when a stock appears to be declining, luring short-sellers before quickly reversing upward and forcing losses. Explore more to understand how these market dynamics impact trading strategies.

Why it is important

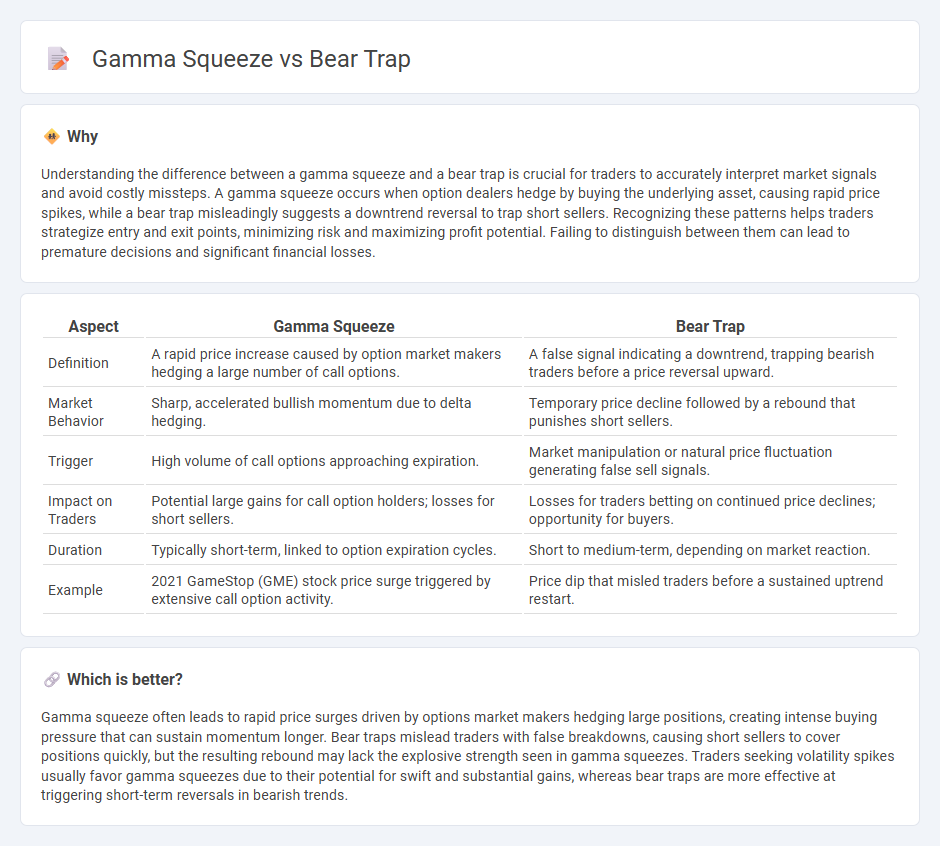

Understanding the difference between a gamma squeeze and a bear trap is crucial for traders to accurately interpret market signals and avoid costly missteps. A gamma squeeze occurs when option dealers hedge by buying the underlying asset, causing rapid price spikes, while a bear trap misleadingly suggests a downtrend reversal to trap short sellers. Recognizing these patterns helps traders strategize entry and exit points, minimizing risk and maximizing profit potential. Failing to distinguish between them can lead to premature decisions and significant financial losses.

Comparison Table

| Aspect | Gamma Squeeze | Bear Trap |

|---|---|---|

| Definition | A rapid price increase caused by option market makers hedging a large number of call options. | A false signal indicating a downtrend, trapping bearish traders before a price reversal upward. |

| Market Behavior | Sharp, accelerated bullish momentum due to delta hedging. | Temporary price decline followed by a rebound that punishes short sellers. |

| Trigger | High volume of call options approaching expiration. | Market manipulation or natural price fluctuation generating false sell signals. |

| Impact on Traders | Potential large gains for call option holders; losses for short sellers. | Losses for traders betting on continued price declines; opportunity for buyers. |

| Duration | Typically short-term, linked to option expiration cycles. | Short to medium-term, depending on market reaction. |

| Example | 2021 GameStop (GME) stock price surge triggered by extensive call option activity. | Price dip that misled traders before a sustained uptrend restart. |

Which is better?

Gamma squeeze often leads to rapid price surges driven by options market makers hedging large positions, creating intense buying pressure that can sustain momentum longer. Bear traps mislead traders with false breakdowns, causing short sellers to cover positions quickly, but the resulting rebound may lack the explosive strength seen in gamma squeezes. Traders seeking volatility spikes usually favor gamma squeezes due to their potential for swift and substantial gains, whereas bear traps are more effective at triggering short-term reversals in bearish trends.

Connection

A gamma squeeze occurs when market makers buy shares to hedge their option positions, causing rapid price increases that can trap bearish investors expecting a decline. This surge often leads to a bear trap, where short sellers face unexpected losses as prices reverse upward sharply. Understanding the interplay between gamma squeezes and bear traps is crucial for traders aiming to navigate volatile market conditions effectively.

Key Terms

Short Selling

Bear traps occur when a stock seemingly breaks down below support, enticing short sellers to enter positions that quickly reverse, causing losses. Gamma squeezes happen when options market makers buy shares to hedge short options, forcing a rapid price increase that pressures short sellers to cover, amplifying upward momentum. To understand how these dynamics impact short selling strategies and risk management, explore detailed analyses on bear traps and gamma squeezes.

Options Contracts

A bear trap in options contracts occurs when investors mistakenly expect a stock price to decline, prompting them to buy puts, but the price instead rallies, causing losses for bearish positions. A gamma squeeze involves rapid price increases triggered by options market makers hedging their positions due to high gamma exposure, often leading to aggressive buying in the underlying stock. Explore the mechanics and market impact of these phenomena to deepen your understanding of options trading strategies.

Short Covering

A bear trap occurs when short sellers are misled into thinking a stock will decline, prompting short selling before prices surge, forcing them to cover their shorts at a loss. A gamma squeeze involves options market makers hedging their positions by buying the underlying asset, which can create sudden price spikes and intensify short covering. Explore how these dynamics impact market volatility and short interest for deeper insights.

Source and External Links

Bear Traps - Schmitt Enterprises, Inc. - Large, heavyweight bear traps designed for collectors, home decor, and originally for catching powerful bears, featuring robust springs and chains, made in the USA.

Sawtooth Trap Company Maker of the World's Largest and Strongest Bear Trap - Manufacturer of uniquely designed, large, and strong bear traps, including some of the biggest ever made, crafted with attention to detail in Idaho.

Bear trap - Wikipedia - Refers primarily to a type of foothold trap used to catch bears, with other meanings including ski bindings and helicopter landing devices, among others.

dowidth.com

dowidth.com