Order book imbalance measures the disparity between buy and sell orders at different price levels, reflecting potential market pressure. Order flow tracks the actual executed trades and their impact on price movement, providing real-time insight into market sentiment. Explore deeper to understand how combining order book imbalance and order flow can enhance trading strategies.

Why it is important

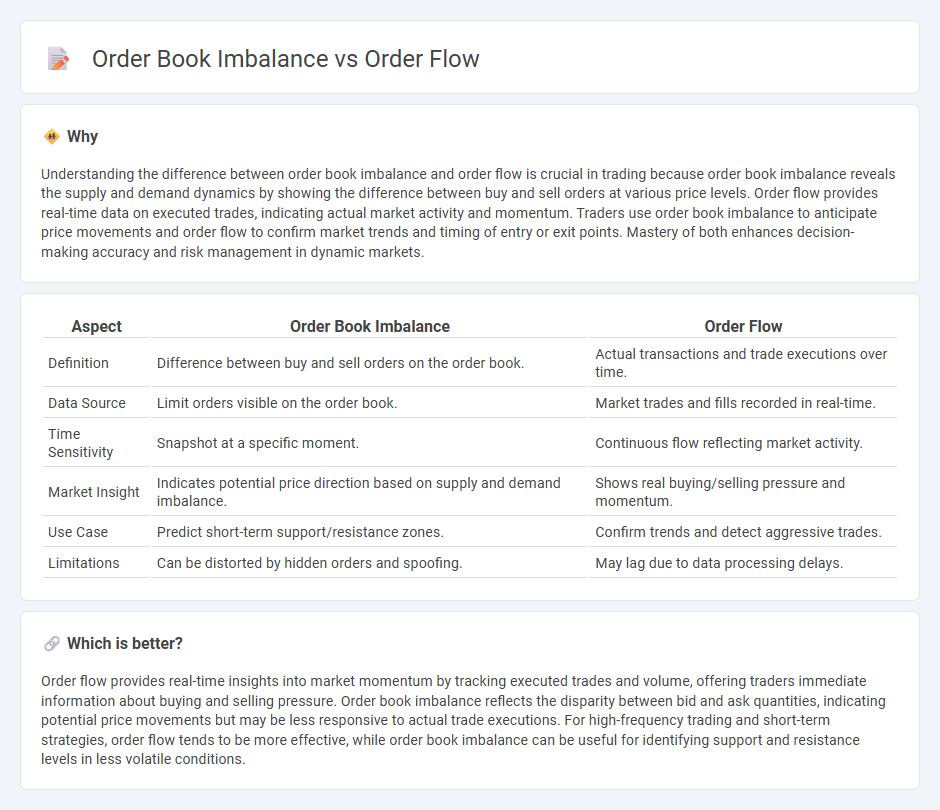

Understanding the difference between order book imbalance and order flow is crucial in trading because order book imbalance reveals the supply and demand dynamics by showing the difference between buy and sell orders at various price levels. Order flow provides real-time data on executed trades, indicating actual market activity and momentum. Traders use order book imbalance to anticipate price movements and order flow to confirm market trends and timing of entry or exit points. Mastery of both enhances decision-making accuracy and risk management in dynamic markets.

Comparison Table

| Aspect | Order Book Imbalance | Order Flow |

|---|---|---|

| Definition | Difference between buy and sell orders on the order book. | Actual transactions and trade executions over time. |

| Data Source | Limit orders visible on the order book. | Market trades and fills recorded in real-time. |

| Time Sensitivity | Snapshot at a specific moment. | Continuous flow reflecting market activity. |

| Market Insight | Indicates potential price direction based on supply and demand imbalance. | Shows real buying/selling pressure and momentum. |

| Use Case | Predict short-term support/resistance zones. | Confirm trends and detect aggressive trades. |

| Limitations | Can be distorted by hidden orders and spoofing. | May lag due to data processing delays. |

Which is better?

Order flow provides real-time insights into market momentum by tracking executed trades and volume, offering traders immediate information about buying and selling pressure. Order book imbalance reflects the disparity between bid and ask quantities, indicating potential price movements but may be less responsive to actual trade executions. For high-frequency trading and short-term strategies, order flow tends to be more effective, while order book imbalance can be useful for identifying support and resistance levels in less volatile conditions.

Connection

Order book imbalance reflects the difference between buy and sell orders at various price levels, providing insights into market sentiment and potential price movements. Order flow captures the real-time execution of trades, revealing the actual buying and selling pressure as orders hit the market. Together, analyzing order book imbalance alongside order flow enables traders to anticipate short-term price changes and optimize entries and exits based on supply-demand dynamics.

Key Terms

Liquidity

Order flow refers to the real-time execution of buy and sell orders, providing immediate insight into market demand and liquidity consumption, while order book imbalance highlights the difference between buy and sell limit orders at various price levels, revealing potential liquidity supply and resistance zones. Understanding order flow offers a dynamic view of market activity and liquidity shifts, whereas order book imbalance shows pending liquidity and pressure points waiting to be triggered. Explore the nuances of order flow and order book imbalance to enhance your liquidity analysis and trading strategy.

Bid-Ask Spread

Order flow analyzes real-time buy and sell orders to predict price movements, while order book imbalance measures the difference between bid and ask volumes at various price levels. The bid-ask spread, representing the price difference between the highest bid and lowest ask, directly impacts liquidity and trading costs within both frameworks. Explore the intricate dynamics of bid-ask spreads to deepen your understanding of market microstructure.

Volume

Order flow analysis captures the actual executed trades and their volumes, providing real-time insight into market sentiment by tracking buy and sell orders as they are filled. Order book imbalance measures the difference between bid and ask volumes currently resting in the order book, highlighting potential support and resistance levels before trades occur. To deepen your understanding of volume dynamics and their impact on trading strategies, explore detailed resources on market microstructure and volume profiling.

Source and External Links

Technical Analysis vs. Order Flow: Techniques and Tools for Traders - Order flow analysis involves observing the real-time flow of buy and sell orders, including their size and aggressiveness, to predict price movements by reading the order book and analyzing volume clusters as indicators of support and resistance levels.

Lesson 1 - The Basics of Order Flow - Jigsaw Trading - Order flow basics focus on the interaction of market orders and limit orders, where aggressive market orders "hit the bid" or "hit the offer," driving price changes based on the consumption of liquidity at the best bid and ask prices.

Order Flow Trading & Volumetric Bars | NinjaTrader - Order flow trading visualizes buying and selling pressure through tools like volumetric bars, order flow volume profile, VWAP, and cumulative delta to identify market momentum, support and resistance levels, and potential reversals based on net buying and selling activity.

dowidth.com

dowidth.com