Tape reading involves analyzing real-time market data such as order flow and volume to make quick trading decisions, focusing on short-term price movements. Swing trading aims to capture gains over days to weeks by identifying trends and key support and resistance levels through technical and fundamental analysis. Discover more about how these distinct trading strategies can enhance your investment approach.

Why it is important

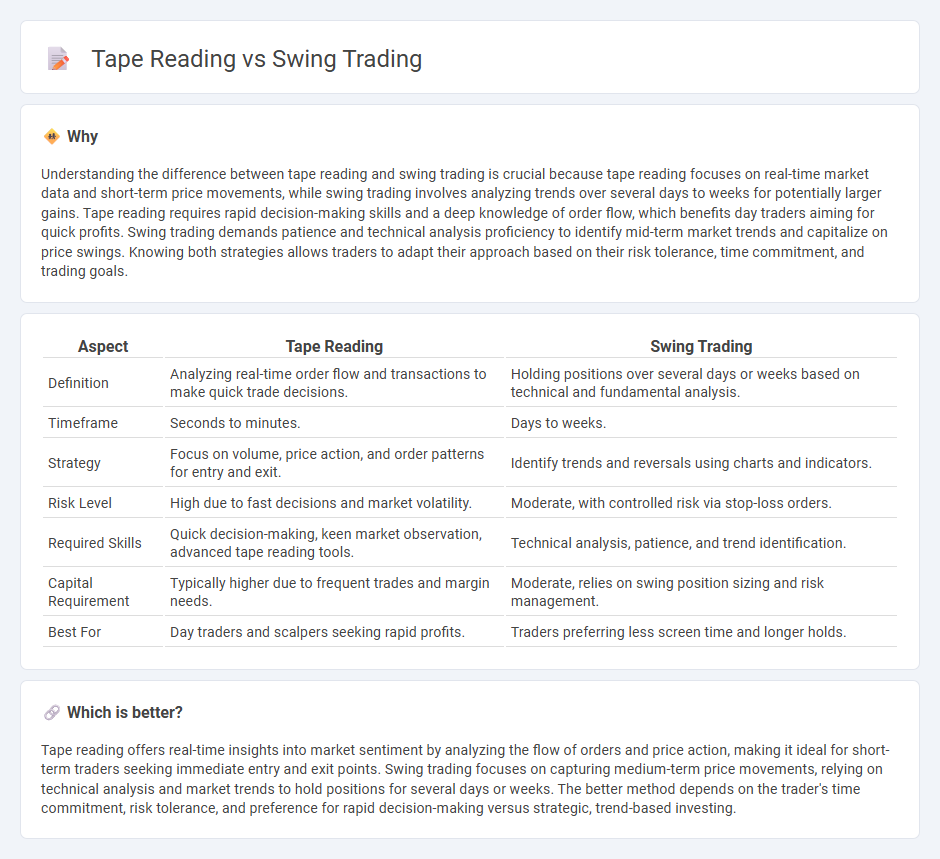

Understanding the difference between tape reading and swing trading is crucial because tape reading focuses on real-time market data and short-term price movements, while swing trading involves analyzing trends over several days to weeks for potentially larger gains. Tape reading requires rapid decision-making skills and a deep knowledge of order flow, which benefits day traders aiming for quick profits. Swing trading demands patience and technical analysis proficiency to identify mid-term market trends and capitalize on price swings. Knowing both strategies allows traders to adapt their approach based on their risk tolerance, time commitment, and trading goals.

Comparison Table

| Aspect | Tape Reading | Swing Trading |

|---|---|---|

| Definition | Analyzing real-time order flow and transactions to make quick trade decisions. | Holding positions over several days or weeks based on technical and fundamental analysis. |

| Timeframe | Seconds to minutes. | Days to weeks. |

| Strategy | Focus on volume, price action, and order patterns for entry and exit. | Identify trends and reversals using charts and indicators. |

| Risk Level | High due to fast decisions and market volatility. | Moderate, with controlled risk via stop-loss orders. |

| Required Skills | Quick decision-making, keen market observation, advanced tape reading tools. | Technical analysis, patience, and trend identification. |

| Capital Requirement | Typically higher due to frequent trades and margin needs. | Moderate, relies on swing position sizing and risk management. |

| Best For | Day traders and scalpers seeking rapid profits. | Traders preferring less screen time and longer holds. |

Which is better?

Tape reading offers real-time insights into market sentiment by analyzing the flow of orders and price action, making it ideal for short-term traders seeking immediate entry and exit points. Swing trading focuses on capturing medium-term price movements, relying on technical analysis and market trends to hold positions for several days or weeks. The better method depends on the trader's time commitment, risk tolerance, and preference for rapid decision-making versus strategic, trend-based investing.

Connection

Tape reading enhances swing trading by providing real-time insights into market sentiment through the analysis of time and sales data. Traders use tape reading to identify large order flows and momentum shifts, which help in timing entry and exit points during swing trading. This combination improves decision-making accuracy and maximizes profit potential in short- to medium-term trades.

Key Terms

Swing Trading:

Swing trading involves holding positions over several days or weeks to capitalize on price fluctuations driven by market trends and patterns, utilizing technical analysis and charting tools to identify entry and exit points. Tape reading, on the other hand, concentrates on analyzing real-time order flow and volume to anticipate short-term price movements within minutes or hours. Discover more about how mastering swing trading strategies can optimize your market performance.

Trend Analysis

Swing trading emphasizes identifying and capitalizing on medium-term price trends by analyzing chart patterns, moving averages, and momentum indicators to capture gains over several days to weeks. Tape reading, or reading the time and sales data, focuses on real-time order flow and volume to anticipate short-term price movements and immediate market sentiment shifts. Explore in-depth techniques and strategies for mastering trend analysis in both swing trading and tape reading to enhance your trading performance.

Holding Period

Swing trading typically involves holding positions for days to weeks to capture medium-term market trends, while tape reading focuses on short-term market movements by analyzing order flow and price action in real-time. The holding period in swing trading is extended, allowing traders to capitalize on broader price shifts, whereas tape readers execute rapid trades within minutes to exploit immediate market liquidity and momentum. Explore detailed strategies and benefits of each approach to determine which aligns best with your trading goals.

Source and External Links

Swing trading - Wikipedia - Swing trading is a strategy where a tradable asset is held for one or more days to profit from price changes or swings, typically longer than day trading but shorter than long-term investing, often using rule-based technical or fundamental analysis to decide buying and selling points.

What is swing trading & how does it work? - Saxo Bank - Swing trading takes advantage of price movement swings using strategies like breakout trading, which focuses on price breaking support or resistance levels, and trend trading, which captures the momentum during short-term trends using technical indicators.

Swing trading: A complete guide for investors | TD Direct Investing - Swing traders aim to profit from short-term price changes by buying on dips and shorting on rises, relying mainly on technical analysis and trading positions held from days to weeks, thus falling between day trading and longer-term trend trading in time horizon.

dowidth.com

dowidth.com