Statistical arbitrage uses quantitative models to exploit price inefficiencies within a single asset class by analyzing historical data and market trends. Cross-asset arbitrage identifies price discrepancies between different asset classes, such as equities and commodities, aiming to profit from relative value differences across markets. Explore the underlying strategies and techniques to understand which arbitrage method suits your trading goals.

Why it is important

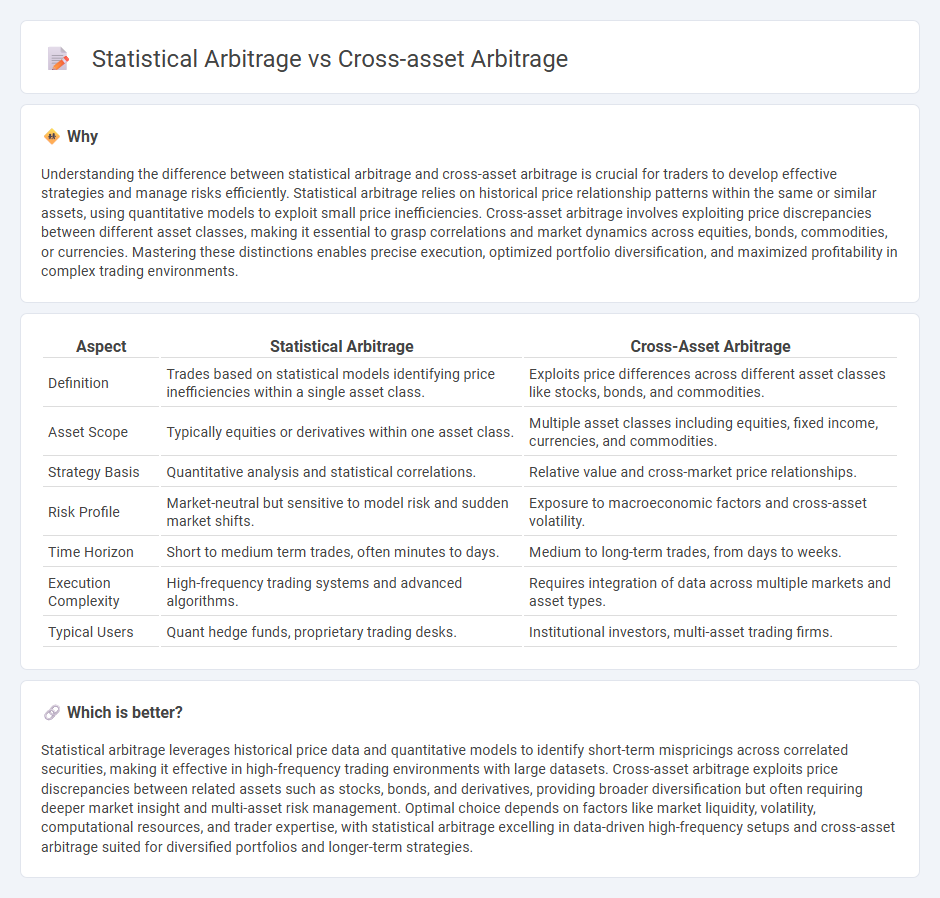

Understanding the difference between statistical arbitrage and cross-asset arbitrage is crucial for traders to develop effective strategies and manage risks efficiently. Statistical arbitrage relies on historical price relationship patterns within the same or similar assets, using quantitative models to exploit small price inefficiencies. Cross-asset arbitrage involves exploiting price discrepancies between different asset classes, making it essential to grasp correlations and market dynamics across equities, bonds, commodities, or currencies. Mastering these distinctions enables precise execution, optimized portfolio diversification, and maximized profitability in complex trading environments.

Comparison Table

| Aspect | Statistical Arbitrage | Cross-Asset Arbitrage |

|---|---|---|

| Definition | Trades based on statistical models identifying price inefficiencies within a single asset class. | Exploits price differences across different asset classes like stocks, bonds, and commodities. |

| Asset Scope | Typically equities or derivatives within one asset class. | Multiple asset classes including equities, fixed income, currencies, and commodities. |

| Strategy Basis | Quantitative analysis and statistical correlations. | Relative value and cross-market price relationships. |

| Risk Profile | Market-neutral but sensitive to model risk and sudden market shifts. | Exposure to macroeconomic factors and cross-asset volatility. |

| Time Horizon | Short to medium term trades, often minutes to days. | Medium to long-term trades, from days to weeks. |

| Execution Complexity | High-frequency trading systems and advanced algorithms. | Requires integration of data across multiple markets and asset types. |

| Typical Users | Quant hedge funds, proprietary trading desks. | Institutional investors, multi-asset trading firms. |

Which is better?

Statistical arbitrage leverages historical price data and quantitative models to identify short-term mispricings across correlated securities, making it effective in high-frequency trading environments with large datasets. Cross-asset arbitrage exploits price discrepancies between related assets such as stocks, bonds, and derivatives, providing broader diversification but often requiring deeper market insight and multi-asset risk management. Optimal choice depends on factors like market liquidity, volatility, computational resources, and trader expertise, with statistical arbitrage excelling in data-driven high-frequency setups and cross-asset arbitrage suited for diversified portfolios and longer-term strategies.

Connection

Statistical arbitrage and cross-asset arbitrage are connected through their reliance on identifying pricing inefficiencies across related financial instruments using quantitative models. Both strategies use historical price data and statistical methods to exploit mean reversion and asset mispricings, often involving pairs trading or multi-asset portfolio construction. By analyzing correlations and co-movements across different asset classes, traders can implement cross-asset arbitrage that enhances the robustness of statistical arbitrage approaches.

Key Terms

**Cross-Asset Arbitrage:**

Cross-Asset Arbitrage exploits pricing inefficiencies between different asset classes, such as equities, commodities, and fixed income, aiming to profit from the relative mispricing while hedging market risk. It requires sophisticated models to analyze correlations and divergences across diverse securities, often leveraging macroeconomic indicators and market sentiment data. Explore deeper insights into Cross-Asset Arbitrage strategies and their implementation to enhance portfolio diversification and risk-adjusted returns.

Price Discrepancy

Cross-asset arbitrage exploits price discrepancies between related assets across different markets, such as bonds and equities, aiming to profit from mispriced relationships driven by correlated market movements. Statistical arbitrage relies on advanced quantitative models and historical price patterns to identify and exploit short-term price inefficiencies within a single asset class or similar securities. Discover the distinct mechanisms and strategies behind these arbitrage types to enhance trading effectiveness and risk management.

Correlation

Cross-asset arbitrage exploits price discrepancies between related assets across different asset classes, often relying on strong correlation patterns to identify mispricings. Statistical arbitrage uses quantitative models to capture mean-reversion or cointegration in price movements, emphasizing statistical relationships and correlation matrices within a single or similar classes of assets. Explore detailed strategies and the role of correlation metrics to understand their distinct applications in portfolio optimization.

Source and External Links

An experimental analysis on cross-asset arbitrage - Cross-asset arbitrage involves opportunities to trade across different types of assets, and its presence reduces price discrepancies and deviations from fundamental values by prompting traders to consider alternative asset pricing simultaneously during transactions.

Cross-asset Trading Strategies - Cross-asset arbitrage is part of strategies where traders leverage correlations and relationships between multiple asset classes like equities, bonds, currencies, and commodities to generate returns and manage risk by exploiting price movements across interconnected markets.

Cross-Asset Trading: Opportunities and Challenges ... - Cross-asset arbitrage exploits inefficiencies and price differences between related assets in diverse markets, allowing traders to capitalize on how economic events impact asset classes differently, thus enhancing return potential while managing risk.

dowidth.com

dowidth.com