Market making involves providing liquidity by continuously quoting buy and sell prices for specific assets, aiming to earn the spread between these prices. High-frequency trading (HFT) uses advanced algorithms and high-speed data processing to execute large volumes of trades within milliseconds, capitalizing on brief market inefficiencies. Explore more to understand the intricate strategies and technologies behind these trading approaches.

Why it is important

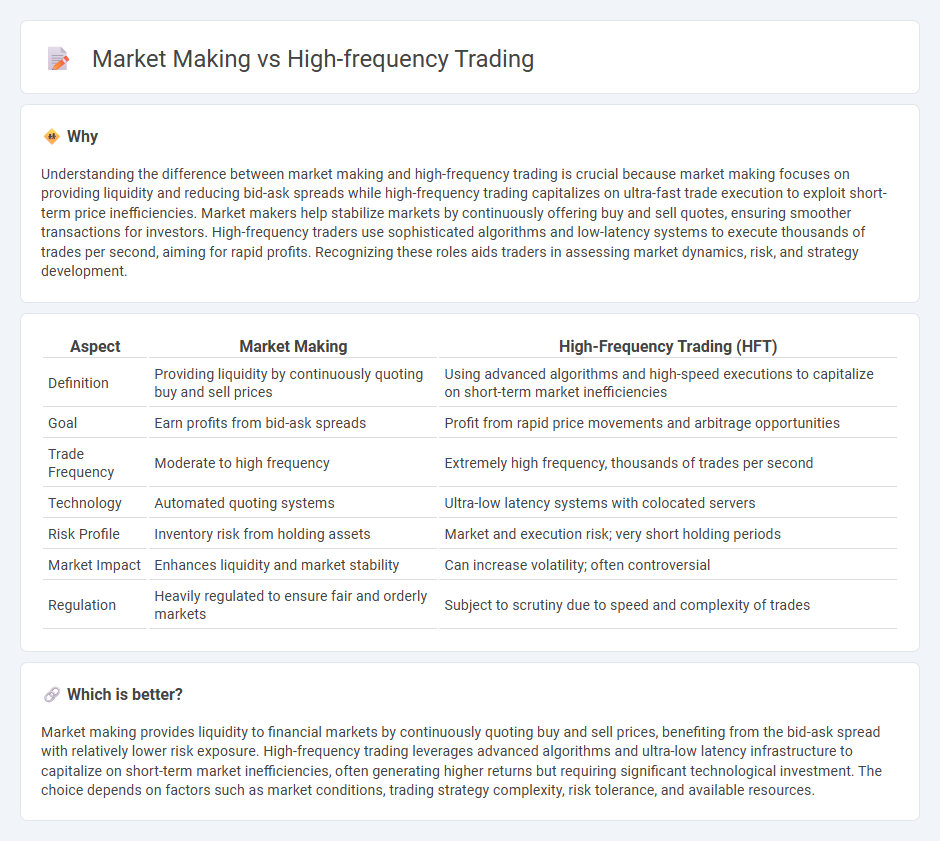

Understanding the difference between market making and high-frequency trading is crucial because market making focuses on providing liquidity and reducing bid-ask spreads while high-frequency trading capitalizes on ultra-fast trade execution to exploit short-term price inefficiencies. Market makers help stabilize markets by continuously offering buy and sell quotes, ensuring smoother transactions for investors. High-frequency traders use sophisticated algorithms and low-latency systems to execute thousands of trades per second, aiming for rapid profits. Recognizing these roles aids traders in assessing market dynamics, risk, and strategy development.

Comparison Table

| Aspect | Market Making | High-Frequency Trading (HFT) |

|---|---|---|

| Definition | Providing liquidity by continuously quoting buy and sell prices | Using advanced algorithms and high-speed executions to capitalize on short-term market inefficiencies |

| Goal | Earn profits from bid-ask spreads | Profit from rapid price movements and arbitrage opportunities |

| Trade Frequency | Moderate to high frequency | Extremely high frequency, thousands of trades per second |

| Technology | Automated quoting systems | Ultra-low latency systems with colocated servers |

| Risk Profile | Inventory risk from holding assets | Market and execution risk; very short holding periods |

| Market Impact | Enhances liquidity and market stability | Can increase volatility; often controversial |

| Regulation | Heavily regulated to ensure fair and orderly markets | Subject to scrutiny due to speed and complexity of trades |

Which is better?

Market making provides liquidity to financial markets by continuously quoting buy and sell prices, benefiting from the bid-ask spread with relatively lower risk exposure. High-frequency trading leverages advanced algorithms and ultra-low latency infrastructure to capitalize on short-term market inefficiencies, often generating higher returns but requiring significant technological investment. The choice depends on factors such as market conditions, trading strategy complexity, risk tolerance, and available resources.

Connection

Market making and high-frequency trading are interconnected through their reliance on speed and liquidity provision in financial markets. Market makers use high-frequency trading algorithms to rapidly quote buy and sell prices, facilitating smoother transactions and tighter bid-ask spreads. The integration of high-frequency strategies enhances market efficiency by increasing trade volume and reducing price volatility.

Key Terms

Latency

High-frequency trading (HFT) and market making both depend heavily on minimizing latency to execute trades faster than competitors and capitalize on fleeting price discrepancies or provide liquidity efficiently. While HFT aims to exploit ultra-low latency for rapid order placement and cancellation, market making prioritizes consistent low latency to maintain tight bid-ask spreads and manage inventory risk in real time. Discover how latency impacts the strategies and technologies employed by top firms in these fast-paced trading environments.

Bid-Ask Spread

High-frequency trading (HFT) leverages ultra-fast algorithms to capitalize on minute price movements, often capturing profits from fleeting bid-ask spread inefficiencies. Market making, by continuously providing liquidity, sets tighter bid-ask spreads that reduce overall trading costs but assumes risk by holding inventory. Explore the strategic nuances and risk profiles distinguishing these approaches for a deeper understanding of bid-ask spread dynamics.

Order Flow

High-frequency trading (HFT) leverages advanced algorithms to execute rapid trades by capitalizing on short-term market inefficiencies, while market making involves continuously providing bid and ask quotes to facilitate liquidity and narrow spreads. Order flow is critical in market making as it helps predict supply and demand dynamics, whereas in HFT, order flow analysis is used to identify profitable trading signals from the momentum of incoming orders. Explore further to understand how order flow impacts these trading strategies and their roles in market dynamics.

Source and External Links

High-Frequency Trading Explained: What Is It and How Do You Get ... - High-frequency trading (HFT) uses powerful computers and advanced algorithms to execute a large number of trades in microseconds, profiting from tiny price differences across markets by automating rapid, high-volume transactions.

High Frequency Trading (HFT) - Definition, Pros and Cons - HFT is algorithmic trading characterized by extremely fast execution, high transaction volumes, and short-term investment, utilized mainly by institutional investors to exploit small price fluctuations and improve market liquidity.

High-frequency trading - Wikipedia - High-frequency trading is quantitative automated trading using computerized models to rapidly execute orders, including strategies like market-making and arbitrage, focusing on speed to capitalize on minute market inefficiencies.

dowidth.com

dowidth.com