High-frequency scalp bots execute thousands of rapid trades exploiting small price fluctuations within milliseconds, maximizing profit through volume and speed in highly liquid markets. Arbitrage trading bots identify and capitalize on price discrepancies across different exchanges or assets, ensuring risk-free profit opportunities by simultaneously buying low and selling high. Explore the distinct advantages and strategies of these advanced trading bots to enhance your automated trading performance.

Why it is important

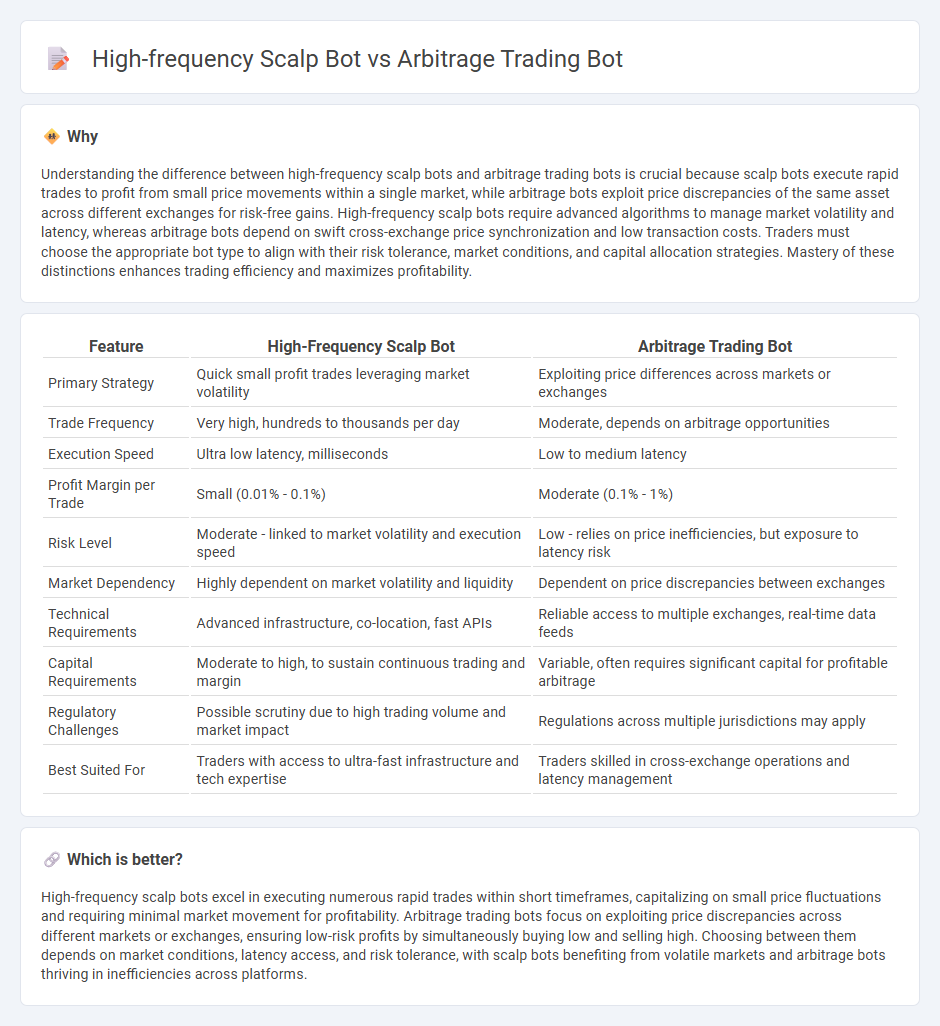

Understanding the difference between high-frequency scalp bots and arbitrage trading bots is crucial because scalp bots execute rapid trades to profit from small price movements within a single market, while arbitrage bots exploit price discrepancies of the same asset across different exchanges for risk-free gains. High-frequency scalp bots require advanced algorithms to manage market volatility and latency, whereas arbitrage bots depend on swift cross-exchange price synchronization and low transaction costs. Traders must choose the appropriate bot type to align with their risk tolerance, market conditions, and capital allocation strategies. Mastery of these distinctions enhances trading efficiency and maximizes profitability.

Comparison Table

| Feature | High-Frequency Scalp Bot | Arbitrage Trading Bot |

|---|---|---|

| Primary Strategy | Quick small profit trades leveraging market volatility | Exploiting price differences across markets or exchanges |

| Trade Frequency | Very high, hundreds to thousands per day | Moderate, depends on arbitrage opportunities |

| Execution Speed | Ultra low latency, milliseconds | Low to medium latency |

| Profit Margin per Trade | Small (0.01% - 0.1%) | Moderate (0.1% - 1%) |

| Risk Level | Moderate - linked to market volatility and execution speed | Low - relies on price inefficiencies, but exposure to latency risk |

| Market Dependency | Highly dependent on market volatility and liquidity | Dependent on price discrepancies between exchanges |

| Technical Requirements | Advanced infrastructure, co-location, fast APIs | Reliable access to multiple exchanges, real-time data feeds |

| Capital Requirements | Moderate to high, to sustain continuous trading and margin | Variable, often requires significant capital for profitable arbitrage |

| Regulatory Challenges | Possible scrutiny due to high trading volume and market impact | Regulations across multiple jurisdictions may apply |

| Best Suited For | Traders with access to ultra-fast infrastructure and tech expertise | Traders skilled in cross-exchange operations and latency management |

Which is better?

High-frequency scalp bots excel in executing numerous rapid trades within short timeframes, capitalizing on small price fluctuations and requiring minimal market movement for profitability. Arbitrage trading bots focus on exploiting price discrepancies across different markets or exchanges, ensuring low-risk profits by simultaneously buying low and selling high. Choosing between them depends on market conditions, latency access, and risk tolerance, with scalp bots benefiting from volatile markets and arbitrage bots thriving in inefficiencies across platforms.

Connection

High-frequency scalp bots and arbitrage trading bots both rely on ultra-fast execution speeds and low-latency data feeds to exploit minute pricing inefficiencies in the market. While scalp bots focus on rapid entry and exit within a single market to capture small price movements, arbitrage bots simultaneously monitor multiple exchanges to identify and capitalize on price discrepancies. Both strategies depend on algorithmic precision and real-time market analysis to generate consistent profits through high trade volumes.

Key Terms

Price Discrepancy

Arbitrage trading bots exploit price discrepancies for the same asset across different exchanges, executing simultaneous buy and sell orders to lock in risk-free profits. High-frequency scalp bots capitalize on small price movements within a single market, rapidly entering and exiting positions to accumulate gains from minimal fluctuations. Explore the detailed mechanics and benefits of each strategy to determine which fits your trading goals best.

Order Execution Speed

Arbitrage trading bots capitalize on price discrepancies across multiple exchanges, requiring rapid order execution to exploit fleeting opportunities before prices converge. High-frequency scalp bots execute a large number of quick trades within a single market, prioritizing ultra-low latency for order execution to capture minimal price movements. Explore the intricacies of order execution speed in both strategies to maximize trading efficiency and profitability.

Market Liquidity

Arbitrage trading bots exploit price discrepancies across different markets, leveraging high market liquidity to execute nearly simultaneous buys and sells, minimizing risk and maximizing profits. High-frequency scalp bots operate within a single market, relying on rapid, small trades that benefit from deep order books and continuous market liquidity to achieve incremental gains. Explore detailed strategies and liquidity impacts to optimize your trading bot selection.

Source and External Links

Arbitrage Trading Bot | Crypto.com Help Center - The Crypto.com Arbitrage Bot allows eligible traders to execute sophisticated arbitrage strategies between perpetual contracts and spot trading pairs, enabling potential profit by capturing funding fees while hedging market risk.

Best Tactics to Boost Gains Using a Crypto Arbitrage Bot - Crypto arbitrage bots connect to exchanges via API to detect and exploit price discrepancies across markets using strategies like cross-exchange, spatial, and triangular arbitrage for efficient and fast trading execution.

Bot Trading 101 | How To Set Up an Arbitrage Bot - Cryptohopper - Setting up an arbitrage bot involves funding both coins on exchanges, configuring trade sizing, selecting markets, and setting minimum profit thresholds to automatically execute arbitrage trades when opportunities arise.

dowidth.com

dowidth.com