High-frequency scalp bots exploit ultra-fast market data to execute numerous small-profit trades within seconds, capitalizing on minimal price movements and liquidity fluctuations. Options trading bots analyze derivatives markets, leveraging complex algorithms to identify strategic entry and exit points based on volatility, time decay, and Greeks. Explore how each bot type optimizes trading strategies to maximize returns in dynamic market conditions.

Why it is important

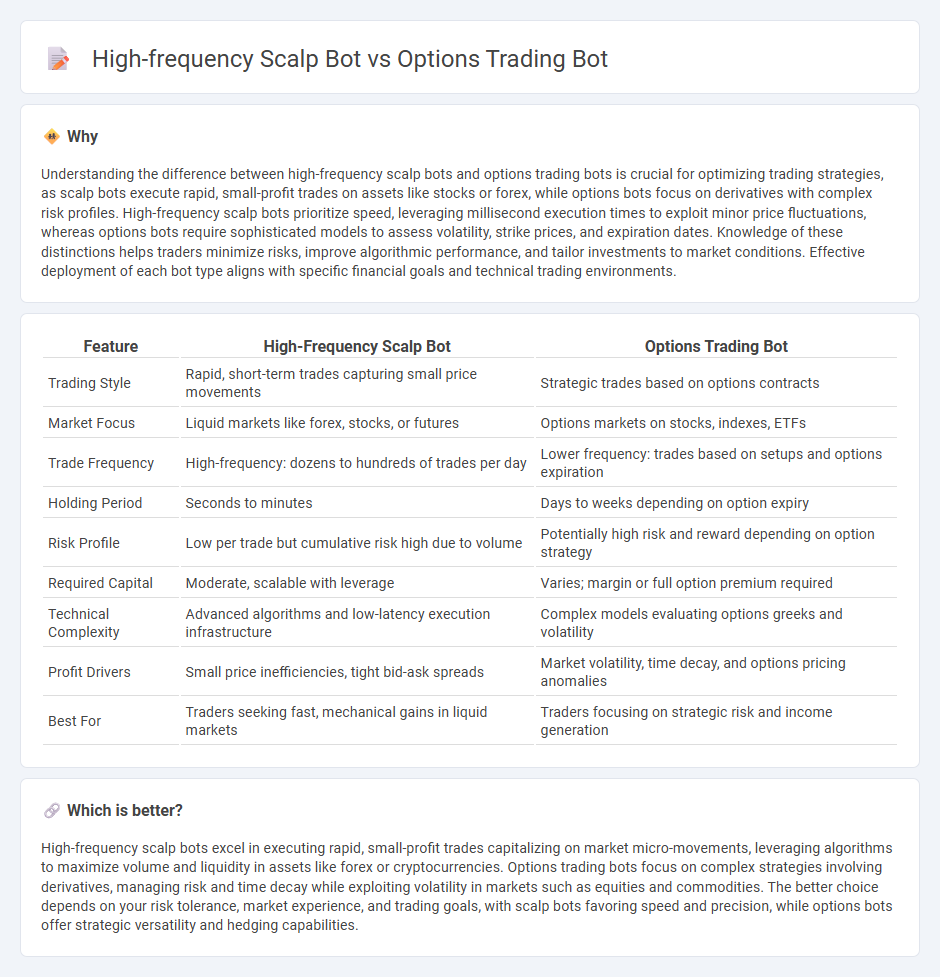

Understanding the difference between high-frequency scalp bots and options trading bots is crucial for optimizing trading strategies, as scalp bots execute rapid, small-profit trades on assets like stocks or forex, while options bots focus on derivatives with complex risk profiles. High-frequency scalp bots prioritize speed, leveraging millisecond execution times to exploit minor price fluctuations, whereas options bots require sophisticated models to assess volatility, strike prices, and expiration dates. Knowledge of these distinctions helps traders minimize risks, improve algorithmic performance, and tailor investments to market conditions. Effective deployment of each bot type aligns with specific financial goals and technical trading environments.

Comparison Table

| Feature | High-Frequency Scalp Bot | Options Trading Bot |

|---|---|---|

| Trading Style | Rapid, short-term trades capturing small price movements | Strategic trades based on options contracts |

| Market Focus | Liquid markets like forex, stocks, or futures | Options markets on stocks, indexes, ETFs |

| Trade Frequency | High-frequency: dozens to hundreds of trades per day | Lower frequency: trades based on setups and options expiration |

| Holding Period | Seconds to minutes | Days to weeks depending on option expiry |

| Risk Profile | Low per trade but cumulative risk high due to volume | Potentially high risk and reward depending on option strategy |

| Required Capital | Moderate, scalable with leverage | Varies; margin or full option premium required |

| Technical Complexity | Advanced algorithms and low-latency execution infrastructure | Complex models evaluating options greeks and volatility |

| Profit Drivers | Small price inefficiencies, tight bid-ask spreads | Market volatility, time decay, and options pricing anomalies |

| Best For | Traders seeking fast, mechanical gains in liquid markets | Traders focusing on strategic risk and income generation |

Which is better?

High-frequency scalp bots excel in executing rapid, small-profit trades capitalizing on market micro-movements, leveraging algorithms to maximize volume and liquidity in assets like forex or cryptocurrencies. Options trading bots focus on complex strategies involving derivatives, managing risk and time decay while exploiting volatility in markets such as equities and commodities. The better choice depends on your risk tolerance, market experience, and trading goals, with scalp bots favoring speed and precision, while options bots offer strategic versatility and hedging capabilities.

Connection

High-frequency scalp bots execute rapid trades by exploiting small price movements, while options trading bots analyze derivatives market data to predict price volatility. Both bots utilize advanced algorithms and real-time data feeds to optimize trade execution speed and accuracy, enhancing profitability in volatile markets. Integration of these bots allows traders to hedge positions dynamically, leveraging scalp profits to inform options strategies and manage risk more effectively.

Key Terms

Strike Price

Options trading bots optimize strike price selection by analyzing volatility, time decay, and underlying asset trends to maximize profits and minimize risk. High-frequency scalp bots prioritize rapid trades near current market prices, focusing less on strike price and more on capturing small price movements within milliseconds. Explore detailed comparisons to understand how strike price strategy impacts bot performance in different trading environments.

Market Microstructure

Options trading bots leverage complex algorithms to analyze implied volatility, options Greeks, and order flow dynamics to exploit pricing inefficiencies in derivatives markets. High-frequency scalp bots operate on millisecond timeframes, executing rapid trades by capitalizing on bid-ask spread discrepancies and liquidity imbalances within the market microstructure. Explore deeper insights into how these bots interact with market microstructure to enhance trading strategies and execution efficiency.

Latency

Options trading bots and high-frequency scalp bots differ significantly in latency requirements, with scalp bots demanding ultra-low latency often measured in microseconds to capitalize on fleeting price inefficiencies. Options trading bots prioritize algorithmic precision and risk management over speed, as options markets are less sensitive to minute-to-minute price changes compared to scalping strategies in highly liquid markets. Explore the latency dynamics further to optimize your trading bot's performance effectively.

Source and External Links

SpeedBot - Leading Options Trading App - SpeedBot lets you create personalized options trading bots without coding through a bot-builder that supports complex options strategies and backtesting with historical data, ideal for traders seeking automation with flexibility and expert assistance.

Options Robot - This platform offers automated bots for options trading that integrate directly with brokers, requiring no coding, and feature templated trading plans, live data, and disciplined management tools to optimize options entries and positions.

Option Alpha Bots - Option Alpha provides no-code automated options trading bots that use natural language decision rules, pre-built templates, and cloud-based execution to improve speed and efficiency, allowing traders full control and access to paper trading for strategy testing.

dowidth.com

dowidth.com