Dark pool prints reveal large institutional trades executed away from public exchanges, providing insight into market impact without influencing price movements. Hidden liquidity refers to orders placed in the order book that are not visible to other traders, allowing for stealthier execution strategies. Explore how understanding dark pool prints and hidden liquidity can enhance trading decisions and market analysis.

Why it is important

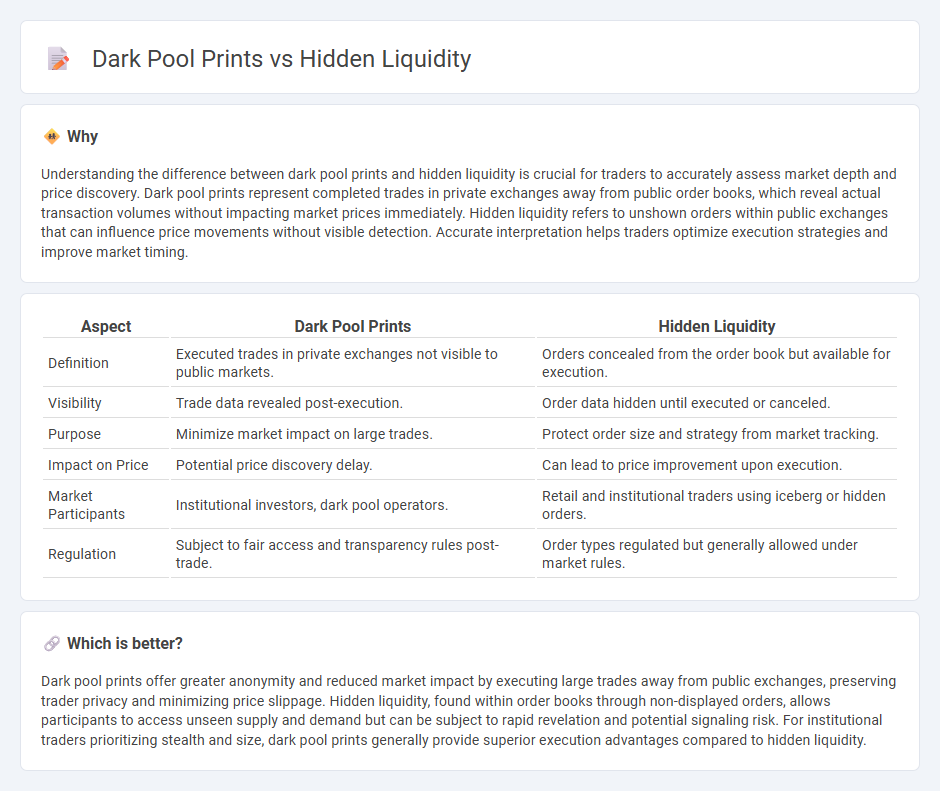

Understanding the difference between dark pool prints and hidden liquidity is crucial for traders to accurately assess market depth and price discovery. Dark pool prints represent completed trades in private exchanges away from public order books, which reveal actual transaction volumes without impacting market prices immediately. Hidden liquidity refers to unshown orders within public exchanges that can influence price movements without visible detection. Accurate interpretation helps traders optimize execution strategies and improve market timing.

Comparison Table

| Aspect | Dark Pool Prints | Hidden Liquidity |

|---|---|---|

| Definition | Executed trades in private exchanges not visible to public markets. | Orders concealed from the order book but available for execution. |

| Visibility | Trade data revealed post-execution. | Order data hidden until executed or canceled. |

| Purpose | Minimize market impact on large trades. | Protect order size and strategy from market tracking. |

| Impact on Price | Potential price discovery delay. | Can lead to price improvement upon execution. |

| Market Participants | Institutional investors, dark pool operators. | Retail and institutional traders using iceberg or hidden orders. |

| Regulation | Subject to fair access and transparency rules post-trade. | Order types regulated but generally allowed under market rules. |

Which is better?

Dark pool prints offer greater anonymity and reduced market impact by executing large trades away from public exchanges, preserving trader privacy and minimizing price slippage. Hidden liquidity, found within order books through non-displayed orders, allows participants to access unseen supply and demand but can be subject to rapid revelation and potential signaling risk. For institutional traders prioritizing stealth and size, dark pool prints generally provide superior execution advantages compared to hidden liquidity.

Connection

Dark pool prints reveal large institutional trades executed away from public exchanges, offering insights into hidden liquidity pools not visible in the order book. These hidden liquidity pockets allow traders to execute substantial orders without causing significant market impact or price fluctuations. Understanding the relationship between dark pool activity and hidden liquidity helps traders anticipate market movements and optimize execution strategies.

Key Terms

Order Book

Hidden liquidity refers to orders placed in the order book that are not visible to the market, often using iceberg orders to conceal large trade sizes and minimize market impact. Dark pool prints represent executed trades within private venues where order details remain undisclosed, contributing to opaque market data beyond the visible order book. Explore the intricacies of order book dynamics to better understand how hidden liquidity and dark pool prints influence market transparency and price discovery.

Trade Reporting

Hidden liquidity represents unadvertised orders that contribute to market depth without revealing full size, enhancing price discovery without impacting visible order books. Dark pool prints occur from trades executed privately within alternative trading systems, avoiding pre-trade transparency but reported post-trade in consolidated tape for regulatory compliance. Explore the nuances of trade reporting to understand how hidden liquidity and dark pool prints influence market transparency and execution quality.

Market Transparency

Hidden liquidity and dark pool prints represent two critical components impacting market transparency by concealing trade intentions from the broader market. Hidden liquidity refers to orders not visible in the public order book, while dark pool prints are executions within private venues that do not immediately disseminate trade details, both challenging price discovery and fairness. Explore how these mechanisms influence trading strategies and regulatory frameworks for a deeper understanding of market transparency dynamics.

Source and External Links

Spotting Hidden Liquidity & Iceberg Orders - Hidden liquidity refers to large orders masked by smaller visible portions (iceberg orders) to conceal true trading intentions, often used by institutional investors to manipulate price perception and prevent revealing their full interest in the market.

Hidden Liquidity: Some new light on dark trading - Hidden liquidity is a common feature allowing traders to hide all or part of their orders, creating non-displayed liquidity that increases market opacity and can impact spreads, trader profits, and overall market transparency.

Navigating the Murky World of Hidden Liquidity - Hidden liquidity accounts for a significant portion of volume on U.S. equity exchanges, and advanced machine learning algorithms are being developed to predict and interact with these non-displayed orders to improve trade execution quality.

dowidth.com

dowidth.com