Flash loan arbitrage leverages instant, uncollateralized loans to exploit price discrepancies across decentralized finance platforms within seconds, maximizing profits through rapid, automated transactions. Swing trading involves holding assets for days to weeks, capitalizing on short- to medium-term market trends and price swings using technical and fundamental analysis. Discover more about how these distinct trading strategies can enhance your investment approach.

Why it is important

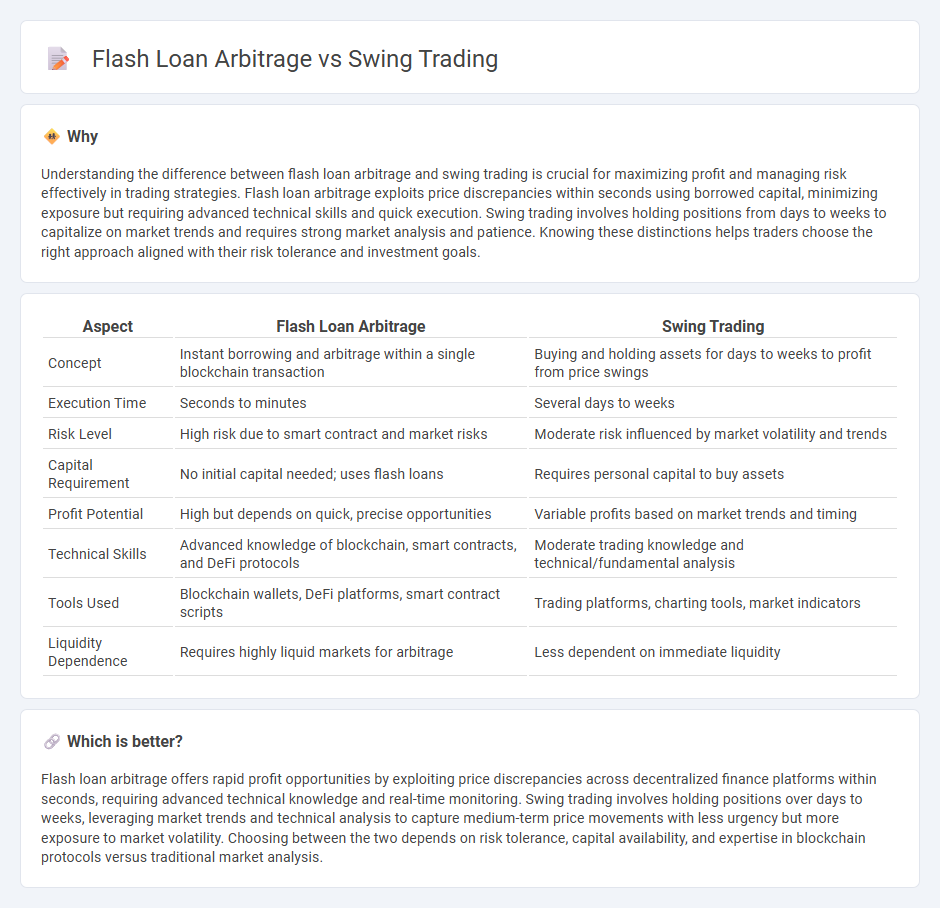

Understanding the difference between flash loan arbitrage and swing trading is crucial for maximizing profit and managing risk effectively in trading strategies. Flash loan arbitrage exploits price discrepancies within seconds using borrowed capital, minimizing exposure but requiring advanced technical skills and quick execution. Swing trading involves holding positions from days to weeks to capitalize on market trends and requires strong market analysis and patience. Knowing these distinctions helps traders choose the right approach aligned with their risk tolerance and investment goals.

Comparison Table

| Aspect | Flash Loan Arbitrage | Swing Trading |

|---|---|---|

| Concept | Instant borrowing and arbitrage within a single blockchain transaction | Buying and holding assets for days to weeks to profit from price swings |

| Execution Time | Seconds to minutes | Several days to weeks |

| Risk Level | High risk due to smart contract and market risks | Moderate risk influenced by market volatility and trends |

| Capital Requirement | No initial capital needed; uses flash loans | Requires personal capital to buy assets |

| Profit Potential | High but depends on quick, precise opportunities | Variable profits based on market trends and timing |

| Technical Skills | Advanced knowledge of blockchain, smart contracts, and DeFi protocols | Moderate trading knowledge and technical/fundamental analysis |

| Tools Used | Blockchain wallets, DeFi platforms, smart contract scripts | Trading platforms, charting tools, market indicators |

| Liquidity Dependence | Requires highly liquid markets for arbitrage | Less dependent on immediate liquidity |

Which is better?

Flash loan arbitrage offers rapid profit opportunities by exploiting price discrepancies across decentralized finance platforms within seconds, requiring advanced technical knowledge and real-time monitoring. Swing trading involves holding positions over days to weeks, leveraging market trends and technical analysis to capture medium-term price movements with less urgency but more exposure to market volatility. Choosing between the two depends on risk tolerance, capital availability, and expertise in blockchain protocols versus traditional market analysis.

Connection

Flash loan arbitrage and swing trading both capitalize on market inefficiencies to generate profit, with flash loan arbitrage exploiting instant price discrepancies within decentralized finance (DeFi) platforms using uncollateralized loans. Swing trading involves holding assets over several days to weeks, profiting from expected short- to medium-term price movements, while flash loan arbitrage requires executing transactions within a single block to capture arbitrage opportunities quickly. Integrating flash loan arbitrage strategies can enhance swing traders' ability to enter or exit positions efficiently, optimizing returns by leveraging DeFi liquidity and speed.

Key Terms

Holding Period

Swing trading involves holding assets for several days to weeks, capitalizing on medium-term market trends and price fluctuations. Flash loan arbitrage executes near-instantaneous trading opportunities within seconds or minutes, leveraging borrowed funds without holding positions beyond a single transaction. Explore detailed strategies and risk profiles to optimize your trading approach.

Market Volatility

Swing trading capitalizes on moderate market volatility by holding positions for days to weeks, aiming to profit from short- to medium-term price trends. Flash loan arbitrage exploits extreme, momentary volatility in decentralized finance (DeFi) markets, requiring rapid, high-frequency trades within a single blockchain transaction. Explore the nuanced impacts of market volatility on these strategies for deeper insights.

Leverage

Swing trading utilizes moderate leverage through margin accounts, allowing traders to hold positions over several days to weeks and capitalize on price momentum. Flash loan arbitrage exploits instant, uncollateralized loans on decentralized finance (DeFi) platforms to execute rapid, high-leverage trades within a single blockchain transaction. Explore the detailed mechanics and risk profiles of both strategies to understand their leverage implications more deeply.

Source and External Links

Swing trading - Wikipedia - Swing trading is a speculative strategy where an asset is held for days to profit from price swings, using technical or fundamental analysis with rule-based systems to time entries and exits without requiring perfect timing, focusing on consistent small gains.

What is swing trading & how does it work? - Saxo Bank - Swing trading strategies include breakout trading and trend trading, where traders use technical indicators like moving averages and volume-weighted averages to enter and exit positions based on price momentum and breakouts.

Swing trading: A complete guide for investors | TD Direct Investing - Swing trading involves profiting from short-term price changes by buying dips and shorting rallies, appealing to trend-spotters who hold positions for days or weeks, as a middle ground between day trading and long-term trend investing.

dowidth.com

dowidth.com