Liquidity sweeps involve traders targeting areas where large orders are likely to be executed, capitalizing on price movements caused by these accumulations of liquidity. Stop hunting refers to strategies aimed at triggering stop-loss orders, often causing sharp market reversals as stops are hit en masse. Explore detailed analyses to better understand how these tactics impact market dynamics and trading decisions.

Why it is important

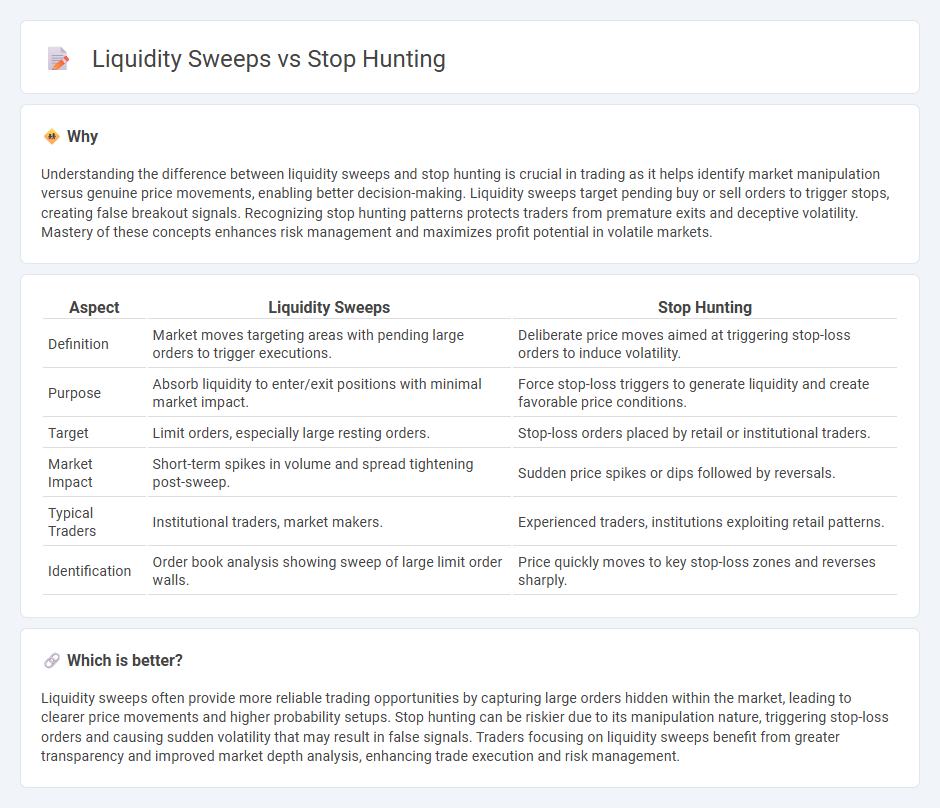

Understanding the difference between liquidity sweeps and stop hunting is crucial in trading as it helps identify market manipulation versus genuine price movements, enabling better decision-making. Liquidity sweeps target pending buy or sell orders to trigger stops, creating false breakout signals. Recognizing stop hunting patterns protects traders from premature exits and deceptive volatility. Mastery of these concepts enhances risk management and maximizes profit potential in volatile markets.

Comparison Table

| Aspect | Liquidity Sweeps | Stop Hunting |

|---|---|---|

| Definition | Market moves targeting areas with pending large orders to trigger executions. | Deliberate price moves aimed at triggering stop-loss orders to induce volatility. |

| Purpose | Absorb liquidity to enter/exit positions with minimal market impact. | Force stop-loss triggers to generate liquidity and create favorable price conditions. |

| Target | Limit orders, especially large resting orders. | Stop-loss orders placed by retail or institutional traders. |

| Market Impact | Short-term spikes in volume and spread tightening post-sweep. | Sudden price spikes or dips followed by reversals. |

| Typical Traders | Institutional traders, market makers. | Experienced traders, institutions exploiting retail patterns. |

| Identification | Order book analysis showing sweep of large limit order walls. | Price quickly moves to key stop-loss zones and reverses sharply. |

Which is better?

Liquidity sweeps often provide more reliable trading opportunities by capturing large orders hidden within the market, leading to clearer price movements and higher probability setups. Stop hunting can be riskier due to its manipulation nature, triggering stop-loss orders and causing sudden volatility that may result in false signals. Traders focusing on liquidity sweeps benefit from greater transparency and improved market depth analysis, enhancing trade execution and risk management.

Connection

Liquidity sweeps occur when large traders trigger stop-loss orders clustered around key price levels, causing rapid price movements that exploit market liquidity. Stop hunting involves deliberately pushing prices to these levels to activate stop orders and profit from the resulting volatility. This connection highlights how market manipulators capitalize on liquidity pools created by clustered stop orders to drive price fluctuations.

Key Terms

Stop-loss orders

Stop hunting targets clustered stop-loss orders by triggering short-term price dips to activate protective sell or buy orders, often leading to increased volatility. Liquidity sweeps involve aggressive market orders sweeping through multiple price levels to capture liquidity behind stop-loss zones, driving rapid price movements. Explore more to understand the impact of stop-loss strategies on market dynamics and trading outcomes.

Liquidity pools

Liquidity sweeps target concentrated liquidity pools where stop-loss orders accumulate, triggering rapid price movements as these orders execute collectively. Unlike stop hunting, which manipulates prices to trigger stops scattered across the order book, liquidity sweeps strategically drain liquidity pools to create momentum in desired directions. Explore the mechanics of liquidity pools and their role in market dynamics to deepen your trading strategy insights.

Order book manipulation

Stop hunting exploits large hidden stop-loss orders to trigger cascades of automatic sell or buy orders, leading to sudden price drops or spikes that benefit manipulators. Liquidity sweeps target the order book by aggressively removing resting limit orders at multiple price levels, creating artificial volatility and misleading market participants about true supply and demand. Explore further to understand how these manipulative tactics distort order book dynamics and impact trading strategies.

Source and External Links

Stop Loss Hunting - How to Use It and How to Protect Yourself From It - Stop hunting is a trading strategy where large traders trigger others' stop-loss orders to profit from the resulting price movements, and traders can protect themselves by using strategies like mean reversion around support and resistance levels.

Stop Hunting Guide (2025): How the Strategy Works - Stop hunting occurs when big players push market prices to trigger groups of stop-loss orders, causing forced exits of smaller traders and enabling these big traders to capitalize on the liquidity created.

Stop Loss Hunting Definition - FOREX.com - Stop-loss hunting refers to market moves aimed at triggering stop orders clustered at certain levels, leading to rapid price changes and increased volatility as multiple stop-losses are executed simultaneously.

dowidth.com

dowidth.com