Social copy trading enables investors to replicate the trades of experienced traders in real-time, offering a hands-off approach ideal for beginners. Swing trading involves holding positions for days to weeks, capitalizing on short- to medium-term price fluctuations using technical analysis. Explore the key differences and benefits of each strategy to determine which suits your trading goals best.

Why it is important

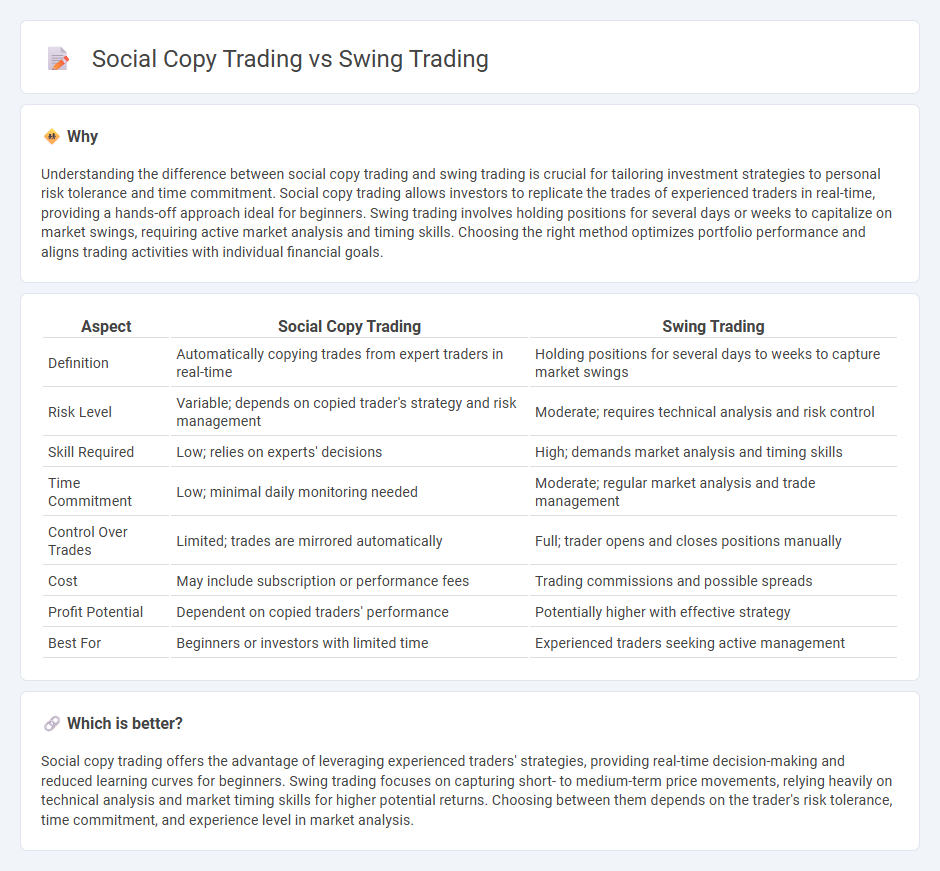

Understanding the difference between social copy trading and swing trading is crucial for tailoring investment strategies to personal risk tolerance and time commitment. Social copy trading allows investors to replicate the trades of experienced traders in real-time, providing a hands-off approach ideal for beginners. Swing trading involves holding positions for several days or weeks to capitalize on market swings, requiring active market analysis and timing skills. Choosing the right method optimizes portfolio performance and aligns trading activities with individual financial goals.

Comparison Table

| Aspect | Social Copy Trading | Swing Trading |

|---|---|---|

| Definition | Automatically copying trades from expert traders in real-time | Holding positions for several days to weeks to capture market swings |

| Risk Level | Variable; depends on copied trader's strategy and risk management | Moderate; requires technical analysis and risk control |

| Skill Required | Low; relies on experts' decisions | High; demands market analysis and timing skills |

| Time Commitment | Low; minimal daily monitoring needed | Moderate; regular market analysis and trade management |

| Control Over Trades | Limited; trades are mirrored automatically | Full; trader opens and closes positions manually |

| Cost | May include subscription or performance fees | Trading commissions and possible spreads |

| Profit Potential | Dependent on copied traders' performance | Potentially higher with effective strategy |

| Best For | Beginners or investors with limited time | Experienced traders seeking active management |

Which is better?

Social copy trading offers the advantage of leveraging experienced traders' strategies, providing real-time decision-making and reduced learning curves for beginners. Swing trading focuses on capturing short- to medium-term price movements, relying heavily on technical analysis and market timing skills for higher potential returns. Choosing between them depends on the trader's risk tolerance, time commitment, and experience level in market analysis.

Connection

Social copy trading leverages collective market insights by allowing traders to replicate strategies of experienced swing traders, enhancing decision-making speed and accuracy. Swing trading focuses on capturing short- to medium-term market trends through technical analysis, which social copy trading platforms use to provide real-time trade signals. Integrating swing trading methods within social copy trading ecosystems improves portfolio diversification and risk management for both novice and expert traders.

Key Terms

Holding Period

Swing trading typically involves holding positions for several days to weeks to capitalize on short- to medium-term price movements. Social copy trading allows traders to replicate others' trades, often with varying holding periods depending on the copied trader's strategy, which can range from minutes to months. Explore further to understand how holding periods impact risk and return in both approaches.

Strategy Autonomy

Swing trading involves independent decision-making based on technical analysis and market trends, allowing traders to execute trades within days to weeks for optimal price movements. Social copy trading relies on automatically mirroring the trades of experienced investors on social platforms, reducing individual strategy control but providing access to expert decisions. Explore the benefits and limitations of strategy autonomy in both approaches to determine the best fit for your trading style.

Signal Provider

Signal providers play a crucial role in both swing trading and social copy trading, offering carefully analyzed market entries and exits to maximize trader profits. In swing trading, signal providers analyze technical indicators and market trends to suggest positions held for days or weeks, while social copy trading platforms enable real-time copying of these signals for immediate execution by followers. Explore the nuances of effective signal provision to enhance your trading strategy and decision-making process.

Source and External Links

Swing trading - Wikipedia - Swing trading is a speculative strategy where an asset is held for days or weeks to profit from price changes, using technical or fundamental analysis and rule-based systems to guide buy and sell decisions.

Swing trading: A complete guide for investors | TD Direct Investing - Swing trading involves profiting from short-term price fluctuations by buying low and selling high or short selling during price rises, typically holding positions for days or weeks, appealing to trend-spotters comfortable with market volatility.

Swing Trading Stocks: Strategies and Indicators - Charles Schwab - Swing traders often trade with broader market trends, using charting techniques like support and resistance levels, and deciding pre-trade on entry, exit, and trade size to capitalize on price swings over days or weeks.

dowidth.com

dowidth.com