Modular blockchains trading enhances scalability and flexibility by separating consensus, data availability, and execution layers, optimizing transaction throughput and reducing latency. Order book trading relies on a centralized or decentralized ledger matching buy and sell orders in real-time, prioritizing price discovery and liquidity management. Explore the benefits and trade-offs between modular blockchain architectures and traditional order book systems to understand which trading model suits your needs.

Why it is important

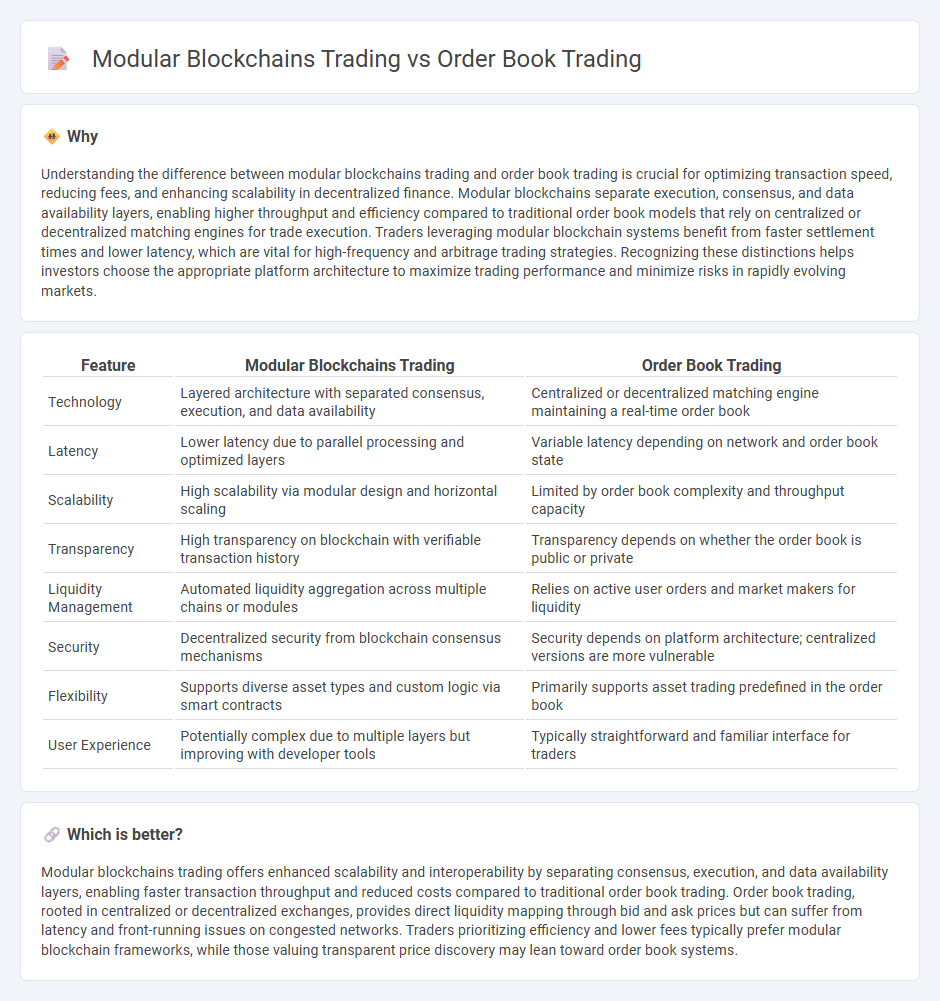

Understanding the difference between modular blockchains trading and order book trading is crucial for optimizing transaction speed, reducing fees, and enhancing scalability in decentralized finance. Modular blockchains separate execution, consensus, and data availability layers, enabling higher throughput and efficiency compared to traditional order book models that rely on centralized or decentralized matching engines for trade execution. Traders leveraging modular blockchain systems benefit from faster settlement times and lower latency, which are vital for high-frequency and arbitrage trading strategies. Recognizing these distinctions helps investors choose the appropriate platform architecture to maximize trading performance and minimize risks in rapidly evolving markets.

Comparison Table

| Feature | Modular Blockchains Trading | Order Book Trading |

|---|---|---|

| Technology | Layered architecture with separated consensus, execution, and data availability | Centralized or decentralized matching engine maintaining a real-time order book |

| Latency | Lower latency due to parallel processing and optimized layers | Variable latency depending on network and order book state |

| Scalability | High scalability via modular design and horizontal scaling | Limited by order book complexity and throughput capacity |

| Transparency | High transparency on blockchain with verifiable transaction history | Transparency depends on whether the order book is public or private |

| Liquidity Management | Automated liquidity aggregation across multiple chains or modules | Relies on active user orders and market makers for liquidity |

| Security | Decentralized security from blockchain consensus mechanisms | Security depends on platform architecture; centralized versions are more vulnerable |

| Flexibility | Supports diverse asset types and custom logic via smart contracts | Primarily supports asset trading predefined in the order book |

| User Experience | Potentially complex due to multiple layers but improving with developer tools | Typically straightforward and familiar interface for traders |

Which is better?

Modular blockchains trading offers enhanced scalability and interoperability by separating consensus, execution, and data availability layers, enabling faster transaction throughput and reduced costs compared to traditional order book trading. Order book trading, rooted in centralized or decentralized exchanges, provides direct liquidity mapping through bid and ask prices but can suffer from latency and front-running issues on congested networks. Traders prioritizing efficiency and lower fees typically prefer modular blockchain frameworks, while those valuing transparent price discovery may lean toward order book systems.

Connection

Modular blockchains trading enhances flexibility and scalability by separating consensus, execution, and data availability layers, which optimizes order book trading through faster and more secure transaction settlement. Order book trading relies on real-time data and efficient order matching, benefiting from modular blockchain architectures that reduce latency and increase throughput. This integration improves liquidity, transparency, and overall market efficiency in decentralized trading platforms.

Key Terms

Order Book Trading:

Order book trading involves a dynamic ledger of buy and sell orders where traders can place limit or market orders, offering greater transparency and price discovery compared to modular blockchains trading. This method allows for real-time matching of orders and greater liquidity, making it a preferred choice in centralized exchanges and some decentralized finance (DeFi) platforms. Explore the advantages and technical nuances of order book trading to optimize your trading strategy.

Bid-Ask Spread

Order book trading typically features narrower bid-ask spreads due to higher liquidity and real-time price discovery, enabling traders to execute orders with minimal slippage. Modular blockchains trading, utilizing separate execution and settlement layers, can experience wider bid-ask spreads from increased transaction latency and reduced liquidity aggregation. Explore the impact of trading architectures on bid-ask dynamics to enhance your strategy insights.

Liquidity

Order book trading in traditional exchanges offers transparent bid-ask prices and immediate liquidity matching, but may suffer from slippage during high volatility. Modular blockchains trading leverages scalable, specialized layers to enhance liquidity fragmentation and increase throughput, improving trade execution efficiency. Explore the differences in liquidity dynamics between these systems to optimize your trading strategy.

Source and External Links

Understanding the Order Book: How It Impacts Trading - SimTrade - An order book is a constantly updated list of buy and sell limit orders for an asset, showing pricing levels and volume on both bid and ask sides, which helps traders understand market liquidity and price depth.

What is an Order Book, and How Do You Read & Analyze it? - The order book records all pending buy and sell orders at specific prices and quantities, updated in real time and used for assessing supply, demand, and price levels with an order matching process that executes transactions when buy and sell prices cross.

What Is an Order Book and How Does It Work? - Binance Academy - Order books show real-time bids and asks for assets and are used by traders to identify market support and resistance levels, analyze liquidity, and anticipate price moves, with different types of orders like market, limit, and stop orders organized within it.

dowidth.com

dowidth.com