Proprietary trading firm challenges offer traders the opportunity to prove their skills under strict evaluation criteria, often requiring specific profit targets and risk management standards. Investment clubs, by contrast, pool resources from multiple members to collectively invest and share both risks and rewards, emphasizing collaboration over individual performance. Discover more about which approach aligns best with your trading goals.

Why it is important

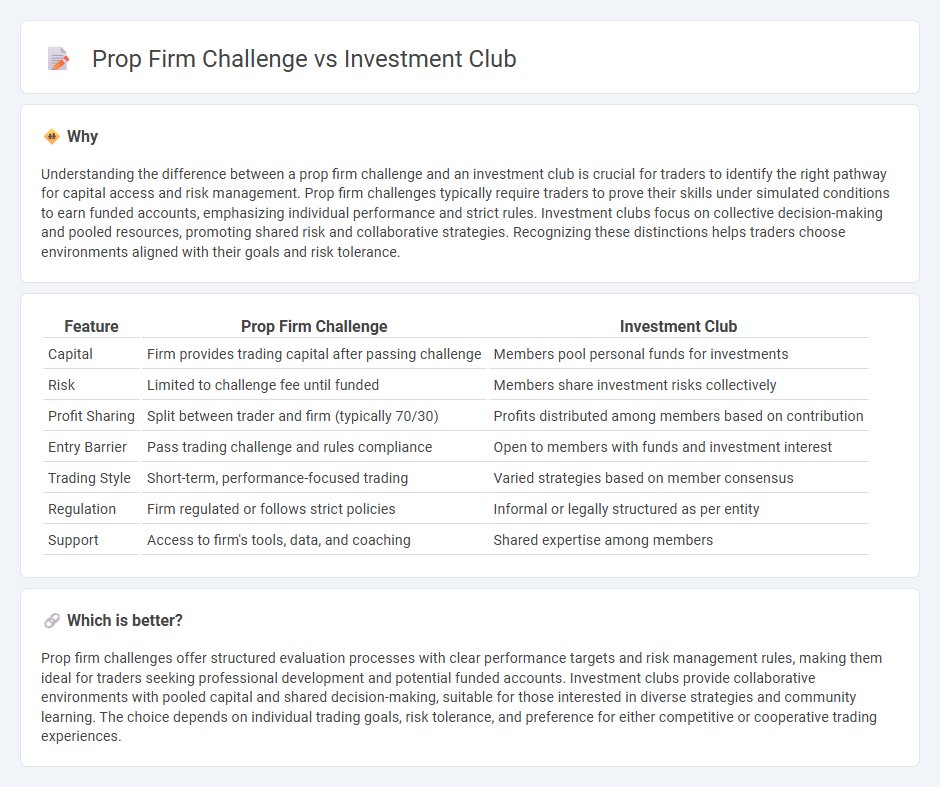

Understanding the difference between a prop firm challenge and an investment club is crucial for traders to identify the right pathway for capital access and risk management. Prop firm challenges typically require traders to prove their skills under simulated conditions to earn funded accounts, emphasizing individual performance and strict rules. Investment clubs focus on collective decision-making and pooled resources, promoting shared risk and collaborative strategies. Recognizing these distinctions helps traders choose environments aligned with their goals and risk tolerance.

Comparison Table

| Feature | Prop Firm Challenge | Investment Club |

|---|---|---|

| Capital | Firm provides trading capital after passing challenge | Members pool personal funds for investments |

| Risk | Limited to challenge fee until funded | Members share investment risks collectively |

| Profit Sharing | Split between trader and firm (typically 70/30) | Profits distributed among members based on contribution |

| Entry Barrier | Pass trading challenge and rules compliance | Open to members with funds and investment interest |

| Trading Style | Short-term, performance-focused trading | Varied strategies based on member consensus |

| Regulation | Firm regulated or follows strict policies | Informal or legally structured as per entity |

| Support | Access to firm's tools, data, and coaching | Shared expertise among members |

Which is better?

Prop firm challenges offer structured evaluation processes with clear performance targets and risk management rules, making them ideal for traders seeking professional development and potential funded accounts. Investment clubs provide collaborative environments with pooled capital and shared decision-making, suitable for those interested in diverse strategies and community learning. The choice depends on individual trading goals, risk tolerance, and preference for either competitive or cooperative trading experiences.

Connection

Prop firm challenges require traders to demonstrate consistent profitability, which helps identify skilled participants who can manage funded accounts. Investment clubs pool resources and share trading strategies, often providing a supportive environment for members to prepare for or succeed in these prop firm challenges. Both structures emphasize risk management and disciplined trading, creating pathways for traders to access capital and enhance their market performance.

Key Terms

**Investment Club:**

Investment clubs pool funds from multiple investors to collectively manage and grow a diversified portfolio, emphasizing collaboration and shared decision-making. Members benefit from collective knowledge, reduced individual risk, and access to broader investment opportunities, unlike proprietary trading firms that primarily compete individually using firm capital. Discover more about how investment clubs can boost your wealth-building strategy and community engagement.

Pooled Funds

Pooled funds in investment clubs combine resources from multiple investors to diversify risk and amplify capital for shared trading opportunities, while prop firm challenges typically require individual traders to demonstrate skill and profitability under predefined conditions without pooling assets. Investment clubs emphasize collaborative decision-making and collective asset growth, whereas prop firm challenges prioritize personal performance and risk management to qualify for firm capital allocation. Explore the nuances and benefits of pooled funds in each context to optimize your trading strategy.

Member Voting

Investment clubs empower members with voting rights to democratically decide on portfolio choices and strategy, fostering collective ownership and shared risk. Proprietary firm challenges typically centralize decision-making with seasoned traders, limiting or excluding member voting to maintain competitive consistency. Explore the nuances of member voting power to understand which model aligns best with your investment goals.

Source and External Links

Investment club - An investment club is a group of individuals who pool money and meet periodically to invest collectively.

Starting an Investment Club - Investment clubs pool members' money to learn about and invest in stocks together, often outperforming major market indices by sharing knowledge and maintaining a long-term investing perspective.

Investment Clubs and the SEC - The SEC generally does not regulate investment clubs if all members actively participate in investment decisions, but clubs must consider registration if membership interests are securities or if they are passive investments.

dowidth.com

dowidth.com