Risk reversal and covered call are advanced options trading strategies used to manage risk and enhance returns. Risk reversal involves buying out-of-the-money call options while selling out-of-the-money put options, often to hedge against potential price movements or speculate on directional trends. Explore the detailed mechanics and use cases of risk reversal versus covered call to optimize your trading approach.

Why it is important

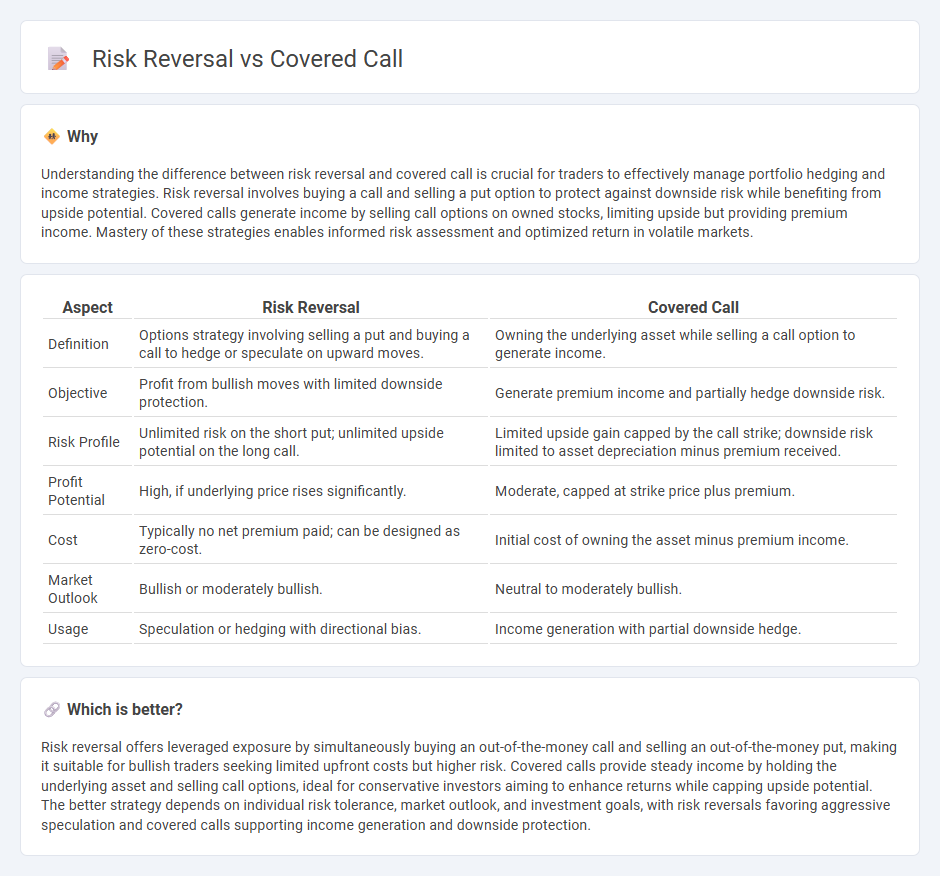

Understanding the difference between risk reversal and covered call is crucial for traders to effectively manage portfolio hedging and income strategies. Risk reversal involves buying a call and selling a put option to protect against downside risk while benefiting from upside potential. Covered calls generate income by selling call options on owned stocks, limiting upside but providing premium income. Mastery of these strategies enables informed risk assessment and optimized return in volatile markets.

Comparison Table

| Aspect | Risk Reversal | Covered Call |

|---|---|---|

| Definition | Options strategy involving selling a put and buying a call to hedge or speculate on upward moves. | Owning the underlying asset while selling a call option to generate income. |

| Objective | Profit from bullish moves with limited downside protection. | Generate premium income and partially hedge downside risk. |

| Risk Profile | Unlimited risk on the short put; unlimited upside potential on the long call. | Limited upside gain capped by the call strike; downside risk limited to asset depreciation minus premium received. |

| Profit Potential | High, if underlying price rises significantly. | Moderate, capped at strike price plus premium. |

| Cost | Typically no net premium paid; can be designed as zero-cost. | Initial cost of owning the asset minus premium income. |

| Market Outlook | Bullish or moderately bullish. | Neutral to moderately bullish. |

| Usage | Speculation or hedging with directional bias. | Income generation with partial downside hedge. |

Which is better?

Risk reversal offers leveraged exposure by simultaneously buying an out-of-the-money call and selling an out-of-the-money put, making it suitable for bullish traders seeking limited upfront costs but higher risk. Covered calls provide steady income by holding the underlying asset and selling call options, ideal for conservative investors aiming to enhance returns while capping upside potential. The better strategy depends on individual risk tolerance, market outlook, and investment goals, with risk reversals favoring aggressive speculation and covered calls supporting income generation and downside protection.

Connection

Risk reversal and covered call strategies both involve options trading to manage risk and enhance returns in the financial markets. A risk reversal typically involves buying a call option and selling a put option to hedge against adverse price movements, while a covered call entails holding the underlying asset and selling a call option to generate income. Both strategies utilize options premiums to balance potential losses and gains, effectively managing risk exposure in trading portfolios.

Key Terms

Options Premium

A covered call strategy involves holding the underlying asset while selling call options to generate premium income, effectively capping upside potential but providing steady premium gains. Risk reversal entails simultaneously selling a put option and buying a call option, designed to hedge downside risk while maintaining upside exposure, often leading to a more neutral or bullish cost structure. Explore in-depth analyses of options premium dynamics to optimize your strategy selection.

Strike Price

Covered calls involve selling call options at strike prices above the current stock price to generate income while owning the stock, limiting upside potential but providing downside protection. Risk reversals combine selling a put option and buying a call option at different strike prices, typically below and above the current price, to profit from directional moves in the underlying asset with defined risk exposure. Explore detailed strategies and strike price selection to optimize risk and reward in options trading.

Hedging

Covered calls involve holding the underlying asset while selling call options to generate income and provide limited downside protection, effectively capping upside potential to hedge against moderate declines. Risk reversals combine selling put options and buying call options to create directional hedges with asymmetric risk, offering protection against downside moves while maintaining upside exposure. Explore the nuanced advantages and applications of each strategy to better tailor your hedging approach.

Source and External Links

Covered Calls - A covered call strategy involves owning a long futures contract and simultaneously selling a call option on that contract to generate income, capping the upside potential in exchange for the premium received.

Covered option - A covered call is a conservative financial strategy where the investor sells a call option against stock they already own, receiving a premium which limits losses but also caps potential profits.

What Is A Covered Call Options Strategy? - Covered calls involve selling a call option for every 100 shares you own, generating income from the premium while providing limited risk and capped returns, suitable for beginners.

dowidth.com

dowidth.com