Delta neutral strategy involves creating a portfolio with offsetting positive and negative deltas to minimize directional risk, commonly using options and underlying assets. Straddle is an options strategy that simultaneously buys a call and put with the same strike price and expiration, profiting from significant price movements regardless of direction. Explore detailed examples and risk profiles of delta neutral strategies versus straddles to optimize trading tactics.

Why it is important

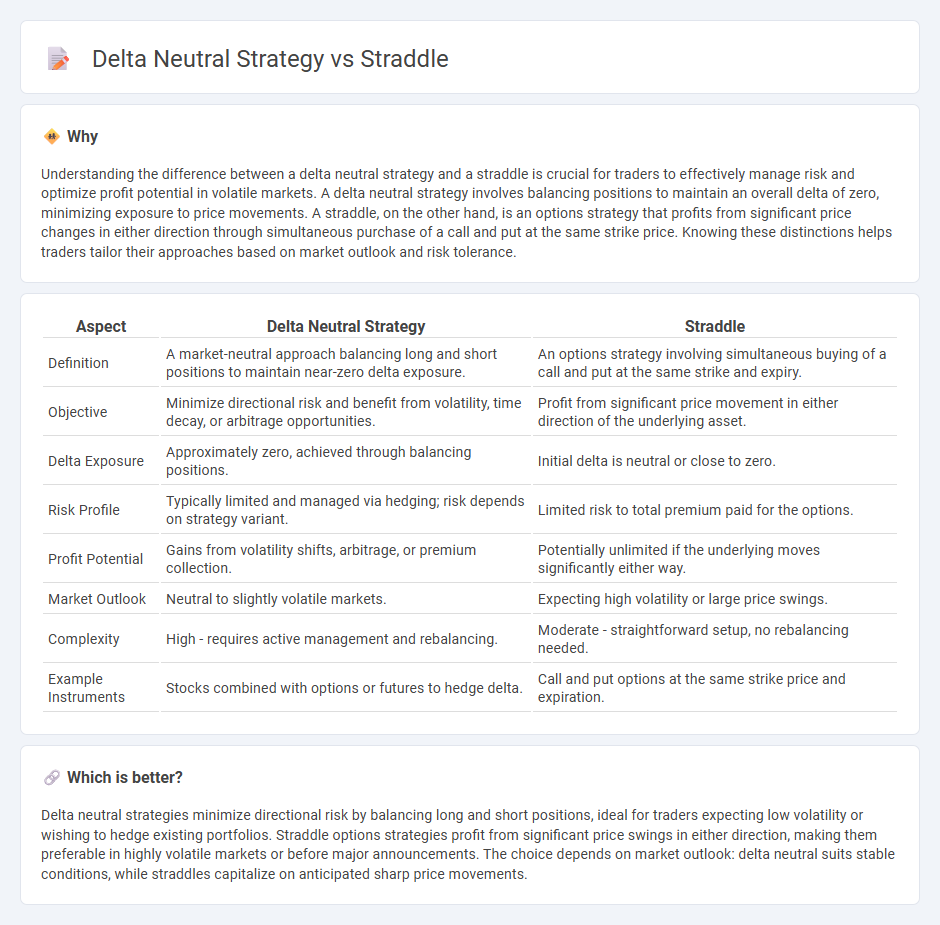

Understanding the difference between a delta neutral strategy and a straddle is crucial for traders to effectively manage risk and optimize profit potential in volatile markets. A delta neutral strategy involves balancing positions to maintain an overall delta of zero, minimizing exposure to price movements. A straddle, on the other hand, is an options strategy that profits from significant price changes in either direction through simultaneous purchase of a call and put at the same strike price. Knowing these distinctions helps traders tailor their approaches based on market outlook and risk tolerance.

Comparison Table

| Aspect | Delta Neutral Strategy | Straddle |

|---|---|---|

| Definition | A market-neutral approach balancing long and short positions to maintain near-zero delta exposure. | An options strategy involving simultaneous buying of a call and put at the same strike and expiry. |

| Objective | Minimize directional risk and benefit from volatility, time decay, or arbitrage opportunities. | Profit from significant price movement in either direction of the underlying asset. |

| Delta Exposure | Approximately zero, achieved through balancing positions. | Initial delta is neutral or close to zero. |

| Risk Profile | Typically limited and managed via hedging; risk depends on strategy variant. | Limited risk to total premium paid for the options. |

| Profit Potential | Gains from volatility shifts, arbitrage, or premium collection. | Potentially unlimited if the underlying moves significantly either way. |

| Market Outlook | Neutral to slightly volatile markets. | Expecting high volatility or large price swings. |

| Complexity | High - requires active management and rebalancing. | Moderate - straightforward setup, no rebalancing needed. |

| Example Instruments | Stocks combined with options or futures to hedge delta. | Call and put options at the same strike price and expiration. |

Which is better?

Delta neutral strategies minimize directional risk by balancing long and short positions, ideal for traders expecting low volatility or wishing to hedge existing portfolios. Straddle options strategies profit from significant price swings in either direction, making them preferable in highly volatile markets or before major announcements. The choice depends on market outlook: delta neutral suits stable conditions, while straddles capitalize on anticipated sharp price movements.

Connection

A delta neutral strategy aims to minimize directional risk by balancing positive and negative delta positions, making the portfolio insensitive to small price movements. A straddle, involving simultaneous purchase of a call and put option at the same strike price and expiration, inherently creates a delta neutral position at inception since the positive delta of the call offsets the negative delta of the put. Traders use straddles as delta neutral strategies to profit from volatility without bias toward market direction.

Key Terms

Options (Call & Put)

A straddle strategy involves buying both a call and a put option at the same strike price and expiration date to profit from significant price volatility in either direction. Delta neutral strategies aim to offset positive and negative delta positions to maintain a net zero delta, reducing directional risk and often involving dynamic adjustments with calls and puts. Explore detailed comparisons of straddle and delta neutral strategies to optimize options trading outcomes.

Delta

A straddle strategy involves holding both a call and put option with the same strike price, creating a position that is initially delta neutral but becomes sensitive to directional moves as the underlying price changes. Delta neutral strategies aim to maintain an overall delta close to zero, continuously adjusting option positions to hedge against price movements and minimize directional risk. Explore how traders implement and manage these approaches to optimize risk and reward in volatile markets.

Volatility

A straddle strategy involves buying both a call and put option at the same strike price, profiting from significant price volatility regardless of direction, as gains from one option offset losses in the other. A delta-neutral strategy aims to maintain a portfolio with zero overall delta, balancing option positions with underlying assets to hedge against price movements and capitalize on implied volatility changes. Discover more about optimizing these volatility-focused strategies for your trading goals.

Source and External Links

Straddle - Definition, How to Create It, Examples - A straddle strategy in trading involves simultaneously buying or selling both a call option and a put option on the same underlying asset, with the same strike price and expiration date, allowing the trader to profit from significant price movements regardless of direction.

Straddle - Wikipedia - In finance, a straddle is an options strategy that consists of buying (long straddle) or selling (short straddle) a call and put option simultaneously at the same strike price and expiration, designed to profit from large price moves without predicting the direction.

Long Straddle Options Strategy - Fidelity Investments - A long straddle is an options strategy buying both a call and a put option with the same strike price and expiration, aiming to gain from large upward or downward moves in the underlying stock, with losses limited to the cost of the options.

dowidth.com

dowidth.com