Retail flow chasing involves individual traders following market trends based on retail order flows, often leading to reactive decision-making and increased volatility. Proprietary trading, however, utilizes firm-owned capital with advanced algorithms and risk management to capitalize on market inefficiencies and generate consistent profits. Discover the key differences and strategies behind these approaches to enhance your trading insights.

Why it is important

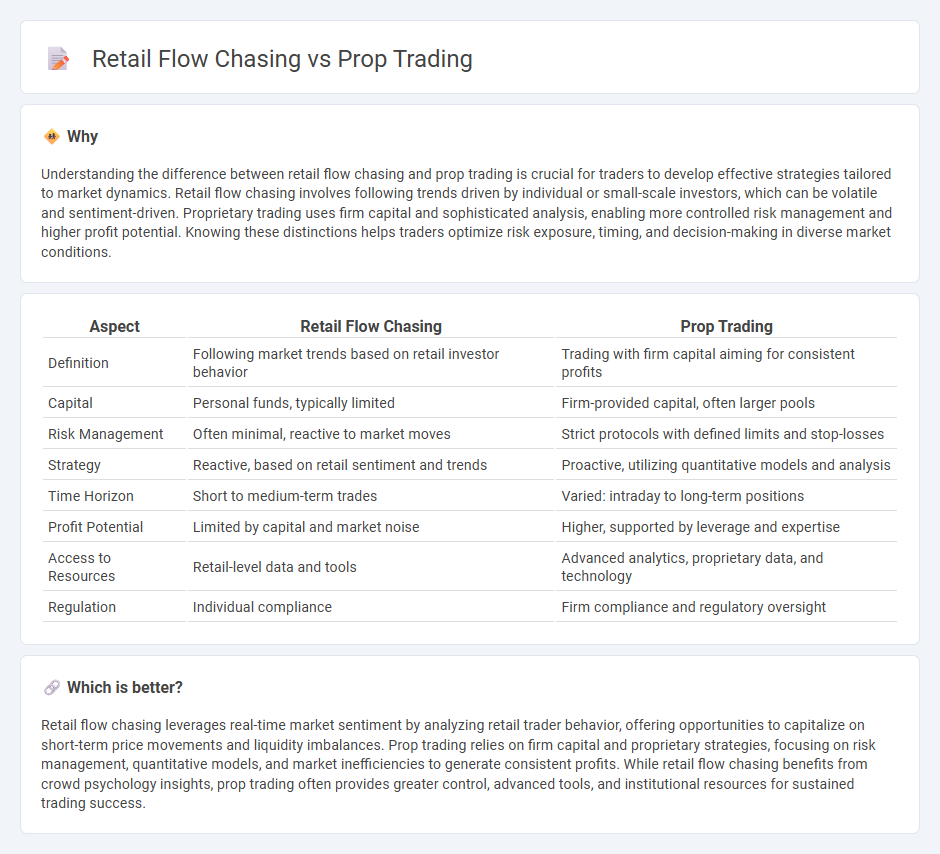

Understanding the difference between retail flow chasing and prop trading is crucial for traders to develop effective strategies tailored to market dynamics. Retail flow chasing involves following trends driven by individual or small-scale investors, which can be volatile and sentiment-driven. Proprietary trading uses firm capital and sophisticated analysis, enabling more controlled risk management and higher profit potential. Knowing these distinctions helps traders optimize risk exposure, timing, and decision-making in diverse market conditions.

Comparison Table

| Aspect | Retail Flow Chasing | Prop Trading |

|---|---|---|

| Definition | Following market trends based on retail investor behavior | Trading with firm capital aiming for consistent profits |

| Capital | Personal funds, typically limited | Firm-provided capital, often larger pools |

| Risk Management | Often minimal, reactive to market moves | Strict protocols with defined limits and stop-losses |

| Strategy | Reactive, based on retail sentiment and trends | Proactive, utilizing quantitative models and analysis |

| Time Horizon | Short to medium-term trades | Varied: intraday to long-term positions |

| Profit Potential | Limited by capital and market noise | Higher, supported by leverage and expertise |

| Access to Resources | Retail-level data and tools | Advanced analytics, proprietary data, and technology |

| Regulation | Individual compliance | Firm compliance and regulatory oversight |

Which is better?

Retail flow chasing leverages real-time market sentiment by analyzing retail trader behavior, offering opportunities to capitalize on short-term price movements and liquidity imbalances. Prop trading relies on firm capital and proprietary strategies, focusing on risk management, quantitative models, and market inefficiencies to generate consistent profits. While retail flow chasing benefits from crowd psychology insights, prop trading often provides greater control, advanced tools, and institutional resources for sustained trading success.

Connection

Retail flow chasing involves monitoring and leveraging the buying and selling behavior of individual traders to anticipate market movements. Prop trading firms capitalize on this by using sophisticated algorithms and strategies to exploit predictable patterns in retail order flow for profit. Understanding this dynamic link enhances market efficiency and provides opportunities for strategic trade execution.

Key Terms

Capital Allocation

Proprietary trading firms allocate capital strategically to leverage advanced algorithms and risk management frameworks, enabling higher returns compared to retail flow chasing that relies on following market trends and external signals. Capital efficiency in prop trading is optimized through disciplined position sizing and real-time market analysis, whereas retail traders often face limitations due to smaller capital bases and emotional decision-making. Explore deeper insights into capital allocation strategies to enhance trading performance.

Order Flow

Proprietary trading firms leverage advanced order flow analysis to anticipate market moves by interpreting the real-time buying and selling pressure within the order book. Retail flow chasing involves less sophisticated tools and reacts to visible market activity, often delaying entry after significant price changes. Explore deeper insights on order flow methodologies and their impact on trading strategies for informed decision-making.

Risk Management

Proprietary trading firms employ advanced risk management strategies, leveraging quantitative models and real-time data to optimize trade execution while minimizing exposure to market volatility. Retail flow chasing often lacks sophisticated risk controls, leading to higher susceptibility to losses during rapid price movements. Explore comprehensive risk management techniques to enhance trading efficacy and safeguard capital.

Source and External Links

What is Prop Trading? Learn how Proprietary Trading Works - Proprietary trading is when a firm trades with its own capital for profit, allowing traders to use allocated capital and strategies like arbitrage, global macro, swing, and day trading to generate profits which the firm then shares with them.

Prop Trading Firms: Here's How They Work - Prop trading firms deploy their own funds across diverse markets like stocks, forex, futures, and crypto, providing capital to skilled traders who use various strategies to generate profits while contributing liquidity and market innovation.

Proprietary Trading - What is Prop Trading & How Does It ... - Prop trading involves banks or firms trading financial instruments with their own money to earn full profits, using sophisticated data and strategies like merger arbitrage and volatility arbitrage; despite risks, it can be highly profitable but is regulated to avoid conflicts of interest.

dowidth.com

dowidth.com