Zero knowledge proof trading leverages encrypted transactions to enhance privacy and security in digital asset exchanges, enabling verifiable trades without revealing sensitive information. High-frequency trading relies on ultra-fast algorithms and low-latency networks to execute thousands of trades per second, capitalizing on minute price discrepancies for profit. Discover the key differences and implications of these trading methods to optimize your financial strategy.

Why it is important

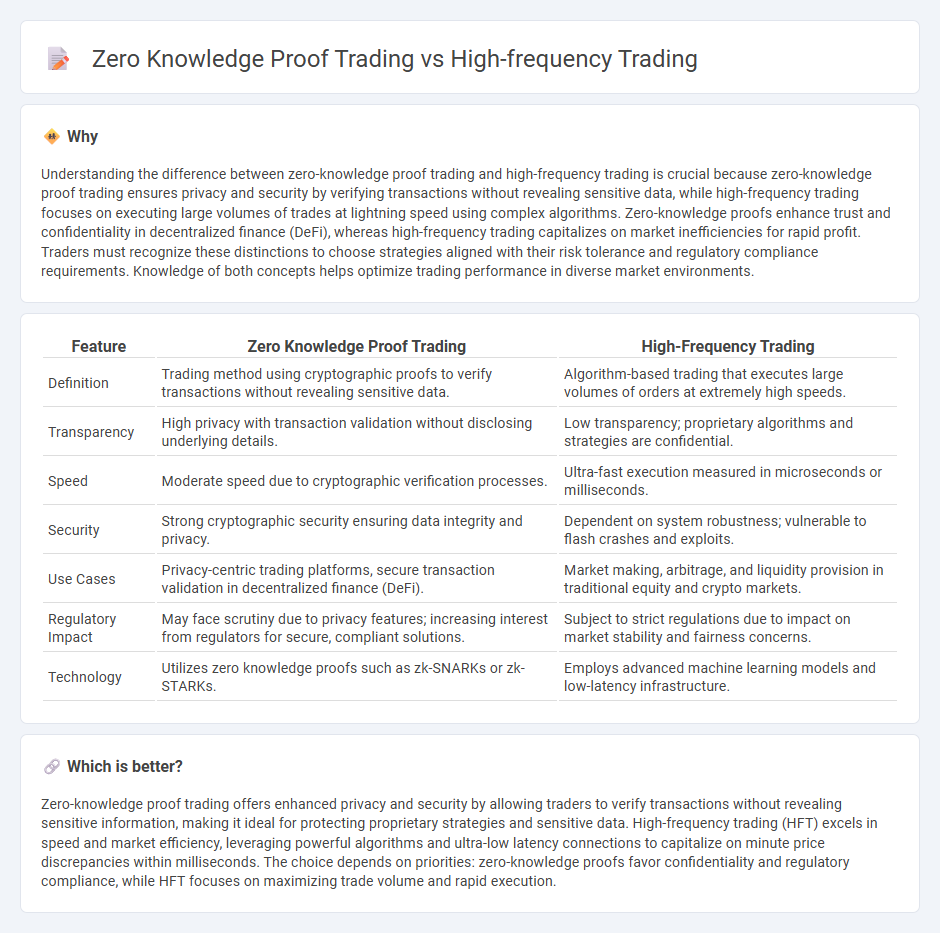

Understanding the difference between zero-knowledge proof trading and high-frequency trading is crucial because zero-knowledge proof trading ensures privacy and security by verifying transactions without revealing sensitive data, while high-frequency trading focuses on executing large volumes of trades at lightning speed using complex algorithms. Zero-knowledge proofs enhance trust and confidentiality in decentralized finance (DeFi), whereas high-frequency trading capitalizes on market inefficiencies for rapid profit. Traders must recognize these distinctions to choose strategies aligned with their risk tolerance and regulatory compliance requirements. Knowledge of both concepts helps optimize trading performance in diverse market environments.

Comparison Table

| Feature | Zero Knowledge Proof Trading | High-Frequency Trading |

|---|---|---|

| Definition | Trading method using cryptographic proofs to verify transactions without revealing sensitive data. | Algorithm-based trading that executes large volumes of orders at extremely high speeds. |

| Transparency | High privacy with transaction validation without disclosing underlying details. | Low transparency; proprietary algorithms and strategies are confidential. |

| Speed | Moderate speed due to cryptographic verification processes. | Ultra-fast execution measured in microseconds or milliseconds. |

| Security | Strong cryptographic security ensuring data integrity and privacy. | Dependent on system robustness; vulnerable to flash crashes and exploits. |

| Use Cases | Privacy-centric trading platforms, secure transaction validation in decentralized finance (DeFi). | Market making, arbitrage, and liquidity provision in traditional equity and crypto markets. |

| Regulatory Impact | May face scrutiny due to privacy features; increasing interest from regulators for secure, compliant solutions. | Subject to strict regulations due to impact on market stability and fairness concerns. |

| Technology | Utilizes zero knowledge proofs such as zk-SNARKs or zk-STARKs. | Employs advanced machine learning models and low-latency infrastructure. |

Which is better?

Zero-knowledge proof trading offers enhanced privacy and security by allowing traders to verify transactions without revealing sensitive information, making it ideal for protecting proprietary strategies and sensitive data. High-frequency trading (HFT) excels in speed and market efficiency, leveraging powerful algorithms and ultra-low latency connections to capitalize on minute price discrepancies within milliseconds. The choice depends on priorities: zero-knowledge proofs favor confidentiality and regulatory compliance, while HFT focuses on maximizing trade volume and rapid execution.

Connection

Zero-knowledge proof trading enhances security and privacy in high-frequency trading by enabling transaction verification without revealing sensitive trading strategies or data. This cryptographic method reduces the risk of information leakage during rapid execution, maintaining competitive advantage in milliseconds-scale trades. Integration of zero-knowledge proofs ensures trustless validation while optimizing speed and confidentiality in algorithmic trading environments.

Key Terms

**High-frequency trading:**

High-frequency trading (HFT) leverages powerful algorithms and ultra-low latency connections to execute thousands of trades within milliseconds, capitalizing on minute price discrepancies in global markets. This approach requires advanced infrastructure, including colocated servers and direct market access, ensuring rapid order placement and execution. Explore the intricacies of high-frequency trading technologies and strategies to gain deeper insights into this competitive trading domain.

Latency

High-frequency trading (HFT) relies on ultra-low latency systems to execute large volumes of trades within microseconds, leveraging algorithms and direct market access to gain competitive advantages. Zero knowledge proof (ZKP) trading prioritizes privacy and security over speed, using cryptographic methods to validate transactions without revealing sensitive data, which generally introduces higher latency compared to HFT. Explore more about how latency impacts trading strategies and the evolving balance between speed and security in financial markets.

Algorithmic strategies

High-frequency trading (HFT) employs ultra-fast algorithms to execute large volumes of trades within milliseconds, capitalizing on minute price discrepancies in financial markets. Zero-knowledge proof trading integrates cryptographic algorithms to validate transactions without revealing sensitive information, enhancing privacy and security in the trading process. Explore the evolving landscape of algorithmic strategies to understand their impact on market efficiency and data confidentiality.

Source and External Links

High-Frequency Trading Explained: What Is It and How Do You Get ... - High-frequency trading is automated trading using powerful computers and advanced algorithms to execute massive numbers of trades at extremely high speeds, capitalizing on tiny price discrepancies for profits in microseconds.

High Frequency Trading (HFT) - Definition, Pros and Cons - HFT uses complex algorithms to scan multiple markets and execute hundreds of trades in seconds, profiting from very small price fluctuations and improving market liquidity and price efficiency.

High-frequency trading - Wikipedia - High-frequency trading is algorithmic and quantitative trading characterized by extremely short portfolio holding periods, focused on exploiting small arbitrage opportunities through speed rather than novel algorithms.

dowidth.com

dowidth.com