Market making involves continuously buying and selling assets to provide liquidity and narrow bid-ask spreads, typically profiting from small price differentials. Swing trading focuses on capturing medium-term price movements by holding positions from several days to weeks, leveraging technical and fundamental analysis to predict market trends. Explore deeper insights into market making and swing trading strategies to optimize your trading performance.

Why it is important

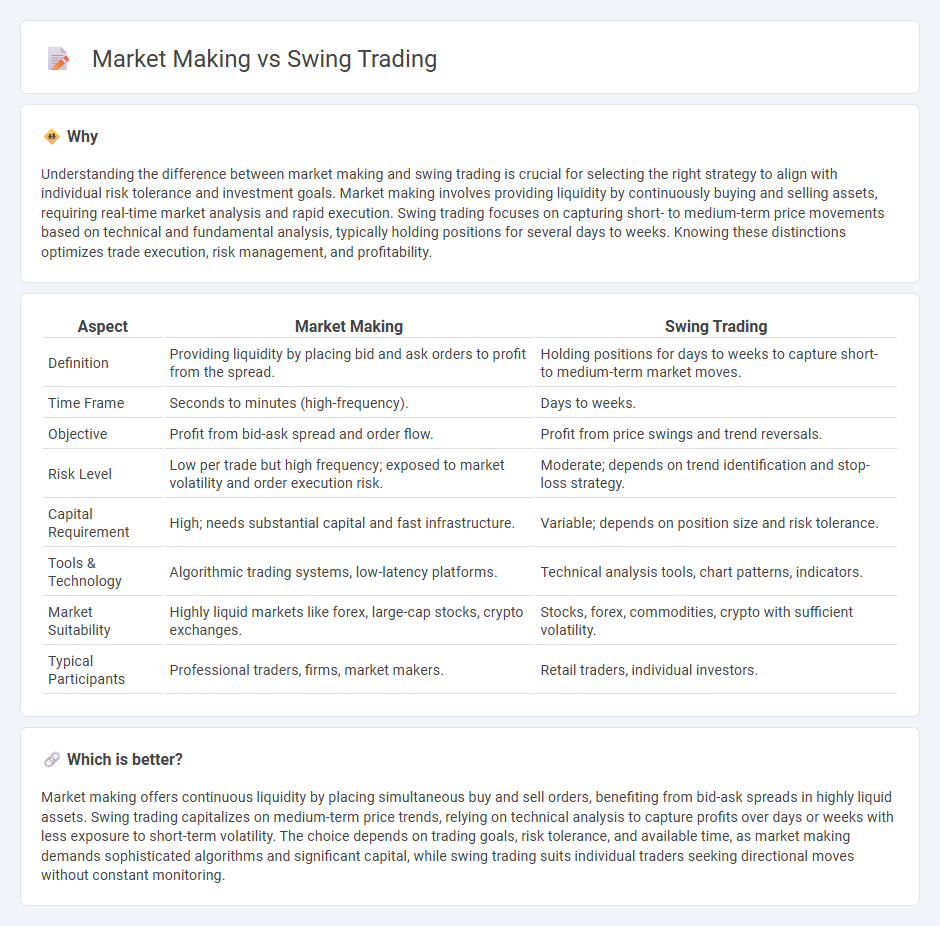

Understanding the difference between market making and swing trading is crucial for selecting the right strategy to align with individual risk tolerance and investment goals. Market making involves providing liquidity by continuously buying and selling assets, requiring real-time market analysis and rapid execution. Swing trading focuses on capturing short- to medium-term price movements based on technical and fundamental analysis, typically holding positions for several days to weeks. Knowing these distinctions optimizes trade execution, risk management, and profitability.

Comparison Table

| Aspect | Market Making | Swing Trading |

|---|---|---|

| Definition | Providing liquidity by placing bid and ask orders to profit from the spread. | Holding positions for days to weeks to capture short- to medium-term market moves. |

| Time Frame | Seconds to minutes (high-frequency). | Days to weeks. |

| Objective | Profit from bid-ask spread and order flow. | Profit from price swings and trend reversals. |

| Risk Level | Low per trade but high frequency; exposed to market volatility and order execution risk. | Moderate; depends on trend identification and stop-loss strategy. |

| Capital Requirement | High; needs substantial capital and fast infrastructure. | Variable; depends on position size and risk tolerance. |

| Tools & Technology | Algorithmic trading systems, low-latency platforms. | Technical analysis tools, chart patterns, indicators. |

| Market Suitability | Highly liquid markets like forex, large-cap stocks, crypto exchanges. | Stocks, forex, commodities, crypto with sufficient volatility. |

| Typical Participants | Professional traders, firms, market makers. | Retail traders, individual investors. |

Which is better?

Market making offers continuous liquidity by placing simultaneous buy and sell orders, benefiting from bid-ask spreads in highly liquid assets. Swing trading capitalizes on medium-term price trends, relying on technical analysis to capture profits over days or weeks with less exposure to short-term volatility. The choice depends on trading goals, risk tolerance, and available time, as market making demands sophisticated algorithms and significant capital, while swing trading suits individual traders seeking directional moves without constant monitoring.

Connection

Market making provides essential liquidity and pricing efficiency that swing traders rely on to enter and exit positions smoothly within short to medium time frames. Swing trading strategies capitalize on the price movements and trends that emerge due to the continuous buy and sell orders placed by market makers. The interaction between market makers' order flow and swing traders' timing creates a dynamic environment conducive to profit opportunities in volatile markets.

Key Terms

Swing Trading:

Swing trading involves holding securities for several days to weeks to capitalize on expected price movements, using technical analysis and market momentum indicators to identify entry and exit points. This strategy contrasts with market making, which involves providing liquidity through continuous bid-ask quotes and profiting from the bid-ask spread rather than price direction. Explore comprehensive guides on swing trading strategies, risk management, and market patterns to enhance your trading effectiveness.

Technical Analysis

Swing trading relies heavily on technical analysis to identify price patterns and momentum for short to medium-term trades, utilizing indicators such as moving averages, RSI, and Fibonacci retracements. Market making, while also using technical tools, focuses more on liquidity provision and bid-ask spread management, requiring rapid response to order flow and market depth data. Explore detailed strategies and differences in technical analysis methods to enhance your trading approach.

Holding Period

Swing trading typically involves holding positions for several days to weeks to capitalize on short- to medium-term price movements, whereas market making requires continuous buying and selling to provide liquidity, often holding positions for only seconds to minutes. The holding period in swing trading aligns with analyzing technical patterns and market trends, while market makers prioritize rapid turnover and tight spreads to profit from bid-ask differentials. Explore more about how holding periods impact trading strategies and risk management.

Source and External Links

Swing trading - Wikipedia - Swing trading is a speculative strategy where assets are held from a few days to weeks to profit from price swings, combining technical or fundamental analysis and rule-based systems to guide buy and sell decisions.

Swing trading: Strategies and insights for successful trading - TD - Swing trading profits from short-term price changes by buying low and selling high or shorting when prices rise, typically holding positions for days to weeks, positioned between day trading and long-term investing.

Swing Trading: Strategies, Benefits, and How to Get Started - Business Insider - Swing trading involves holding positions for days or weeks, offering flexibility and potentially higher returns with less time commitment compared to day trading, making it suitable for busy individuals.

dowidth.com

dowidth.com