Flash loan arbitrage leverages instant, uncollateralized loans to exploit price discrepancies across decentralized exchanges, enabling traders to execute risk-free profit strategies within a single transaction. Pair trading involves simultaneously taking long and short positions in correlated assets to capitalize on divergences while minimizing market risk through a market-neutral stance. Explore the distinct mechanisms and strategic advantages of flash loan arbitrage versus pair trading to enhance your trading expertise.

Why it is important

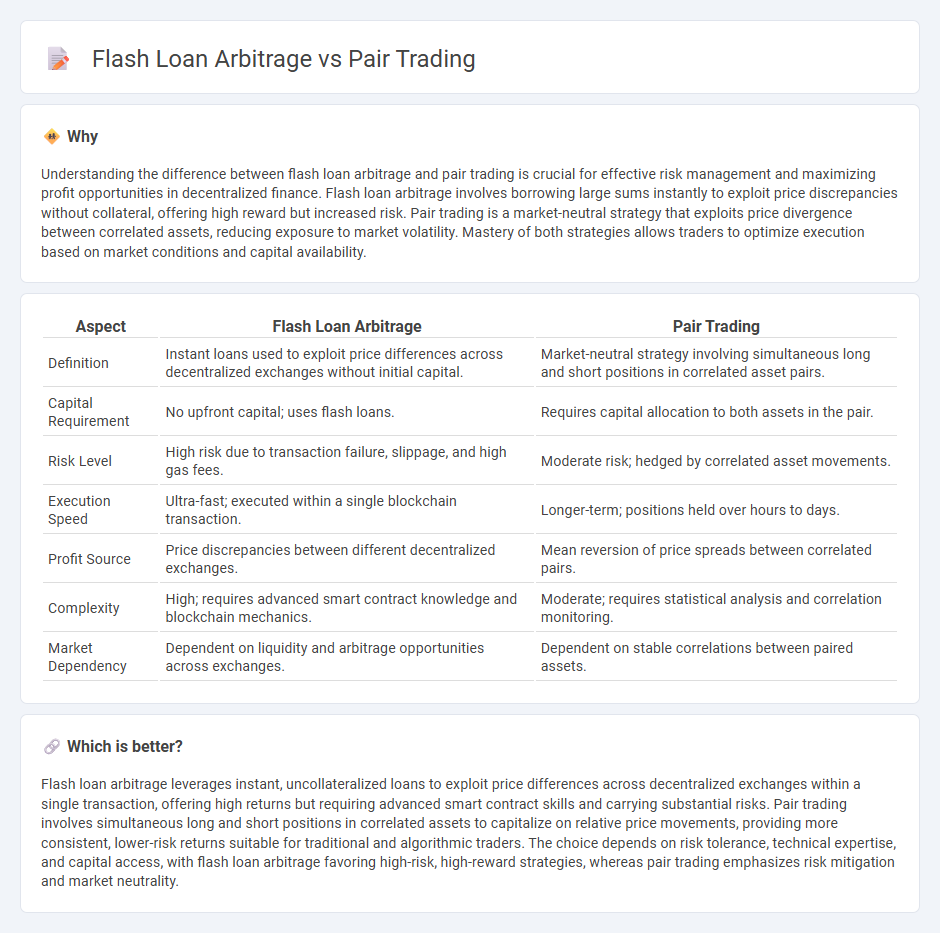

Understanding the difference between flash loan arbitrage and pair trading is crucial for effective risk management and maximizing profit opportunities in decentralized finance. Flash loan arbitrage involves borrowing large sums instantly to exploit price discrepancies without collateral, offering high reward but increased risk. Pair trading is a market-neutral strategy that exploits price divergence between correlated assets, reducing exposure to market volatility. Mastery of both strategies allows traders to optimize execution based on market conditions and capital availability.

Comparison Table

| Aspect | Flash Loan Arbitrage | Pair Trading |

|---|---|---|

| Definition | Instant loans used to exploit price differences across decentralized exchanges without initial capital. | Market-neutral strategy involving simultaneous long and short positions in correlated asset pairs. |

| Capital Requirement | No upfront capital; uses flash loans. | Requires capital allocation to both assets in the pair. |

| Risk Level | High risk due to transaction failure, slippage, and high gas fees. | Moderate risk; hedged by correlated asset movements. |

| Execution Speed | Ultra-fast; executed within a single blockchain transaction. | Longer-term; positions held over hours to days. |

| Profit Source | Price discrepancies between different decentralized exchanges. | Mean reversion of price spreads between correlated pairs. |

| Complexity | High; requires advanced smart contract knowledge and blockchain mechanics. | Moderate; requires statistical analysis and correlation monitoring. |

| Market Dependency | Dependent on liquidity and arbitrage opportunities across exchanges. | Dependent on stable correlations between paired assets. |

Which is better?

Flash loan arbitrage leverages instant, uncollateralized loans to exploit price differences across decentralized exchanges within a single transaction, offering high returns but requiring advanced smart contract skills and carrying substantial risks. Pair trading involves simultaneous long and short positions in correlated assets to capitalize on relative price movements, providing more consistent, lower-risk returns suitable for traditional and algorithmic traders. The choice depends on risk tolerance, technical expertise, and capital access, with flash loan arbitrage favoring high-risk, high-reward strategies, whereas pair trading emphasizes risk mitigation and market neutrality.

Connection

Flash loan arbitrage leverages instantly borrowed funds to exploit price discrepancies across decentralized exchanges without initial capital investment. Pair trading involves simultaneously buying and selling correlated assets to profit from their price convergence or divergence. The connection lies in using flash loans to execute pair trades efficiently, enabling traders to capture arbitrage opportunities swiftly within blockchain ecosystems.

Key Terms

Pair Trading:

Pair trading exploits price discrepancies between two correlated assets, aiming to profit from their mean reversion without holding directional market risk. It relies on statistical models to identify when one asset is undervalued relative to its paired counterpart, executing simultaneous long and short positions for balanced exposure. Discover detailed strategies and risk management techniques to optimize pair trading outcomes.

Cointegration

Pair trading relies on cointegration to identify and exploit the statistical relationship between two correlated assets, ensuring that price deviations revert to a mean, which minimizes risk and maximizes profit potential. Flash loan arbitrage capitalizes on temporary price discrepancies across decentralized exchanges without the need for upfront capital but does not inherently depend on cointegration between assets. Explore deeper comparisons and strategies to enhance your trading approach with advanced cointegration methods.

Spread

Pair trading involves capitalizing on the spread between two correlated assets by simultaneously buying the undervalued asset and selling the overvalued one, aiming to profit when the spread reverts to its historical mean. Flash loan arbitrage exploits temporary price discrepancies across decentralized exchanges by using uncollateralized loans to capture risk-free profits within a single transaction block. Explore the nuances of spread dynamics in these strategies to enhance your trading insights.

Source and External Links

Pairs Trading: Meaning, Advantages & Attributes - Bajaj Finserv - Pairs trading is a market-neutral strategy where traders simultaneously buy an undervalued security and sell an overvalued one in a correlated pair, aiming to profit as their prices converge back to their historical relationship.

Pairs trade - This statistical arbitrage strategy involves shorting the outperforming stock and going long the underperforming one in a historically correlated pair, betting that their price spread will revert to the mean.

Understanding Pairs Trading: A Beginner Guide | easyMarkets AU - Pairs trading focuses on the price difference between two related assets, buying the weaker and selling the stronger, then profiting as their prices realign over time.

dowidth.com

dowidth.com