Stop hunting targets clustered stop-loss orders to trigger premature exits, exploiting predictable trader behavior for market moves. Shakeout involves sudden price swings designed to induce panic selling, clearing weak positions before a trend continuation. Discover how mastering these tactics can improve your trading strategy and risk management.

Why it is important

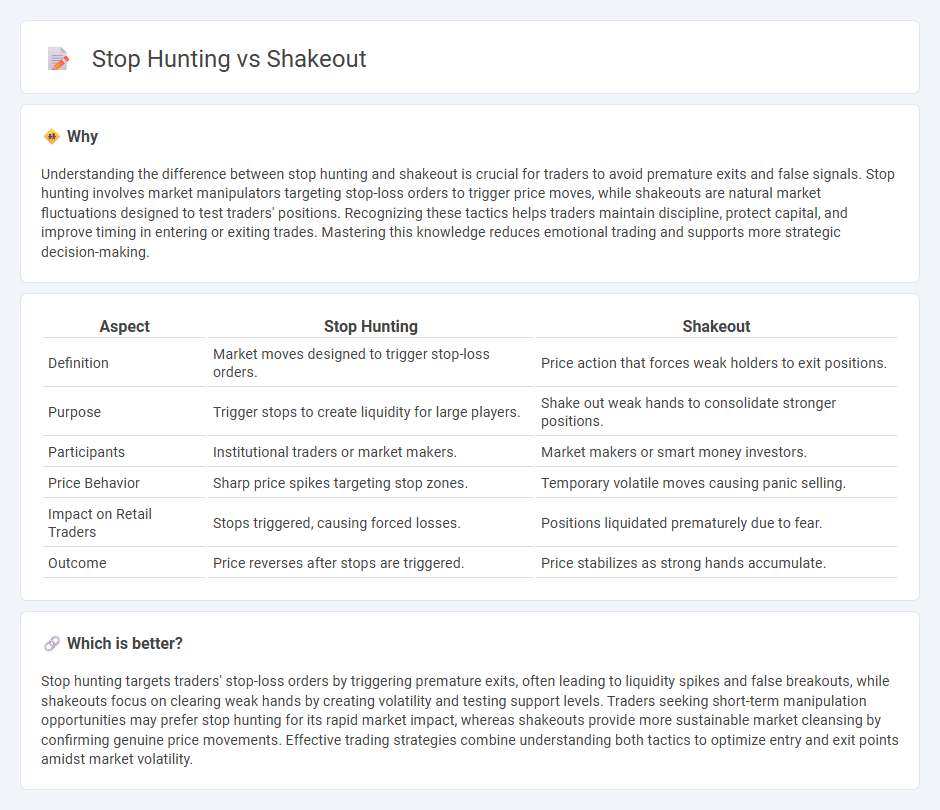

Understanding the difference between stop hunting and shakeout is crucial for traders to avoid premature exits and false signals. Stop hunting involves market manipulators targeting stop-loss orders to trigger price moves, while shakeouts are natural market fluctuations designed to test traders' positions. Recognizing these tactics helps traders maintain discipline, protect capital, and improve timing in entering or exiting trades. Mastering this knowledge reduces emotional trading and supports more strategic decision-making.

Comparison Table

| Aspect | Stop Hunting | Shakeout |

|---|---|---|

| Definition | Market moves designed to trigger stop-loss orders. | Price action that forces weak holders to exit positions. |

| Purpose | Trigger stops to create liquidity for large players. | Shake out weak hands to consolidate stronger positions. |

| Participants | Institutional traders or market makers. | Market makers or smart money investors. |

| Price Behavior | Sharp price spikes targeting stop zones. | Temporary volatile moves causing panic selling. |

| Impact on Retail Traders | Stops triggered, causing forced losses. | Positions liquidated prematurely due to fear. |

| Outcome | Price reverses after stops are triggered. | Price stabilizes as strong hands accumulate. |

Which is better?

Stop hunting targets traders' stop-loss orders by triggering premature exits, often leading to liquidity spikes and false breakouts, while shakeouts focus on clearing weak hands by creating volatility and testing support levels. Traders seeking short-term manipulation opportunities may prefer stop hunting for its rapid market impact, whereas shakeouts provide more sustainable market cleansing by confirming genuine price movements. Effective trading strategies combine understanding both tactics to optimize entry and exit points amidst market volatility.

Connection

Stop hunting and shakeout are connected as both involve triggering stop-loss orders to force traders out of their positions, creating liquidity for larger market participants. Stop hunting targets clustered stop-loss orders by pushing price beyond support or resistance levels, while shakeouts induce panic selling through false price movements. Together, these tactics manipulate market behavior to accumulate positions at favorable prices.

Key Terms

Liquidity

Shakeout and stop hunting both target liquidity but differ in approach and intent; shakeouts involve rapid price drops to trigger weak holders into selling, enhancing market liquidity for stronger players. Stop hunting exploits clustered stop-loss orders to force price moves that activate liquidity pools, enabling institutional traders to enter or exit positions advantageously. Explore these tactics further to understand their impact on market dynamics and trading strategies.

False Breakout

False breakouts often lead to shakeouts and stop hunting, where market manipulation triggers traders into premature exits by creating misleading price movements beyond support or resistance levels. Shakeouts flush out weak holders through sudden volatility, while stop hunting targets clustered stop-loss orders to fuel rapid price reversals. Explore deeper to understand how false breakouts exploit these tactics in trading strategies.

Market Manipulation

Market manipulation through shakeouts involves driving prices below support levels to trigger widespread stop-loss orders, causing panic selling and allowing manipulators to accumulate assets at lower prices. Stop hunting targets the specific stop-loss orders of traders by pushing the price temporarily beyond these points, creating false breakouts to liquidate positions before reversing the trend. Explore the mechanisms and strategies behind these tactics to better recognize and respond to market manipulation.

Source and External Links

Shakeout - Wikipedia - In business and economics, a shakeout refers to the consolidation of an industry or sector where weaker companies are eliminated or acquired, often following a period of rapid growth and overexpansion, and can also describe a market situation where many investors exit positions due to uncertainty.

Great ShakeOut - FEMA - The Great ShakeOut is a global earthquake preparedness drill where participants practice "Drop, Cover, and Hold On" to improve survival and recovery chances during earthquakes, with widespread public and organizational involvement.

New Zealand ShakeOut - Get Ready NZ - New Zealand's national ShakeOut earthquake drill involves Drop, Cover, and Hold for 60 seconds along with tsunami evacuation practice, promoting emergency preparedness across communities.

dowidth.com

dowidth.com