Delta neutral strategy balances a portfolio's delta to zero, minimizing exposure to price movements in the underlying asset. Statistical arbitrage utilizes quantitative models to exploit short-term market inefficiencies through high-frequency trading and pair trading strategies. Discover how these approaches optimize risk and return by exploring their core mechanics and applications.

Why it is important

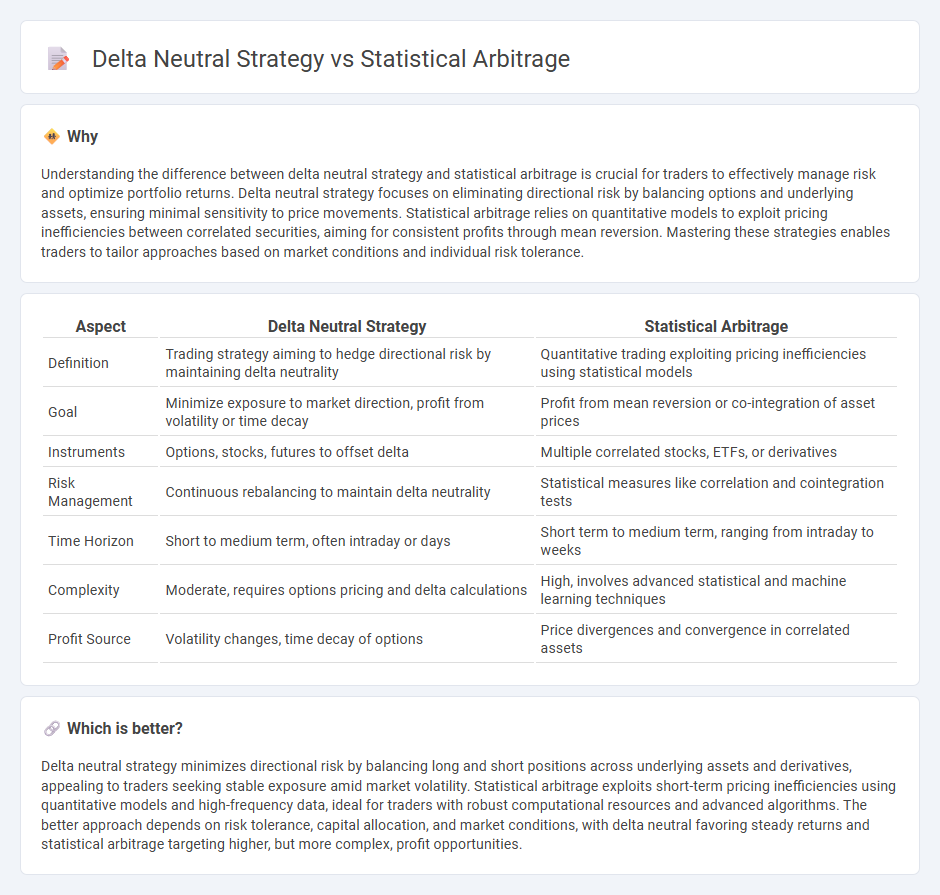

Understanding the difference between delta neutral strategy and statistical arbitrage is crucial for traders to effectively manage risk and optimize portfolio returns. Delta neutral strategy focuses on eliminating directional risk by balancing options and underlying assets, ensuring minimal sensitivity to price movements. Statistical arbitrage relies on quantitative models to exploit pricing inefficiencies between correlated securities, aiming for consistent profits through mean reversion. Mastering these strategies enables traders to tailor approaches based on market conditions and individual risk tolerance.

Comparison Table

| Aspect | Delta Neutral Strategy | Statistical Arbitrage |

|---|---|---|

| Definition | Trading strategy aiming to hedge directional risk by maintaining delta neutrality | Quantitative trading exploiting pricing inefficiencies using statistical models |

| Goal | Minimize exposure to market direction, profit from volatility or time decay | Profit from mean reversion or co-integration of asset prices |

| Instruments | Options, stocks, futures to offset delta | Multiple correlated stocks, ETFs, or derivatives |

| Risk Management | Continuous rebalancing to maintain delta neutrality | Statistical measures like correlation and cointegration tests |

| Time Horizon | Short to medium term, often intraday or days | Short term to medium term, ranging from intraday to weeks |

| Complexity | Moderate, requires options pricing and delta calculations | High, involves advanced statistical and machine learning techniques |

| Profit Source | Volatility changes, time decay of options | Price divergences and convergence in correlated assets |

Which is better?

Delta neutral strategy minimizes directional risk by balancing long and short positions across underlying assets and derivatives, appealing to traders seeking stable exposure amid market volatility. Statistical arbitrage exploits short-term pricing inefficiencies using quantitative models and high-frequency data, ideal for traders with robust computational resources and advanced algorithms. The better approach depends on risk tolerance, capital allocation, and market conditions, with delta neutral favoring steady returns and statistical arbitrage targeting higher, but more complex, profit opportunities.

Connection

Delta neutral strategy minimizes directional risk by balancing positive and negative delta positions, creating a portfolio insensitive to small price movements. Statistical arbitrage relies on identifying mispricings using quantitative models, often employing delta neutral portfolios to hedge market exposure while exploiting pricing anomalies. Combining these approaches allows traders to capitalize on short-term inefficiencies without depending on market direction.

Key Terms

**Statistical Arbitrage:**

Statistical arbitrage leverages quantitative models and historical price data to identify mispriced securities, capitalizing on temporary market inefficiencies across correlated assets. This strategy employs high-frequency trading, mean reversion, and pairs trading techniques to generate consistent returns while managing market risk. Explore more details to understand how statistical arbitrage can optimize portfolio performance.

Mean Reversion

Statistical arbitrage strategies exploit mean reversion by identifying price discrepancies between correlated assets, predicting their prices will revert to historical averages. Delta neutral strategies maintain a portfolio balanced to have zero overall delta, focusing on minimizing market risk while profiting from price oscillations around a mean value. Explore detailed insights on mean reversion techniques in both approaches for enhanced trading performance.

Pairs Trading

Statistical arbitrage in pairs trading involves identifying price discrepancies between correlated assets to exploit mean reversion patterns, while delta neutral strategies focus on balancing option positions to hedge directional market risk. Both approaches aim to minimize exposure to market movements, but pairs trading specifically capitalizes on relative price movements of co-integrated securities. Explore deeper insights into the mechanics and benefits of each strategy to enhance trading performance.

Source and External Links

Top Statistical Arbitrage Strategies and Their Risks - WunderTrading - Statistical arbitrage is a market-neutral, quantitative trading strategy using complex algorithms and statistical models to exploit price discrepancies between related securities, aiming for consistent returns mainly through strategies like Pair Trading, Basket Trading, and Mean Reversion while emphasizing risk management.

Statistical arbitrage - Wikipedia - Statistical arbitrage (StatArb) refers to short-term, mathematically driven trading strategies that use mean reversion and other statistical methods on diversified portfolios, often automated and beta-neutral, to profit from small price inefficiencies across securities held for seconds to days.

Statistical Arbitrage in High Frequency Trading Based on Limit Order ... - Stanford (PDF) - An academic perspective defines statistical arbitrage as a strategy that mitigates risk by spreading it over thousands to millions of short-horizon trades, commonly applied in high-frequency trading environments.

dowidth.com

dowidth.com