Flash loans enable traders to borrow large amounts of capital instantly without collateral, executing complex arbitrage opportunities or refinancing actions within a single transaction block. Smart contract trading automates order execution, risk management, and settlement on blockchain platforms, reducing reliance on traditional intermediaries and enhancing transparency. Explore how these innovative tools transform decentralized finance and unlock new trading possibilities.

Why it is important

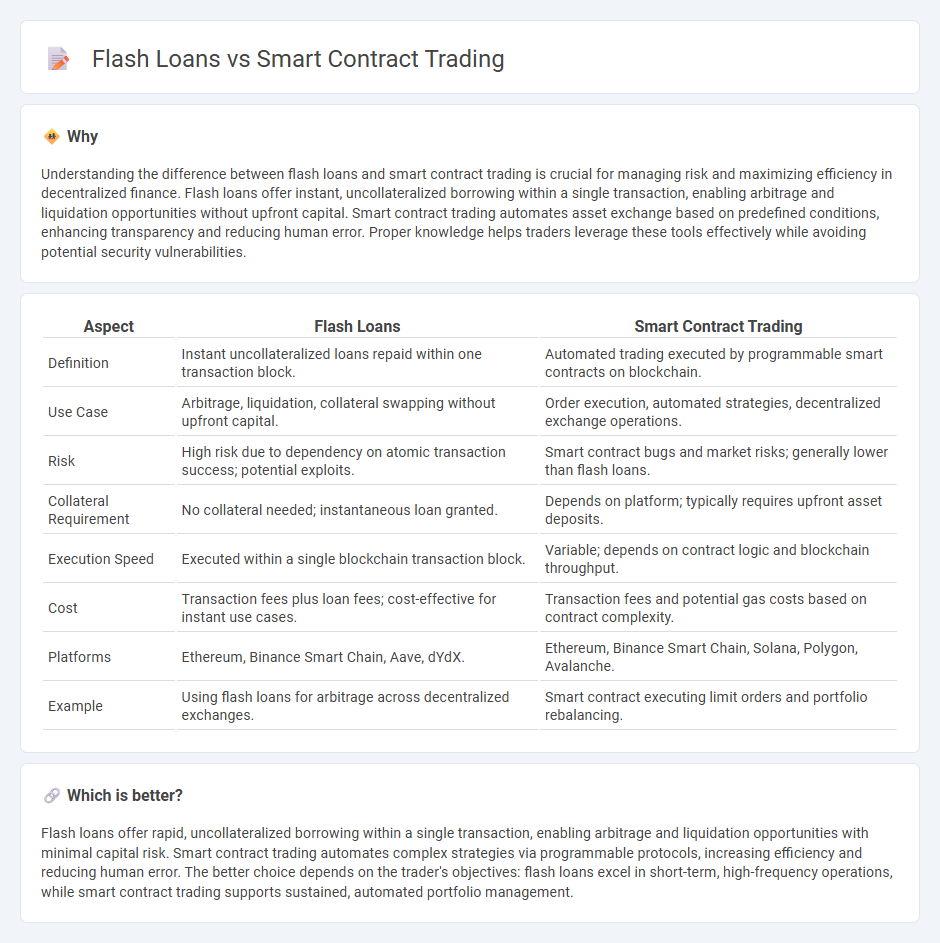

Understanding the difference between flash loans and smart contract trading is crucial for managing risk and maximizing efficiency in decentralized finance. Flash loans offer instant, uncollateralized borrowing within a single transaction, enabling arbitrage and liquidation opportunities without upfront capital. Smart contract trading automates asset exchange based on predefined conditions, enhancing transparency and reducing human error. Proper knowledge helps traders leverage these tools effectively while avoiding potential security vulnerabilities.

Comparison Table

| Aspect | Flash Loans | Smart Contract Trading |

|---|---|---|

| Definition | Instant uncollateralized loans repaid within one transaction block. | Automated trading executed by programmable smart contracts on blockchain. |

| Use Case | Arbitrage, liquidation, collateral swapping without upfront capital. | Order execution, automated strategies, decentralized exchange operations. |

| Risk | High risk due to dependency on atomic transaction success; potential exploits. | Smart contract bugs and market risks; generally lower than flash loans. |

| Collateral Requirement | No collateral needed; instantaneous loan granted. | Depends on platform; typically requires upfront asset deposits. |

| Execution Speed | Executed within a single blockchain transaction block. | Variable; depends on contract logic and blockchain throughput. |

| Cost | Transaction fees plus loan fees; cost-effective for instant use cases. | Transaction fees and potential gas costs based on contract complexity. |

| Platforms | Ethereum, Binance Smart Chain, Aave, dYdX. | Ethereum, Binance Smart Chain, Solana, Polygon, Avalanche. |

| Example | Using flash loans for arbitrage across decentralized exchanges. | Smart contract executing limit orders and portfolio rebalancing. |

Which is better?

Flash loans offer rapid, uncollateralized borrowing within a single transaction, enabling arbitrage and liquidation opportunities with minimal capital risk. Smart contract trading automates complex strategies via programmable protocols, increasing efficiency and reducing human error. The better choice depends on the trader's objectives: flash loans excel in short-term, high-frequency operations, while smart contract trading supports sustained, automated portfolio management.

Connection

Flash loans enable instant, uncollateralized borrowing within a single blockchain transaction, powering sophisticated arbitrage and liquidation strategies in smart contract trading. Smart contracts automate these trades, executing complex sequences securely and efficiently, harnessing the liquidity and speed of flash loans. This synergy revolutionizes decentralized finance by allowing traders to capitalize on price discrepancies and market opportunities without upfront capital.

Key Terms

Automation

Smart contract trading leverages automated protocols to execute pre-programmed transactions on blockchain platforms, ensuring precision and efficiency without human intervention. Flash loans offer instant, uncollateralized loans within a single transaction, enabling users to capitalize on arbitrage or liquidity opportunities by automating complex financial strategies. Discover how combining smart contract automation with flash loan mechanics can revolutionize decentralized finance workflows.

Arbitrage

Arbitrage in smart contract trading leverages automated protocols to exploit price discrepancies across decentralized exchanges, ensuring rapid and trustless execution. Flash loans provide instant, uncollateralized capital that enables traders to perform arbitrage without upfront funds, executing complex multi-step trades within a single blockchain transaction. Explore how combining smart contract automation with flash loan strategies can maximize arbitrage opportunities in decentralized finance.

Liquidity

Smart contract trading leverages automated protocols to execute trades efficiently, optimizing liquidity across decentralized exchanges by reducing slippage and enabling real-time market responses. Flash loans provide instant, unsecured capital, allowing users to capitalize on arbitrage opportunities or refinance positions without upfront collateral, significantly impacting liquidity pools by facilitating rapid asset movements. Explore the mechanisms behind these DeFi innovations to understand their distinct roles in managing and enhancing liquidity.

Source and External Links

Smart Contract Trading: The Future of DeFi Automation | Bitsgap blog - Smart contract trading uses automated blockchain programs that execute trades based on predefined rules and market conditions, creating secure, immutable, and transparent self-executing trades without intermediaries.

What are smart contracts on the blockchain? 4 real-world use cases - Smart contracts are self-executing programs on blockchain that carry out transactions automatically once preset conditions are met, ensuring transparent and tamper-resistant trade execution without manual intervention.

Learn how smart contracts and automated trading advance capital ... - In capital markets, smart contracts streamline trade clearing and settlement by automating processes previously prone to errors and delays, enabling faster, more efficient, and cost-saving automated trading operations.

dowidth.com

dowidth.com