Microstructure trading focuses on the detailed mechanics of trading processes, such as order flow, bid-ask spreads, and market depth, to capitalize on short-term price movements. Fundamental analysis evaluates a company's financial health, economic indicators, and industry trends to determine the intrinsic value of assets for long-term investment decisions. Explore how combining these approaches can enhance trading strategies and optimize portfolio performance.

Why it is important

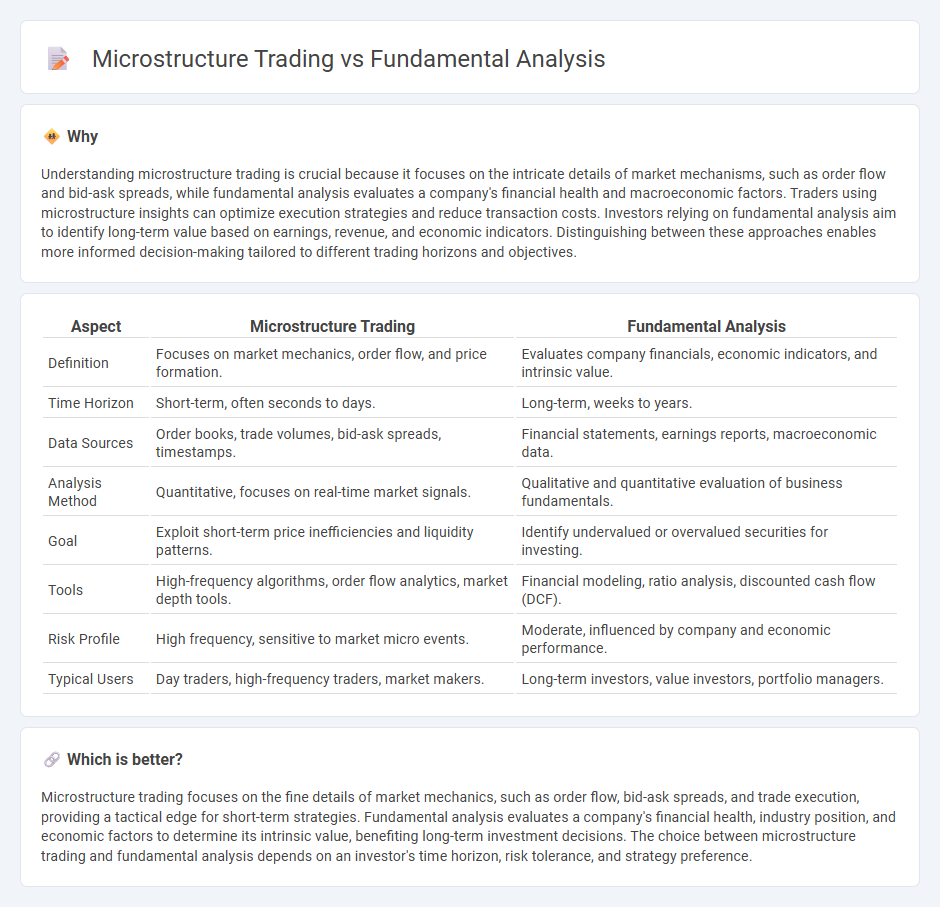

Understanding microstructure trading is crucial because it focuses on the intricate details of market mechanisms, such as order flow and bid-ask spreads, while fundamental analysis evaluates a company's financial health and macroeconomic factors. Traders using microstructure insights can optimize execution strategies and reduce transaction costs. Investors relying on fundamental analysis aim to identify long-term value based on earnings, revenue, and economic indicators. Distinguishing between these approaches enables more informed decision-making tailored to different trading horizons and objectives.

Comparison Table

| Aspect | Microstructure Trading | Fundamental Analysis |

|---|---|---|

| Definition | Focuses on market mechanics, order flow, and price formation. | Evaluates company financials, economic indicators, and intrinsic value. |

| Time Horizon | Short-term, often seconds to days. | Long-term, weeks to years. |

| Data Sources | Order books, trade volumes, bid-ask spreads, timestamps. | Financial statements, earnings reports, macroeconomic data. |

| Analysis Method | Quantitative, focuses on real-time market signals. | Qualitative and quantitative evaluation of business fundamentals. |

| Goal | Exploit short-term price inefficiencies and liquidity patterns. | Identify undervalued or overvalued securities for investing. |

| Tools | High-frequency algorithms, order flow analytics, market depth tools. | Financial modeling, ratio analysis, discounted cash flow (DCF). |

| Risk Profile | High frequency, sensitive to market micro events. | Moderate, influenced by company and economic performance. |

| Typical Users | Day traders, high-frequency traders, market makers. | Long-term investors, value investors, portfolio managers. |

Which is better?

Microstructure trading focuses on the fine details of market mechanics, such as order flow, bid-ask spreads, and trade execution, providing a tactical edge for short-term strategies. Fundamental analysis evaluates a company's financial health, industry position, and economic factors to determine its intrinsic value, benefiting long-term investment decisions. The choice between microstructure trading and fundamental analysis depends on an investor's time horizon, risk tolerance, and strategy preference.

Connection

Microstructure trading focuses on the detailed mechanisms of order execution, bid-ask spreads, and market liquidity, which influence short-term price movements. Fundamental analysis evaluates a company's intrinsic value by examining financial statements, economic indicators, and industry conditions, impacting long-term investment decisions. The connection lies in microstructure trading's ability to interpret how fundamental information is incorporated into prices through market microdynamics, enhancing timing and execution strategies.

Key Terms

Earnings Reports (Fundamental Analysis)

Earnings reports offer crucial insights into a company's financial health, revenue growth, and profit margins, serving as a cornerstone in fundamental analysis to evaluate stock valuation. Microstructure trading, however, focuses on real-time market data, order flow, and trade execution strategies rather than underlying financial metrics. Explore how integrating earnings report analysis with microstructure trading can enhance investment decision-making.

Order Book Dynamics (Microstructure Trading)

Order book dynamics in microstructure trading provide granular insights into supply and demand through real-time bid-ask data, contrasting with fundamental analysis that evaluates a company's intrinsic value via financial statements and macroeconomic factors. Microstructure focuses on short-term price movements driven by order flow, liquidity, and market participant behavior, offering strategic advantages in high-frequency and algorithmic trading. Explore how understanding order book interactions can enhance your trading strategies beyond traditional fundamental approaches.

Price-to-Earnings Ratio (Fundamental Analysis)

The Price-to-Earnings (P/E) ratio is a key metric in fundamental analysis, measuring a company's current share price relative to its per-share earnings to evaluate valuation and growth potential. Microstructure trading, however, concentrates on price formation processes and order flow dynamics rather than broad valuation metrics like the P/E ratio. Explore detailed insights on how these approaches diverge and complement each other in market strategies.

Source and External Links

Fundamental Analysis - Corporate Finance Institute - Fundamental analysis is a method to assess the intrinsic value of a security by examining macroeconomic and microeconomic factors, aiming to compare this value to the market price for investment decisions, and can be applied via top-down or bottom-up approaches.

What is fundamental analysis? How to assess value in trading | Saxo - Fundamental analysis evaluates an asset's intrinsic value to determine if it is overvalued or undervalued by the market, focusing on the asset's core aspects rather than market price movements or sentiment.

Fundamental analysis - Wikipedia - Fundamental analysis involves economic, industry, and company analysis to estimate a security's true intrinsic value, guiding decisions to buy, hold, or sell based on whether the market price deviates from this value.

dowidth.com

dowidth.com