Paper trading platforms offer risk-free environments where users can simulate real market conditions using virtual funds, helping traders develop strategies without financial exposure. Social trading platforms combine real trading with social networking, allowing users to follow and copy experienced traders' moves to potentially enhance their performance. Explore the key differences and benefits to determine which platform suits your trading goals best.

Why it is important

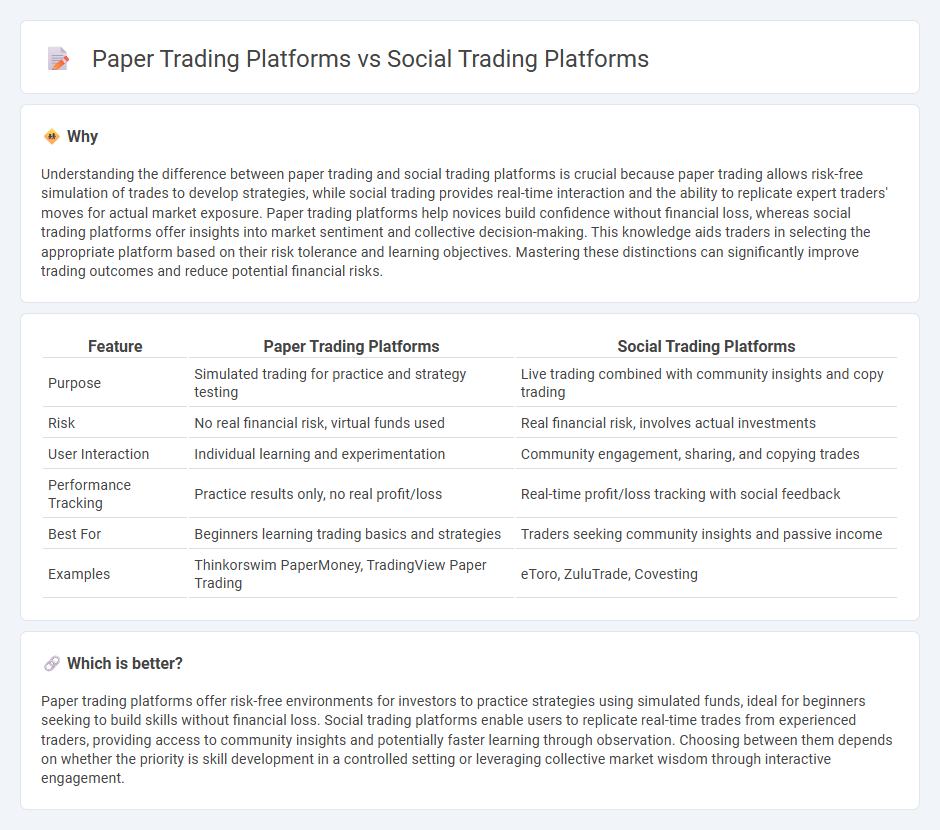

Understanding the difference between paper trading and social trading platforms is crucial because paper trading allows risk-free simulation of trades to develop strategies, while social trading provides real-time interaction and the ability to replicate expert traders' moves for actual market exposure. Paper trading platforms help novices build confidence without financial loss, whereas social trading platforms offer insights into market sentiment and collective decision-making. This knowledge aids traders in selecting the appropriate platform based on their risk tolerance and learning objectives. Mastering these distinctions can significantly improve trading outcomes and reduce potential financial risks.

Comparison Table

| Feature | Paper Trading Platforms | Social Trading Platforms |

|---|---|---|

| Purpose | Simulated trading for practice and strategy testing | Live trading combined with community insights and copy trading |

| Risk | No real financial risk, virtual funds used | Real financial risk, involves actual investments |

| User Interaction | Individual learning and experimentation | Community engagement, sharing, and copying trades |

| Performance Tracking | Practice results only, no real profit/loss | Real-time profit/loss tracking with social feedback |

| Best For | Beginners learning trading basics and strategies | Traders seeking community insights and passive income |

| Examples | Thinkorswim PaperMoney, TradingView Paper Trading | eToro, ZuluTrade, Covesting |

Which is better?

Paper trading platforms offer risk-free environments for investors to practice strategies using simulated funds, ideal for beginners seeking to build skills without financial loss. Social trading platforms enable users to replicate real-time trades from experienced traders, providing access to community insights and potentially faster learning through observation. Choosing between them depends on whether the priority is skill development in a controlled setting or leveraging collective market wisdom through interactive engagement.

Connection

Paper trading platforms simulate real market conditions, enabling traders to practice strategies without risking actual capital, while social trading platforms allow users to share, follow, and replicate successful trades within a community. Integration between these platforms enhances learning by providing a risk-free environment for users to test ideas and observe real-time strategies executed by experienced traders. This connection fosters informed decision-making, accelerates skill development, and builds confidence before engaging in live trading.

Key Terms

**Social Trading Platforms:**

Social trading platforms enable users to replicate the trades of experienced investors by accessing real-time market data and community insights, enhancing decision-making through social interaction and shared strategies. These platforms often feature leaderboards, performance metrics, and interactive forums that foster collaborative learning and collective intelligence among traders. Discover how social trading platforms can elevate your investment strategy by connecting you to a network of expert traders and dynamic market trends.

Copy Trading

Social trading platforms enable real investors to share their trades and strategies, allowing followers to replicate successful portfolios through copy trading, enhancing real-time market engagement and potential profit. Paper trading platforms simulate market conditions without risking real capital, providing a risk-free environment to practice strategies but lacking the emotional and financial stakes of live copy trading. Explore how leveraging copy trading on social platforms can enhance your trading skills and results.

Signal Providers

Social trading platforms connect investors with signal providers who share real-time trade signals and market insights, enabling users to follow or replicate expert strategies. Paper trading platforms simulate market conditions without actual financial risk, primarily serving as practice tools rather than sources for live signal providers. Discover the advantages and limitations of each platform type to enhance your trading strategy effectively.

Source and External Links

Best Social Trading Platforms in the U.S. 2025 - Investing.com - eToro stands out as a popular social trading platform offering both traditional and cryptocurrency investments with its CopyTrader feature, alongside other notable platforms like ZuluTrade and NAGA Trader that provide access to professional signal providers and user-friendly interfaces for trading various assets.

Best Social Trading Platforms in the United States in 2025 - BrokerChooser - eToro is ranked as the top social trading platform in the U.S. for 2025 due to its low fees, seamless account opening, and rich social trading features, with other recommended platforms including tastytrade, Tradier, Interactive Brokers, Charles Schwab, Fidelity, and J.P. Morgan, each offering a mix of low fees, strong educational resources, and broad product selections.

Social trading - Wikipedia - Social trading platforms enable traders to interact, watch, copy, or mirror trades from others, blending social networking with investment strategies to help both novices and experienced traders learn and replicate successful techniques in real time.

dowidth.com

dowidth.com