Gamma squeeze occurs when rapid buying of options forces dealers to purchase the underlying stock to hedge, driving prices sharply higher. Margin calls happen when a trader's account value falls below required levels, prompting forced asset sales to meet obligations. Explore the dynamics behind gamma squeezes and margin calls to enhance your trading strategy.

Why it is important

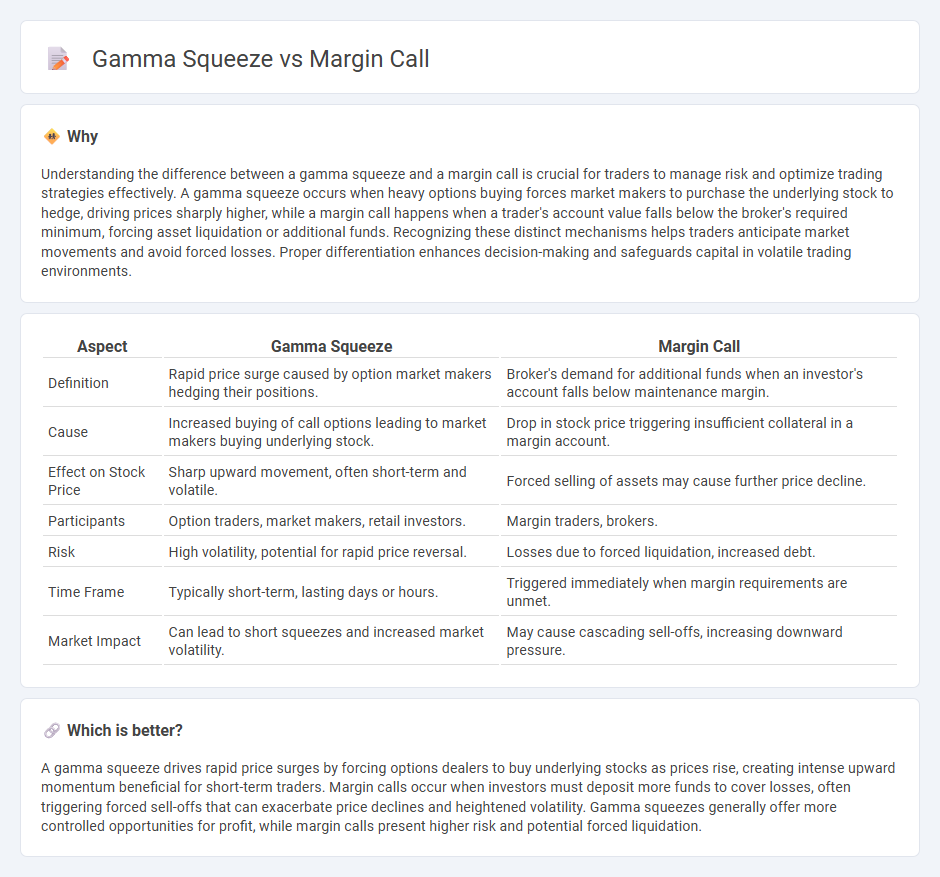

Understanding the difference between a gamma squeeze and a margin call is crucial for traders to manage risk and optimize trading strategies effectively. A gamma squeeze occurs when heavy options buying forces market makers to purchase the underlying stock to hedge, driving prices sharply higher, while a margin call happens when a trader's account value falls below the broker's required minimum, forcing asset liquidation or additional funds. Recognizing these distinct mechanisms helps traders anticipate market movements and avoid forced losses. Proper differentiation enhances decision-making and safeguards capital in volatile trading environments.

Comparison Table

| Aspect | Gamma Squeeze | Margin Call |

|---|---|---|

| Definition | Rapid price surge caused by option market makers hedging their positions. | Broker's demand for additional funds when an investor's account falls below maintenance margin. |

| Cause | Increased buying of call options leading to market makers buying underlying stock. | Drop in stock price triggering insufficient collateral in a margin account. |

| Effect on Stock Price | Sharp upward movement, often short-term and volatile. | Forced selling of assets may cause further price decline. |

| Participants | Option traders, market makers, retail investors. | Margin traders, brokers. |

| Risk | High volatility, potential for rapid price reversal. | Losses due to forced liquidation, increased debt. |

| Time Frame | Typically short-term, lasting days or hours. | Triggered immediately when margin requirements are unmet. |

| Market Impact | Can lead to short squeezes and increased market volatility. | May cause cascading sell-offs, increasing downward pressure. |

Which is better?

A gamma squeeze drives rapid price surges by forcing options dealers to buy underlying stocks as prices rise, creating intense upward momentum beneficial for short-term traders. Margin calls occur when investors must deposit more funds to cover losses, often triggering forced sell-offs that can exacerbate price declines and heightened volatility. Gamma squeezes generally offer more controlled opportunities for profit, while margin calls present higher risk and potential forced liquidation.

Connection

A gamma squeeze occurs when options market makers buy underlying stocks to hedge their positions, driving prices sharply higher and forcing leveraged traders to meet margin calls as their positions become riskier. This surge in stock price from the gamma squeeze increases margin requirements, triggering margin calls that may force traders to liquidate assets, further accelerating price movements. The interplay of gamma squeeze dynamics and margin calls creates a feedback loop that amplifies market volatility and trading volume.

Key Terms

Leverage

Margin calls occur when leveraged traders face forced liquidation due to insufficient collateral, intensifying selling pressure and rapidly declining asset prices. Gamma squeezes arise when options market makers hedge by buying underlying stocks to manage rising delta risks, driving stocks higher amid leveraged positions. Explore deeper insights on leverage dynamics in margin calls and gamma squeezes to enhance trading strategies.

Short squeeze

A short squeeze occurs when heavily shorted stocks experience a rapid price increase, forcing short sellers to buy back shares to cover losses, amplifying upward momentum. Margin calls happen when traders using borrowed funds face demands to add collateral due to falling asset prices, potentially triggering forced liquidations but not necessarily causing price spikes. Understanding the dynamics between short squeezes, margin calls, and gamma squeezes reveals critical market movements; explore further to grasp their distinct impacts.

Volatility

Margin calls occur when a trader's account equity falls below the broker's required maintenance margin, forcing the liquidation of positions and increasing market volatility due to rapid sell-offs. Gamma squeezes arise from options market dynamics, where dealers hedge their gamma exposure by aggressively buying or selling the underlying asset, driving sharp price movements and heightened volatility in the underlying stock. Discover the critical differences between margin calls and gamma squeezes and their distinct impacts on market volatility.

Source and External Links

Margin Call - Definition, Formula, How To Cover - A margin call is a broker's demand for an investor to deposit more cash or sell securities to bring their margin account back up to the minimum maintenance requirement after it falls below that threshold.

Know What Triggers a Margin Call - A margin call occurs when an investor's account equity drops below the brokerage or FINRA required maintenance margin, requiring additional funds or liquidation of assets.

Margin Call - When securities bought on margin decline in value, a brokerage firm can require immediate additional deposits or sell securities to cover the shortfall, potentially without prior notice.

dowidth.com

dowidth.com