High-frequency trading exploits advanced algorithms to execute thousands of trades per second, capitalizing on minute price fluctuations in highly liquid markets. Swing trading focuses on capturing short to medium-term price movements by holding positions from several days to weeks, relying on technical and fundamental analysis. Explore the key strategies and risk profiles of both trading styles to determine which aligns best with your investment goals.

Why it is important

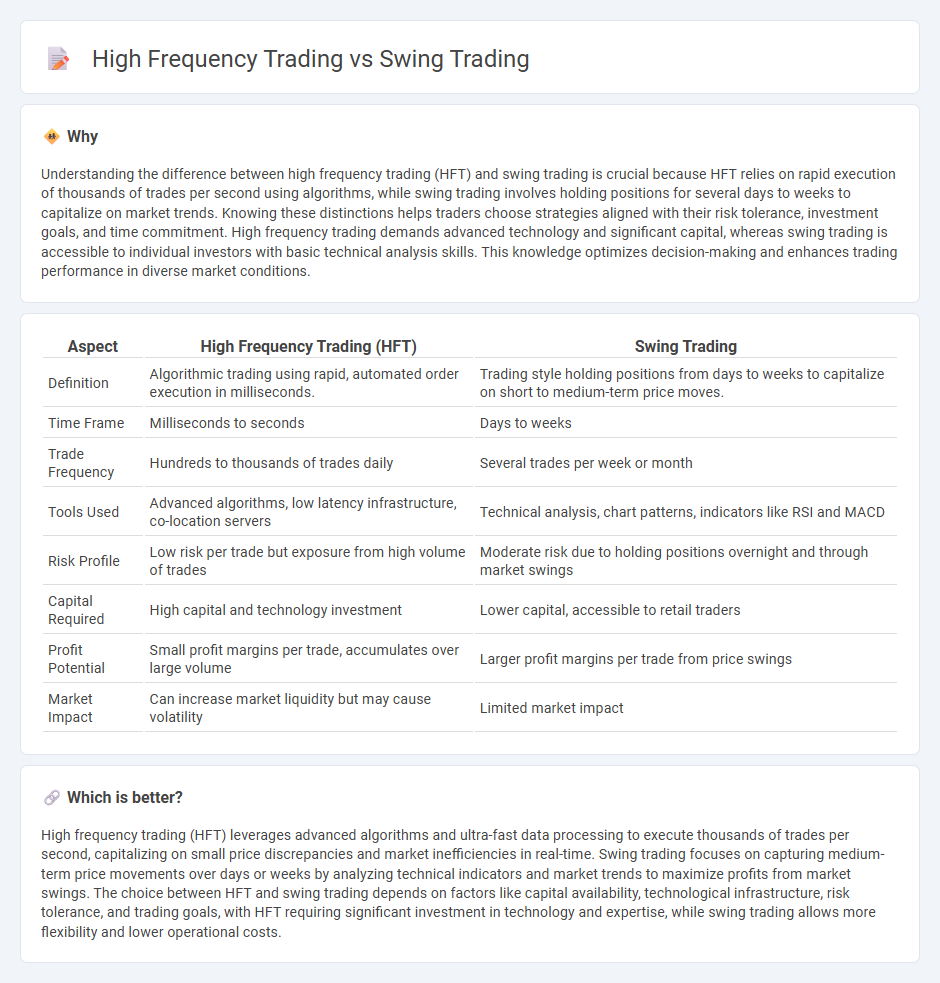

Understanding the difference between high frequency trading (HFT) and swing trading is crucial because HFT relies on rapid execution of thousands of trades per second using algorithms, while swing trading involves holding positions for several days to weeks to capitalize on market trends. Knowing these distinctions helps traders choose strategies aligned with their risk tolerance, investment goals, and time commitment. High frequency trading demands advanced technology and significant capital, whereas swing trading is accessible to individual investors with basic technical analysis skills. This knowledge optimizes decision-making and enhances trading performance in diverse market conditions.

Comparison Table

| Aspect | High Frequency Trading (HFT) | Swing Trading |

|---|---|---|

| Definition | Algorithmic trading using rapid, automated order execution in milliseconds. | Trading style holding positions from days to weeks to capitalize on short to medium-term price moves. |

| Time Frame | Milliseconds to seconds | Days to weeks |

| Trade Frequency | Hundreds to thousands of trades daily | Several trades per week or month |

| Tools Used | Advanced algorithms, low latency infrastructure, co-location servers | Technical analysis, chart patterns, indicators like RSI and MACD |

| Risk Profile | Low risk per trade but exposure from high volume of trades | Moderate risk due to holding positions overnight and through market swings |

| Capital Required | High capital and technology investment | Lower capital, accessible to retail traders |

| Profit Potential | Small profit margins per trade, accumulates over large volume | Larger profit margins per trade from price swings |

| Market Impact | Can increase market liquidity but may cause volatility | Limited market impact |

Which is better?

High frequency trading (HFT) leverages advanced algorithms and ultra-fast data processing to execute thousands of trades per second, capitalizing on small price discrepancies and market inefficiencies in real-time. Swing trading focuses on capturing medium-term price movements over days or weeks by analyzing technical indicators and market trends to maximize profits from market swings. The choice between HFT and swing trading depends on factors like capital availability, technological infrastructure, risk tolerance, and trading goals, with HFT requiring significant investment in technology and expertise, while swing trading allows more flexibility and lower operational costs.

Connection

High frequency trading (HFT) and swing trading both rely on analyzing market data to capitalize on price fluctuations, though HFT operates on milliseconds while swing trading spans days to weeks. Both strategies use sophisticated algorithms and technical indicators to identify entry and exit points, enhancing decision-making accuracy. Integrating HFT insights can improve swing trading timing by highlighting short-term trends within broader market movements.

Key Terms

Holding period

Swing trading involves holding positions from several days to weeks to capitalize on medium-term market trends, allowing traders to analyze technical indicators and price patterns for entry and exit points. High frequency trading (HFT) executes thousands of trades within milliseconds to exploit tiny price discrepancies, relying heavily on advanced algorithms and ultra-low latency systems. Explore more to understand how holding periods impact risk and profit potential in these trading strategies.

Trade volume

Swing trading typically involves lower trade volumes with positions held from days to weeks, emphasizing market trends and price patterns. High frequency trading (HFT) executes thousands to millions of trades per day, leveraging advanced algorithms and high-speed data to capitalize on minuscule price discrepancies. Explore the detailed mechanics and advantages of both trading styles to enhance your market strategy.

Strategy automation

Swing trading relies on automated systems that analyze medium-term market trends, optimizing entry and exit points over days to weeks with moderate trade frequency and risk management. High frequency trading uses advanced algorithms and ultra-low latency technology to execute thousands of trades per second, capitalizing on minute price discrepancies with minimal holding periods and significant automation complexity. Explore detailed comparisons to understand which strategy automation aligns best with your trading goals.

Source and External Links

Swing trading - Wikipedia - Swing trading is a speculative strategy where assets are held from one to several days to profit from price "swings," using objective rules or algorithms based on technical or fundamental analysis for buy and sell signals, aiming for small consistent profits over time.

What is swing trading & how does it work? - Saxo Bank - Swing trading involves exploiting short-term price movements using strategies like breakout trading, where traders act on price breaking support or resistance levels, and trend trading, which captures parts of broader price trends using technical indicators such as moving averages and RSI.

Swing trading: A complete guide for investors | TD Direct Investing - Swing trading suits investors comfortable with moving in and out of positions over days or weeks, profiting from short-term price changes by analyzing price and volume trends along with company fundamentals, positioned between day trading and long-term trend trading in terms of holding period.

dowidth.com

dowidth.com