Flash loan arbitrage exploits temporary price differences across decentralized finance platforms using instant, uncollateralized loans to maximize profit without upfront capital. Spread trading involves simultaneously buying and selling related assets to capitalize on price discrepancies while minimizing market risk exposure. Explore the key distinctions and strategies to determine which approach suits your trading goals best.

Why it is important

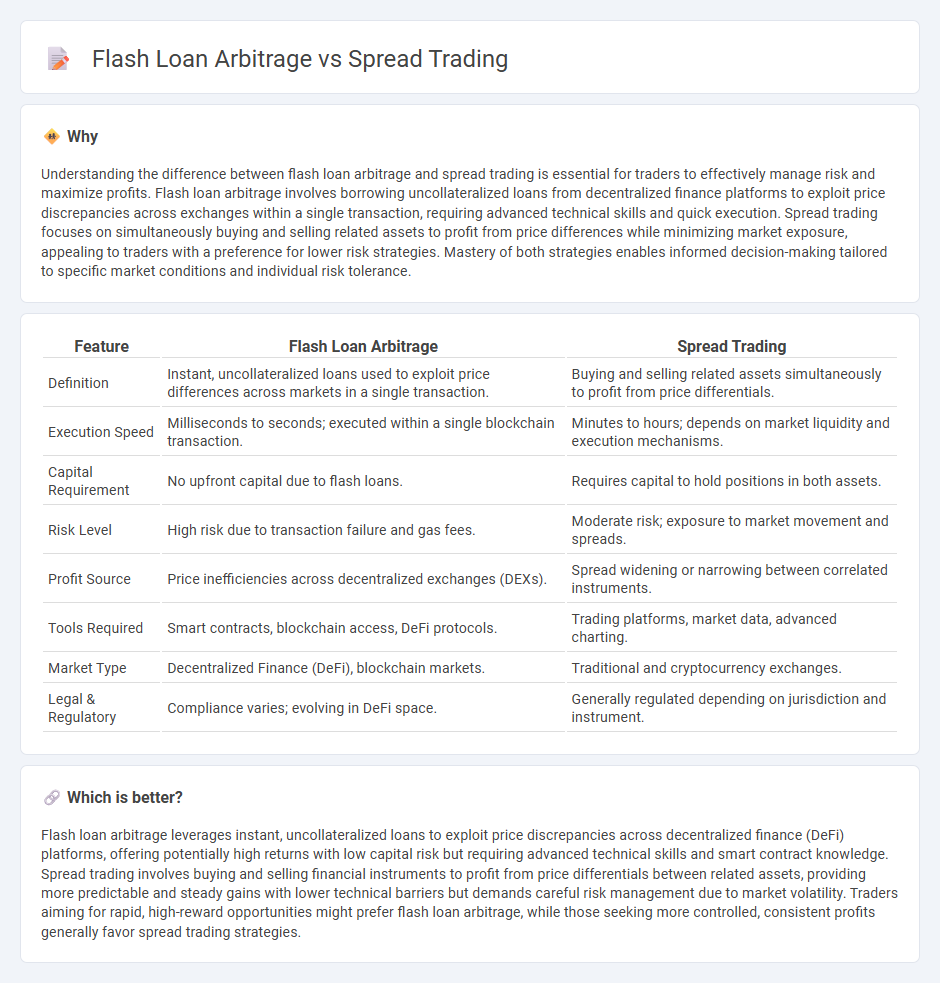

Understanding the difference between flash loan arbitrage and spread trading is essential for traders to effectively manage risk and maximize profits. Flash loan arbitrage involves borrowing uncollateralized loans from decentralized finance platforms to exploit price discrepancies across exchanges within a single transaction, requiring advanced technical skills and quick execution. Spread trading focuses on simultaneously buying and selling related assets to profit from price differences while minimizing market exposure, appealing to traders with a preference for lower risk strategies. Mastery of both strategies enables informed decision-making tailored to specific market conditions and individual risk tolerance.

Comparison Table

| Feature | Flash Loan Arbitrage | Spread Trading |

|---|---|---|

| Definition | Instant, uncollateralized loans used to exploit price differences across markets in a single transaction. | Buying and selling related assets simultaneously to profit from price differentials. |

| Execution Speed | Milliseconds to seconds; executed within a single blockchain transaction. | Minutes to hours; depends on market liquidity and execution mechanisms. |

| Capital Requirement | No upfront capital due to flash loans. | Requires capital to hold positions in both assets. |

| Risk Level | High risk due to transaction failure and gas fees. | Moderate risk; exposure to market movement and spreads. |

| Profit Source | Price inefficiencies across decentralized exchanges (DEXs). | Spread widening or narrowing between correlated instruments. |

| Tools Required | Smart contracts, blockchain access, DeFi protocols. | Trading platforms, market data, advanced charting. |

| Market Type | Decentralized Finance (DeFi), blockchain markets. | Traditional and cryptocurrency exchanges. |

| Legal & Regulatory | Compliance varies; evolving in DeFi space. | Generally regulated depending on jurisdiction and instrument. |

Which is better?

Flash loan arbitrage leverages instant, uncollateralized loans to exploit price discrepancies across decentralized finance (DeFi) platforms, offering potentially high returns with low capital risk but requiring advanced technical skills and smart contract knowledge. Spread trading involves buying and selling financial instruments to profit from price differentials between related assets, providing more predictable and steady gains with lower technical barriers but demands careful risk management due to market volatility. Traders aiming for rapid, high-reward opportunities might prefer flash loan arbitrage, while those seeking more controlled, consistent profits generally favor spread trading strategies.

Connection

Flash loan arbitrage involves borrowing large amounts of cryptocurrency instantly without collateral to exploit price discrepancies across decentralized exchanges. Spread trading capitalizes on these differences by simultaneously buying and selling related assets to profit from the price gap. The connection lies in using flash loans to amplify arbitrage opportunities within spread trading strategies, maximizing returns in decentralized finance markets.

Key Terms

Spread Trading:

Spread trading involves simultaneously buying and selling two related financial instruments to profit from the price difference or spread between them, commonly seen in futures, options, and forex markets. This strategy minimizes risk exposure by hedging market volatility, allowing traders to exploit relative price movements rather than directional market trends. Explore the mechanics and advantages of spread trading to enhance your market strategies.

Bid-Ask Spread

Spread trading exploits the bid-ask spread by simultaneously buying at the bid price and selling at the ask price to capture small, consistent profits from market inefficiencies. Flash loan arbitrage leverages uncollateralized loans to exploit price discrepancies across decentralized exchanges in a single transaction, often bypassing bid-ask spread constraints. Explore the nuances of bid-ask spreads, liquidity, and execution strategies to master both spread trading and flash loan arbitrage.

Price Differential

Spread trading exploits the price differential between two related securities to capture consistent profits with minimal risk. Flash loan arbitrage leverages instant, uncollateralized loans on blockchain platforms to exploit temporary price discrepancies across decentralized exchanges. Explore the mechanics and comparative advantages of each strategy to enhance your trading insights.

Source and External Links

What is Spread Trading: Meaning and Types | Angel One - Spread trading involves simultaneously buying one security and selling another to profit from the price difference, with common types including intermarket, intracommodity, and options spreads, and factors such as market volatility and liquidity affecting profitability.

A Guide to Spread Trading Futures - Futures spread trading consists of taking a long and short position simultaneously to benefit from price discrepancies while lowering risk, profiting from the difference between two related futures contracts.

Spread trade - Wikipedia - A spread trade is the simultaneous purchase and sale of related securities as a unit, aiming to profit from the widening or narrowing of the price difference, often executed using futures or options with typically lower volatility and margin requirements than single positions.

dowidth.com

dowidth.com