Quantitative momentum trading leverages statistical models to identify securities exhibiting strong price trends, focusing on momentum as the key driver for buy and sell signals. Algorithmic trading involves automated execution of pre-programmed strategies, which can include momentum indicators among various other quantitative factors for optimizing trade timing and risk management. Explore the nuances and advantages of both approaches to enhance your trading strategy.

Why it is important

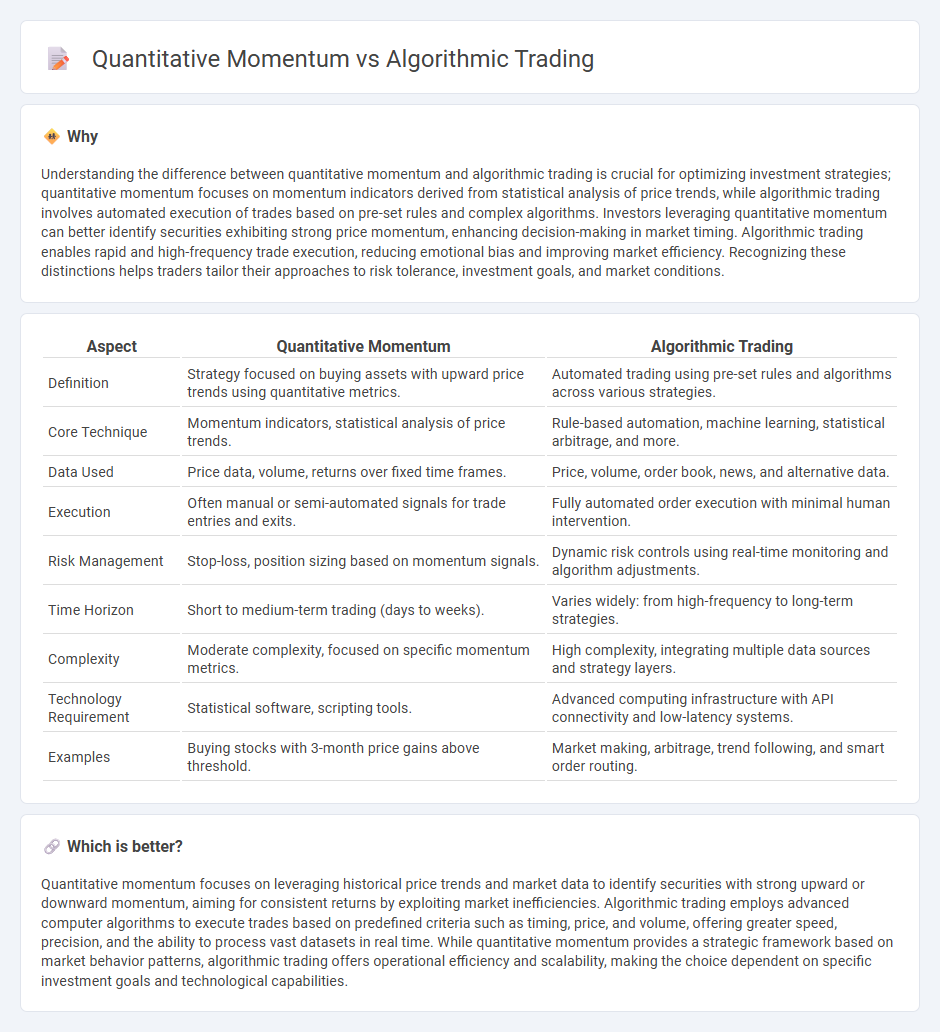

Understanding the difference between quantitative momentum and algorithmic trading is crucial for optimizing investment strategies; quantitative momentum focuses on momentum indicators derived from statistical analysis of price trends, while algorithmic trading involves automated execution of trades based on pre-set rules and complex algorithms. Investors leveraging quantitative momentum can better identify securities exhibiting strong price momentum, enhancing decision-making in market timing. Algorithmic trading enables rapid and high-frequency trade execution, reducing emotional bias and improving market efficiency. Recognizing these distinctions helps traders tailor their approaches to risk tolerance, investment goals, and market conditions.

Comparison Table

| Aspect | Quantitative Momentum | Algorithmic Trading |

|---|---|---|

| Definition | Strategy focused on buying assets with upward price trends using quantitative metrics. | Automated trading using pre-set rules and algorithms across various strategies. |

| Core Technique | Momentum indicators, statistical analysis of price trends. | Rule-based automation, machine learning, statistical arbitrage, and more. |

| Data Used | Price data, volume, returns over fixed time frames. | Price, volume, order book, news, and alternative data. |

| Execution | Often manual or semi-automated signals for trade entries and exits. | Fully automated order execution with minimal human intervention. |

| Risk Management | Stop-loss, position sizing based on momentum signals. | Dynamic risk controls using real-time monitoring and algorithm adjustments. |

| Time Horizon | Short to medium-term trading (days to weeks). | Varies widely: from high-frequency to long-term strategies. |

| Complexity | Moderate complexity, focused on specific momentum metrics. | High complexity, integrating multiple data sources and strategy layers. |

| Technology Requirement | Statistical software, scripting tools. | Advanced computing infrastructure with API connectivity and low-latency systems. |

| Examples | Buying stocks with 3-month price gains above threshold. | Market making, arbitrage, trend following, and smart order routing. |

Which is better?

Quantitative momentum focuses on leveraging historical price trends and market data to identify securities with strong upward or downward momentum, aiming for consistent returns by exploiting market inefficiencies. Algorithmic trading employs advanced computer algorithms to execute trades based on predefined criteria such as timing, price, and volume, offering greater speed, precision, and the ability to process vast datasets in real time. While quantitative momentum provides a strategic framework based on market behavior patterns, algorithmic trading offers operational efficiency and scalability, making the choice dependent on specific investment goals and technological capabilities.

Connection

Quantitative momentum trading leverages statistical models to identify securities with strong price trends, enabling algorithmic trading systems to execute trades systematically based on these momentum signals. Algorithmic trading automates the analysis and execution process, using mathematical algorithms to capitalize on momentum patterns faster than manual strategies. This integration enhances trade efficiency and consistency, optimizing portfolio performance through data-driven momentum strategies.

Key Terms

Algorithmic Trading:

Algorithmic trading utilizes computer algorithms to automatically execute trades based on predetermined criteria, enhancing speed and precision in financial markets. It incorporates various strategies, including statistical arbitrage, trend following, and mean reversion, with the goal of optimizing trade execution and minimizing human error. Discover how algorithmic trading revolutionizes market efficiency and decision-making by exploring its tools and methodologies.

Execution Algorithms

Execution algorithms in algorithmic trading prioritize the efficient and timely execution of large orders to minimize market impact and transaction costs. Quantitative momentum strategies rely on these algorithms to rapidly capitalize on trends identified through mathematical models and historical data analysis. Explore advanced execution techniques to enhance your momentum trading strategies and maximize returns.

High-Frequency Trading (HFT)

High-frequency trading (HFT) in algorithmic trading relies on ultra-fast data processing and execution to capitalize on minute price discrepancies within milliseconds. Quantitative momentum strategies in HFT exploit rapid trends and price momentum derived from advanced mathematical models and real-time data analytics. Explore our detailed insights to understand the nuances and performance metrics of HFT-driven algorithmic trading versus quantitative momentum approaches.

Source and External Links

What is Algorithmic Trading and How Do You Get Started? - IG - Algorithmic trading uses computer codes to execute trades based on set rules like price movements, with main strategies including price action, technical analysis, and combination strategies.

Algorithmic Trading - Definition, Example, Pros, Cons - Algorithmic trading involves programmed pre-set rules making trades automatically when conditions such as moving averages are met, enabling large orders to be broken into smaller batches for reduced market impact.

Algorithmic trading - Wikipedia - Algorithmic trading automates order execution using instructions accounting for variables like time and price, with recent advances integrating machine learning to dynamically adapt to changing market conditions.

dowidth.com

dowidth.com