Quantitative momentum trading leverages algorithms to identify and capitalize on stock price trends based on historical price momentum, utilizing statistical models and data analysis. Event-driven trading focuses on exploiting price movements triggered by corporate events such as mergers, earnings reports, or regulatory announcements, often requiring deep market insight and timing precision. Explore further to understand how these distinct strategies can optimize portfolio performance and risk management.

Why it is important

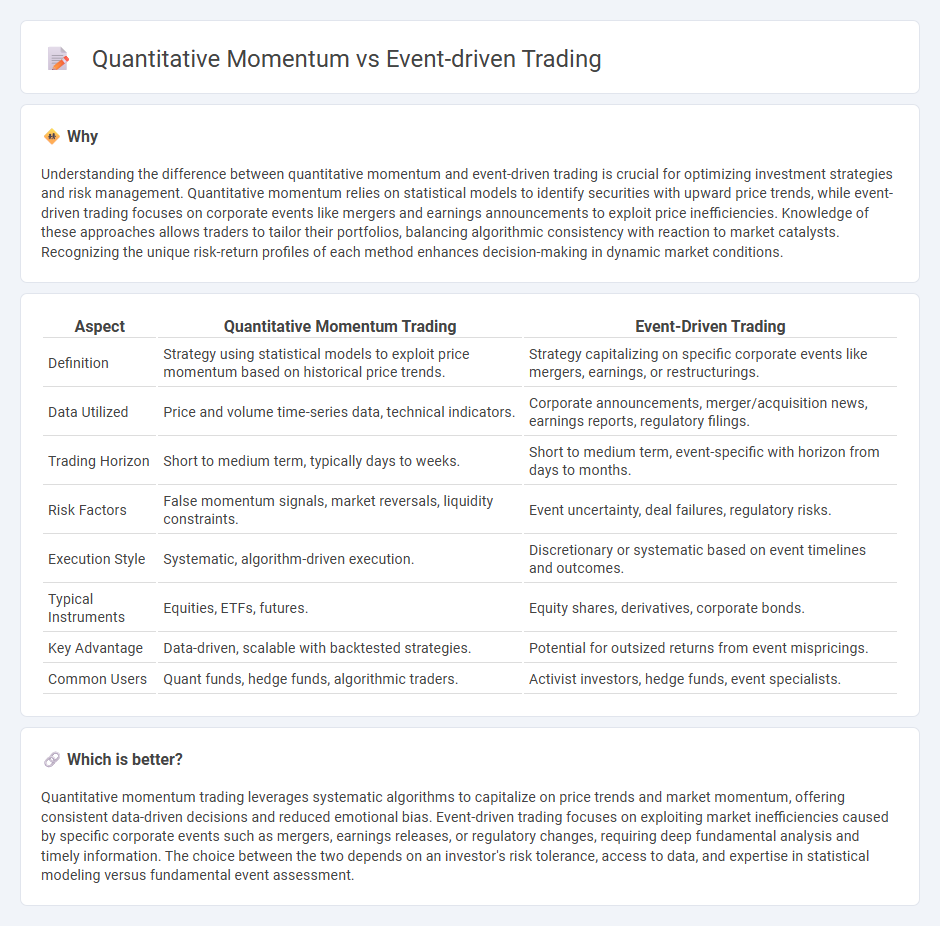

Understanding the difference between quantitative momentum and event-driven trading is crucial for optimizing investment strategies and risk management. Quantitative momentum relies on statistical models to identify securities with upward price trends, while event-driven trading focuses on corporate events like mergers and earnings announcements to exploit price inefficiencies. Knowledge of these approaches allows traders to tailor their portfolios, balancing algorithmic consistency with reaction to market catalysts. Recognizing the unique risk-return profiles of each method enhances decision-making in dynamic market conditions.

Comparison Table

| Aspect | Quantitative Momentum Trading | Event-Driven Trading |

|---|---|---|

| Definition | Strategy using statistical models to exploit price momentum based on historical price trends. | Strategy capitalizing on specific corporate events like mergers, earnings, or restructurings. |

| Data Utilized | Price and volume time-series data, technical indicators. | Corporate announcements, merger/acquisition news, earnings reports, regulatory filings. |

| Trading Horizon | Short to medium term, typically days to weeks. | Short to medium term, event-specific with horizon from days to months. |

| Risk Factors | False momentum signals, market reversals, liquidity constraints. | Event uncertainty, deal failures, regulatory risks. |

| Execution Style | Systematic, algorithm-driven execution. | Discretionary or systematic based on event timelines and outcomes. |

| Typical Instruments | Equities, ETFs, futures. | Equity shares, derivatives, corporate bonds. |

| Key Advantage | Data-driven, scalable with backtested strategies. | Potential for outsized returns from event mispricings. |

| Common Users | Quant funds, hedge funds, algorithmic traders. | Activist investors, hedge funds, event specialists. |

Which is better?

Quantitative momentum trading leverages systematic algorithms to capitalize on price trends and market momentum, offering consistent data-driven decisions and reduced emotional bias. Event-driven trading focuses on exploiting market inefficiencies caused by specific corporate events such as mergers, earnings releases, or regulatory changes, requiring deep fundamental analysis and timely information. The choice between the two depends on an investor's risk tolerance, access to data, and expertise in statistical modeling versus fundamental event assessment.

Connection

Quantitative momentum trading leverages statistical models to identify assets with strong price trends, while event-driven trading focuses on exploiting price movements triggered by specific corporate events such as mergers or earnings announcements. Both strategies utilize algorithmic analysis to detect patterns and capitalize on market inefficiencies, often incorporating high-frequency data and risk metrics. Integration of these approaches allows traders to systematically capture momentum shifts tied to real-time events, enhancing predictive accuracy and portfolio returns.

Key Terms

**Event-driven trading:**

Event-driven trading capitalizes on price inefficiencies caused by corporate actions such as mergers, acquisitions, earnings reports, or bankruptcies. This strategy leverages detailed event analysis and timely information to anticipate market reactions and generate alpha. Explore deeper insights into event-driven trading strategies to enhance your market approach.

Catalysts

Event-driven trading capitalizes on specific corporate actions such as mergers, acquisitions, earnings releases, or regulatory announcements, using these catalysts to generate profits through anticipated price movements. Quantitative momentum strategies systematically analyze historical price trends and momentum indicators, aiming to capitalize on sustained directional market movements regardless of specific corporate events. Explore these distinct approaches to understanding how catalyst-driven events and momentum metrics influence trading decisions.

Merger Arbitrage

Event-driven trading exploits corporate events such as mergers and acquisitions to capture price inefficiencies, while quantitative momentum strategies rely on statistical analysis of asset price trends to inform trading decisions. Merger arbitrage, a subset of event-driven trading, involves capitalizing on the spread between the current market price of a target company's stock and the acquisition price announced in a merger deal, often using quantitative models to assess deal probability and timing. Explore how integrating quantitative momentum techniques can enhance merger arbitrage strategies by improving risk-adjusted returns and timing precision.

Source and External Links

Event Driven Trading Strategies: How They Work and Why They Matter - Event-driven trading involves identifying anticipated or unexpected corporate events like earnings announcements or mergers, analyzing their likely impact on a company's stock, and taking positions accordingly, often requiring real-time monitoring and risk management due to the inherent high risk and volatility.

Event-Driven Investing | Fund Strategy + Examples - Wall Street Prep - Event-driven investing is a strategy exploiting pricing inefficiencies from corporate events such as mergers, acquisitions, spin-offs, and bankruptcies, with common strategies including merger arbitrage, convertible arbitrage, and distressed investing, performing differently depending on economic conditions.

What is Event-Driven Investing: Common Strategies & Examples - Event-driven investing capitalizes on temporary market mispricings caused by significant corporate events like mergers or restructurings, requiring thorough analysis of the event's impact, regulatory environment, and market factors to position investments profitably amid volatility.

dowidth.com

dowidth.com