Alternative data signals harness unconventional data sources such as satellite imagery, social media trends, and credit card transactions to provide unique market insights beyond traditional financial metrics. Algorithmic trading signals rely on mathematical models and historical price patterns to generate automated buy and sell decisions at high speeds. Explore the differences and benefits of these approaches to enhance your trading strategy.

Why it is important

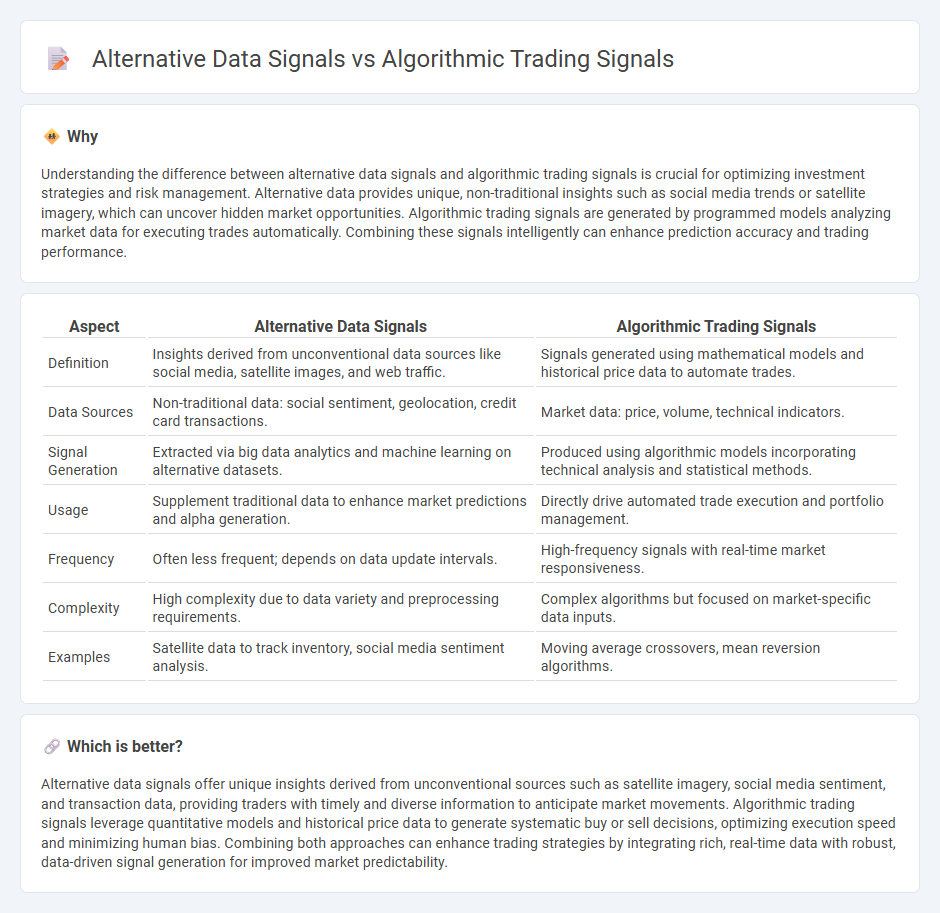

Understanding the difference between alternative data signals and algorithmic trading signals is crucial for optimizing investment strategies and risk management. Alternative data provides unique, non-traditional insights such as social media trends or satellite imagery, which can uncover hidden market opportunities. Algorithmic trading signals are generated by programmed models analyzing market data for executing trades automatically. Combining these signals intelligently can enhance prediction accuracy and trading performance.

Comparison Table

| Aspect | Alternative Data Signals | Algorithmic Trading Signals |

|---|---|---|

| Definition | Insights derived from unconventional data sources like social media, satellite images, and web traffic. | Signals generated using mathematical models and historical price data to automate trades. |

| Data Sources | Non-traditional data: social sentiment, geolocation, credit card transactions. | Market data: price, volume, technical indicators. |

| Signal Generation | Extracted via big data analytics and machine learning on alternative datasets. | Produced using algorithmic models incorporating technical analysis and statistical methods. |

| Usage | Supplement traditional data to enhance market predictions and alpha generation. | Directly drive automated trade execution and portfolio management. |

| Frequency | Often less frequent; depends on data update intervals. | High-frequency signals with real-time market responsiveness. |

| Complexity | High complexity due to data variety and preprocessing requirements. | Complex algorithms but focused on market-specific data inputs. |

| Examples | Satellite data to track inventory, social media sentiment analysis. | Moving average crossovers, mean reversion algorithms. |

Which is better?

Alternative data signals offer unique insights derived from unconventional sources such as satellite imagery, social media sentiment, and transaction data, providing traders with timely and diverse information to anticipate market movements. Algorithmic trading signals leverage quantitative models and historical price data to generate systematic buy or sell decisions, optimizing execution speed and minimizing human bias. Combining both approaches can enhance trading strategies by integrating rich, real-time data with robust, data-driven signal generation for improved market predictability.

Connection

Alternative data signals enhance algorithmic trading signals by providing unconventional datasets like satellite imagery, social media sentiment, and transaction records that refine predictive models. These enriched inputs improve the accuracy and timeliness of algorithmic strategies, enabling more informed decision-making and market edge. The integration of diverse alternative data with algorithmic signals boosts market responsiveness and risk management in trading systems.

Key Terms

Alpha generation

Algorithmic trading signals utilize historical price, volume, and technical indicators to generate predictive insights for alpha generation, leveraging quantitative models and machine learning algorithms. Alternative data signals incorporate non-traditional data sources such as social media sentiment, satellite imagery, and transaction data, providing unique market perspectives that enhance forecasting accuracy. Explore detailed methodologies and performance comparisons to understand how these signals drive superior alpha generation in different market conditions.

Data source

Algorithmic trading signals primarily rely on structured market data such as price, volume, and historical trade patterns, sourced from exchanges and financial databases. Alternative data signals, derived from unconventional sources like social media sentiment, satellite imagery, and credit card transactions, provide unique insights that complement traditional datasets. Explore the distinctions between these data sources to enhance your trading strategy.

Signal validation

Algorithmic trading signals rely on historical price patterns and technical indicators, whereas alternative data signals derive from unconventional sources like satellite imagery, social media sentiment, or credit card transactions, offering potentially unique market insights. Signal validation for algorithmic trading involves backtesting and statistical significance testing, while alternative data requires rigorous filtering, real-time accuracy checks, and cross-validation with traditional financial metrics to ensure robustness. Explore deeper methods for validating diverse signals to enhance your trading strategy's predictive power and reliability.

Source and External Links

Algorithmic Buy / Sell Signals - MBoxWave Wyckoff Trading System - These signals identify trading opportunities using Wyckoff concepts, analyzing waves, volume, and effort/result to detect setups like supply/demand imbalances and market turning points.

Easily Understanding How Algorithmic Trading Signals Work - Algorithmic trading signals are generated by machine learning models that process fundamental, technical, and on-chain data to predict buy/sell points.

What Do Algorithmic Bots Do and How Do They Analyze Signals? - Algorithmic bots analyze large datasets including price trends and technical indicators to rapidly detect trading opportunities and execute trades, often using risk management tools like stop-loss orders.

dowidth.com

dowidth.com