Delta neutral strategy minimizes market risk by balancing positive and negative deltas, allowing traders to profit from volatility without directional exposure. Swing trading focuses on capturing gains from short- to medium-term price movements, relying on technical analysis and market trends. Explore deeper insights to choose the strategy that best fits your trading goals.

Why it is important

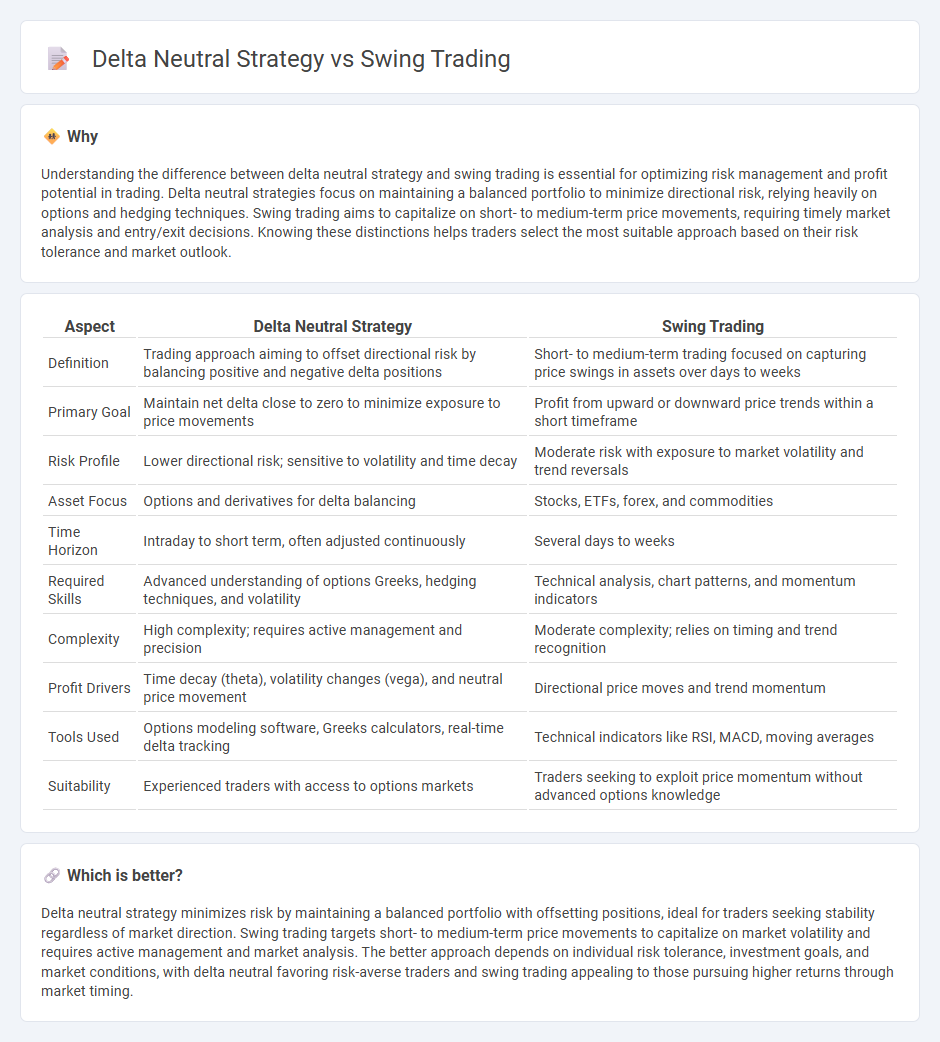

Understanding the difference between delta neutral strategy and swing trading is essential for optimizing risk management and profit potential in trading. Delta neutral strategies focus on maintaining a balanced portfolio to minimize directional risk, relying heavily on options and hedging techniques. Swing trading aims to capitalize on short- to medium-term price movements, requiring timely market analysis and entry/exit decisions. Knowing these distinctions helps traders select the most suitable approach based on their risk tolerance and market outlook.

Comparison Table

| Aspect | Delta Neutral Strategy | Swing Trading |

|---|---|---|

| Definition | Trading approach aiming to offset directional risk by balancing positive and negative delta positions | Short- to medium-term trading focused on capturing price swings in assets over days to weeks |

| Primary Goal | Maintain net delta close to zero to minimize exposure to price movements | Profit from upward or downward price trends within a short timeframe |

| Risk Profile | Lower directional risk; sensitive to volatility and time decay | Moderate risk with exposure to market volatility and trend reversals |

| Asset Focus | Options and derivatives for delta balancing | Stocks, ETFs, forex, and commodities |

| Time Horizon | Intraday to short term, often adjusted continuously | Several days to weeks |

| Required Skills | Advanced understanding of options Greeks, hedging techniques, and volatility | Technical analysis, chart patterns, and momentum indicators |

| Complexity | High complexity; requires active management and precision | Moderate complexity; relies on timing and trend recognition |

| Profit Drivers | Time decay (theta), volatility changes (vega), and neutral price movement | Directional price moves and trend momentum |

| Tools Used | Options modeling software, Greeks calculators, real-time delta tracking | Technical indicators like RSI, MACD, moving averages |

| Suitability | Experienced traders with access to options markets | Traders seeking to exploit price momentum without advanced options knowledge |

Which is better?

Delta neutral strategy minimizes risk by maintaining a balanced portfolio with offsetting positions, ideal for traders seeking stability regardless of market direction. Swing trading targets short- to medium-term price movements to capitalize on market volatility and requires active management and market analysis. The better approach depends on individual risk tolerance, investment goals, and market conditions, with delta neutral favoring risk-averse traders and swing trading appealing to those pursuing higher returns through market timing.

Connection

Delta neutral strategy and swing trading intersect by enabling traders to manage risk while capturing medium-term market movements. Delta neutral strategies help maintain a balanced portfolio unaffected by small price changes, allowing swing traders to hold positions over days or weeks without significant directional exposure. Combining these approaches enhances portfolio stability and optimizes profit potential in volatile markets.

Key Terms

Holding Period

Swing trading typically involves holding positions for several days to weeks to capitalize on short- to medium-term price movements, while delta neutral strategies aim to minimize directional risk by balancing options and underlying assets, often requiring frequent adjustments within shorter holding periods. Swing traders benefit from trends and momentum, whereas delta neutral methods focus on maintaining a neutral delta to profit from volatility rather than price direction. Explore the nuances of holding periods in swing trading and delta neutral strategies to optimize your investment approach.

Market Exposure

Swing trading involves taking directional positions based on short- to medium-term market trends, exposing traders to significant market risk and potential rewards within days to weeks. Delta neutral strategies aim to minimize market exposure by balancing options or underlying assets to maintain a net delta close to zero, reducing sensitivity to price movements and hedging against volatility. Explore detailed comparisons of these strategies to optimize your trading approach and manage market exposure effectively.

Risk Management

Swing trading involves holding positions for several days to weeks, capitalizing on short- to medium-term price movements, whereas a delta neutral strategy aims to minimize directional risk by balancing options and underlying assets. Effective risk management in swing trading relies on stop-loss orders and position sizing, while delta neutral strategies focus on maintaining hedged positions to reduce volatility exposure. Explore detailed risk management techniques to optimize performance in both trading approaches.

Source and External Links

Swing trading - Wikipedia - Swing trading is a speculative financial strategy where assets are held for several days to profit from price swings, using technical or fundamental analysis and set rules for entry and exit decisions to manage risk and maximize profits over a time frame longer than day trading but shorter than long-term investing.

What Is Swing Trading? - Finimize - Swing trading captures short-to-medium-term gains by holding positions for days or weeks, focusing on technical analysis to time trades, offering flexibility compared to day trading and allowing traders to benefit from market trends without constant monitoring.

Swing trading: A complete guide for investors | TD Direct Investing - Swing trading profits from short-term price changes by buying dips or shorting rises, relying mainly on technical analysis, appealing to traders who prefer active position management over days or weeks, and sitting between day trading and longer trend investing in terms of holding period.

dowidth.com

dowidth.com