High frequency trading (HFT) leverages ultra-fast data processing and execution speeds to capitalize on tiny price discrepancies within milliseconds, primarily using co-location and advanced hardware. Algorithmic trading involves deploying pre-programmed strategies based on mathematical models to automate order execution across various timeframes, focusing on optimizing trade size and timing. Explore the key distinctions and applications of HFT and algorithmic trading to enhance your understanding of modern financial markets.

Why it is important

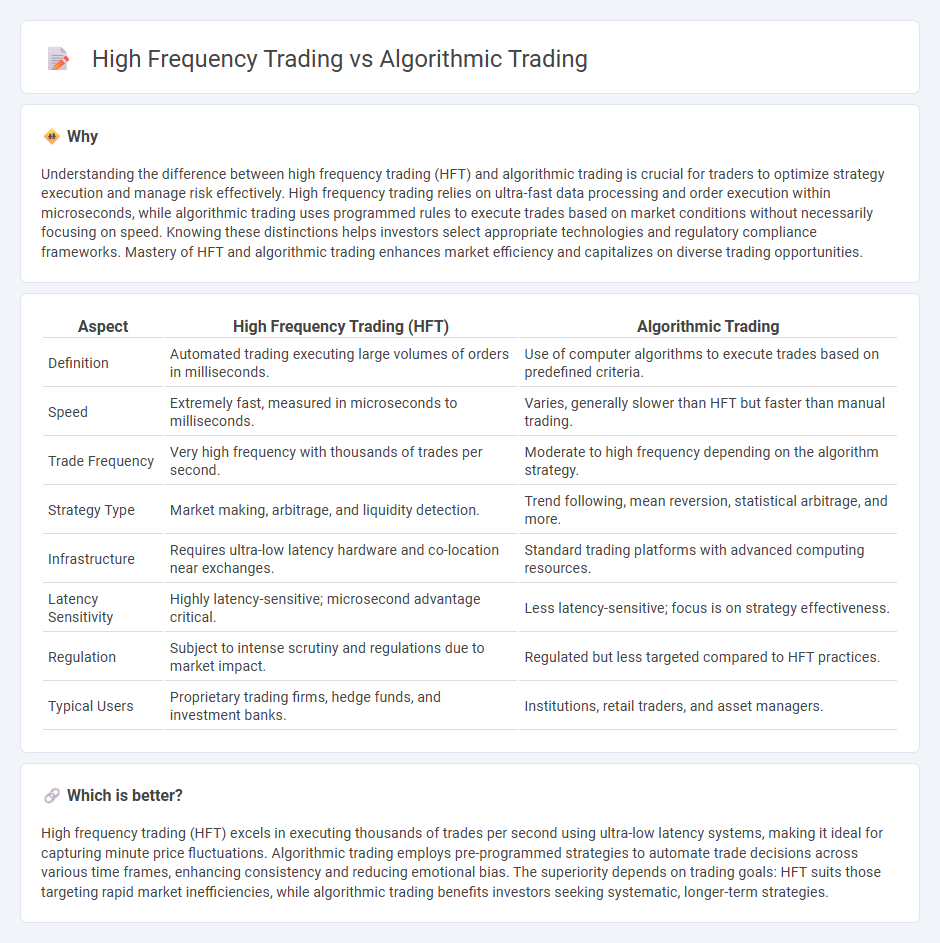

Understanding the difference between high frequency trading (HFT) and algorithmic trading is crucial for traders to optimize strategy execution and manage risk effectively. High frequency trading relies on ultra-fast data processing and order execution within microseconds, while algorithmic trading uses programmed rules to execute trades based on market conditions without necessarily focusing on speed. Knowing these distinctions helps investors select appropriate technologies and regulatory compliance frameworks. Mastery of HFT and algorithmic trading enhances market efficiency and capitalizes on diverse trading opportunities.

Comparison Table

| Aspect | High Frequency Trading (HFT) | Algorithmic Trading |

|---|---|---|

| Definition | Automated trading executing large volumes of orders in milliseconds. | Use of computer algorithms to execute trades based on predefined criteria. |

| Speed | Extremely fast, measured in microseconds to milliseconds. | Varies, generally slower than HFT but faster than manual trading. |

| Trade Frequency | Very high frequency with thousands of trades per second. | Moderate to high frequency depending on the algorithm strategy. |

| Strategy Type | Market making, arbitrage, and liquidity detection. | Trend following, mean reversion, statistical arbitrage, and more. |

| Infrastructure | Requires ultra-low latency hardware and co-location near exchanges. | Standard trading platforms with advanced computing resources. |

| Latency Sensitivity | Highly latency-sensitive; microsecond advantage critical. | Less latency-sensitive; focus is on strategy effectiveness. |

| Regulation | Subject to intense scrutiny and regulations due to market impact. | Regulated but less targeted compared to HFT practices. |

| Typical Users | Proprietary trading firms, hedge funds, and investment banks. | Institutions, retail traders, and asset managers. |

Which is better?

High frequency trading (HFT) excels in executing thousands of trades per second using ultra-low latency systems, making it ideal for capturing minute price fluctuations. Algorithmic trading employs pre-programmed strategies to automate trade decisions across various time frames, enhancing consistency and reducing emotional bias. The superiority depends on trading goals: HFT suits those targeting rapid market inefficiencies, while algorithmic trading benefits investors seeking systematic, longer-term strategies.

Connection

High frequency trading (HFT) and algorithmic trading both rely on advanced computer algorithms to execute trades at speeds and volumes far beyond human capabilities. HFT is a subset of algorithmic trading focused on extremely rapid order execution and market making, often exploiting minimal price discrepancies within microseconds. Both strategies utilize complex algorithms and low-latency connections to financial markets to maximize efficiency and profitability.

Key Terms

Automation

Algorithmic trading leverages pre-programmed instructions to execute trades based on various market criteria, optimizing speed and efficiency through automation. High-frequency trading (HFT) represents a specialized subset of algorithmic trading characterized by extremely rapid order execution, often measured in microseconds, to capitalize on minute price discrepancies. Explore the nuances between these automated trading strategies to understand their impact on market dynamics and technological requirements.

Latency

Algorithmic trading employs computer algorithms to execute orders based on pre-set criteria, often with moderate emphasis on speed, while high frequency trading (HFT) prioritizes ultra-low latency to capitalize on fleeting market opportunities with millisecond or microsecond execution times. Latency reduction in HFT is achieved through advanced infrastructure such as colocated servers, direct market access, and optimized communication protocols, making latency a critical factor distinguishing it from broader algorithmic strategies. Explore the latest advancements in latency optimization techniques to understand their impact on trading performance.

Execution Speed

Algorithmic trading employs pre-programmed strategies to execute orders efficiently, while high-frequency trading (HFT) prioritizes ultra-low latency to capitalize on minuscule market movements within milliseconds. Execution speed in HFT is critical, leveraging advanced technologies such as co-location and FPGA hardware to minimize delays, compared to standard algorithmic trading latency. Discover more about how execution speed drives the competitive edge in modern financial markets.

Source and External Links

What is Algorithmic Trading and How Do You Get Started? - IG - Algorithmic trading uses computer codes to automatically execute trades based on predefined rules such as price movements, employing strategies like price action, technical analysis, and combinations, often for high-frequency trading and risk management.

Algorithmic Trading - Definition, Example, Pros, Cons - Algorithmic trading involves executing trades using programmed rules, including strategies like moving average crossovers, enabling efficient large trades by splitting orders to avoid market price distortion.

Algorithmic trading - Wikipedia - Algorithmic trading automates order execution using pre-programmed instructions and has evolved to include machine learning techniques like deep reinforcement learning for adaptive trading and directional change algorithms that improve timing in volatile markets.

dowidth.com

dowidth.com