Perpetual swaps offer traders the ability to maintain leveraged positions without an expiry date, providing continuous exposure to an asset's price movements. Margin trading involves borrowing funds to increase position size, exposing traders to liquidation risk if the market moves against them. Explore the differences in risk, cost structures, and strategies to optimize your trading approach.

Why it is important

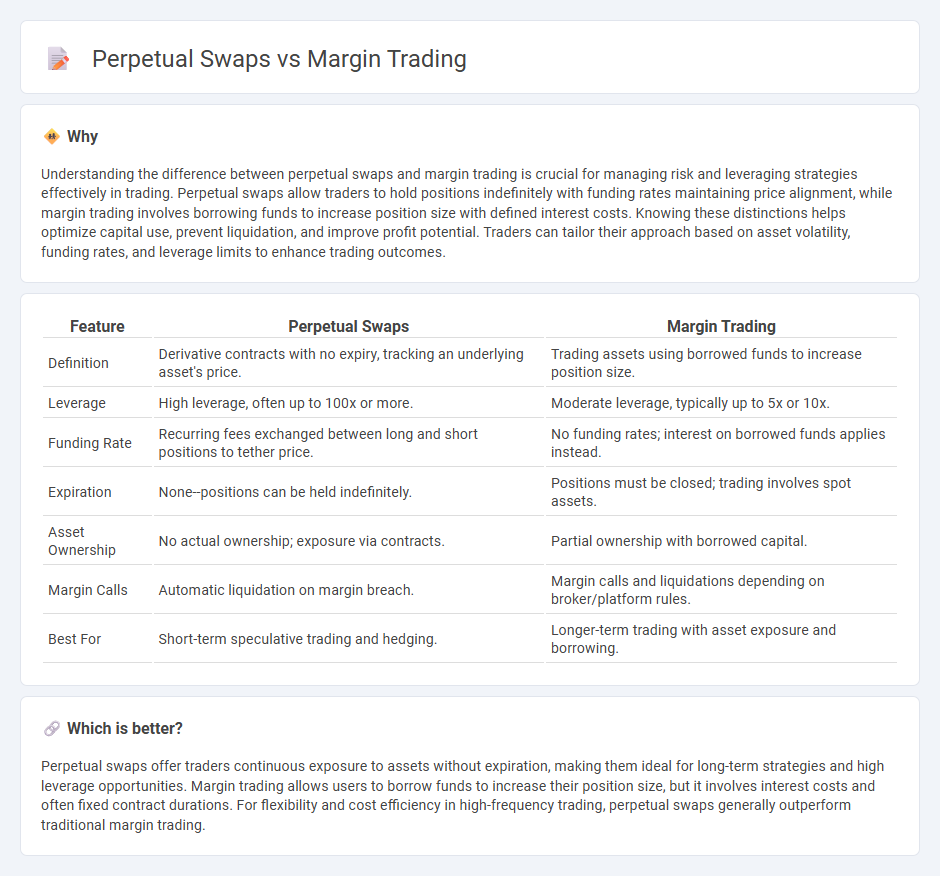

Understanding the difference between perpetual swaps and margin trading is crucial for managing risk and leveraging strategies effectively in trading. Perpetual swaps allow traders to hold positions indefinitely with funding rates maintaining price alignment, while margin trading involves borrowing funds to increase position size with defined interest costs. Knowing these distinctions helps optimize capital use, prevent liquidation, and improve profit potential. Traders can tailor their approach based on asset volatility, funding rates, and leverage limits to enhance trading outcomes.

Comparison Table

| Feature | Perpetual Swaps | Margin Trading |

|---|---|---|

| Definition | Derivative contracts with no expiry, tracking an underlying asset's price. | Trading assets using borrowed funds to increase position size. |

| Leverage | High leverage, often up to 100x or more. | Moderate leverage, typically up to 5x or 10x. |

| Funding Rate | Recurring fees exchanged between long and short positions to tether price. | No funding rates; interest on borrowed funds applies instead. |

| Expiration | None--positions can be held indefinitely. | Positions must be closed; trading involves spot assets. |

| Asset Ownership | No actual ownership; exposure via contracts. | Partial ownership with borrowed capital. |

| Margin Calls | Automatic liquidation on margin breach. | Margin calls and liquidations depending on broker/platform rules. |

| Best For | Short-term speculative trading and hedging. | Longer-term trading with asset exposure and borrowing. |

Which is better?

Perpetual swaps offer traders continuous exposure to assets without expiration, making them ideal for long-term strategies and high leverage opportunities. Margin trading allows users to borrow funds to increase their position size, but it involves interest costs and often fixed contract durations. For flexibility and cost efficiency in high-frequency trading, perpetual swaps generally outperform traditional margin trading.

Connection

Perpetual swaps enable traders to hold leveraged positions without expiration dates, closely linking to margin trading where borrowed funds amplify exposure to assets. Both mechanisms utilize leverage to maximize potential profits while increasing risk, requiring traders to maintain margin balances to avoid liquidation. The integration of funding rates in perpetual swaps aligns with margin requirements, ensuring continuous price convergence between the swap and spot markets.

Key Terms

Leverage

Margin trading allows traders to borrow funds to increase their position size, offering leverage typically ranging from 2x to 10x depending on the platform and asset. Perpetual swaps provide higher leverage options, often up to 100x, combined with no expiry date, enabling continuous exposure to the asset's price movements. Explore our detailed guide to understand how leverage impacts risk management and profit potential in both trading methods.

Liquidation

Margin trading involves borrowing funds to open leveraged positions, with liquidation triggered when the trader's margin balance falls below the maintenance margin level. Perpetual swaps utilize a funding rate mechanism and mark price to prevent manipulation, where liquidation occurs once the position's margin cannot cover potential losses, often resulting in automatic position closure. Explore more to understand risk management and liquidation mechanics in these leveraged trading instruments.

Funding Rate

Margin trading involves borrowing funds to amplify position size, with interest rates influencing overall costs, whereas perpetual swaps incorporate a crucial funding rate mechanism balancing long and short positions by periodic payments between traders. The funding rate for perpetual swaps can be positive or negative, reflecting market sentiment and ensuring the contract price aligns with the underlying asset's price, differing from traditional margin interest calculations. Explore detailed comparisons and dynamic funding rate impacts to optimize trading strategies effectively.

Source and External Links

Basics of Margin Trading for Investors | Charles Schwab - Margin trading involves borrowing money from a broker to buy more stock than you could with just your available cash, magnifying both potential returns and losses, and incurring interest on the loaned amount.

What is Margin Trading and How Do You Trade On It? - IG - Margin trading is leveraged trading where you open positions using a percentage deposit (margin), which amplifies profits and losses, and brokers may require additional funds if positions move against you.

Margin (finance) - Wikipedia - Margin is collateral deposited with a broker to cover credit risk for borrowing funds or securities, enabling trading on loan but subject to margin calls and interest charges if the account value falls below required levels.

dowidth.com

dowidth.com