Liquidity sweeps focus on rapidly executing trades by targeting hidden or less visible liquidity within the market, bypassing the traditional order book's visible limit orders. The order book displays all current buy and sell orders, offering transparency but often revealing only surface-level liquidity, which may not account for large or hidden orders. Explore deeper insights on how these trading strategies impact market efficiency and execution quality.

Why it is important

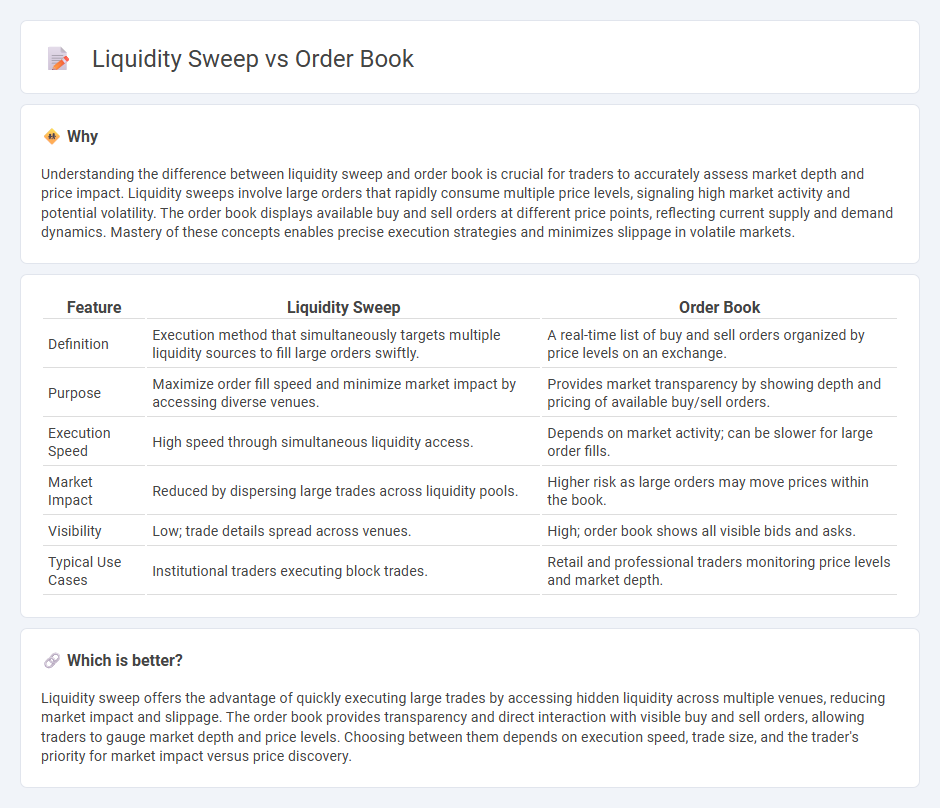

Understanding the difference between liquidity sweep and order book is crucial for traders to accurately assess market depth and price impact. Liquidity sweeps involve large orders that rapidly consume multiple price levels, signaling high market activity and potential volatility. The order book displays available buy and sell orders at different price points, reflecting current supply and demand dynamics. Mastery of these concepts enables precise execution strategies and minimizes slippage in volatile markets.

Comparison Table

| Feature | Liquidity Sweep | Order Book |

|---|---|---|

| Definition | Execution method that simultaneously targets multiple liquidity sources to fill large orders swiftly. | A real-time list of buy and sell orders organized by price levels on an exchange. |

| Purpose | Maximize order fill speed and minimize market impact by accessing diverse venues. | Provides market transparency by showing depth and pricing of available buy/sell orders. |

| Execution Speed | High speed through simultaneous liquidity access. | Depends on market activity; can be slower for large order fills. |

| Market Impact | Reduced by dispersing large trades across liquidity pools. | Higher risk as large orders may move prices within the book. |

| Visibility | Low; trade details spread across venues. | High; order book shows all visible bids and asks. |

| Typical Use Cases | Institutional traders executing block trades. | Retail and professional traders monitoring price levels and market depth. |

Which is better?

Liquidity sweep offers the advantage of quickly executing large trades by accessing hidden liquidity across multiple venues, reducing market impact and slippage. The order book provides transparency and direct interaction with visible buy and sell orders, allowing traders to gauge market depth and price levels. Choosing between them depends on execution speed, trade size, and the trader's priority for market impact versus price discovery.

Connection

Liquidity sweeps occur when large market orders rapidly consume available liquidity at multiple price levels in the order book, causing swift price movements. The order book's depth and distribution of limit orders directly influence the effectiveness and impact of liquidity sweeps on market prices. Traders analyze order book data to anticipate potential liquidity sweeps and adjust their trading strategies accordingly.

Key Terms

Bid-Ask Spread

The order book displays the list of buy and sell orders at various price levels, directly influencing the bid-ask spread by showing the depth of liquidity on both sides. Liquidity sweeps occur when aggressive market orders consume multiple levels in the order book, rapidly narrowing or widening the bid-ask spread and reflecting immediate market demand or supply. Explore the dynamics between order book structures and liquidity sweeps to better understand their impact on bid-ask spread volatility.

Market Depth

Order book displays real-time buy and sell orders at different price levels, showcasing market depth and liquidity distribution for assets. Liquidity sweep refers to aggressive market orders that consume multiple levels of the order book, impacting price stability and revealing hidden liquidity pools. Explore how understanding both concepts can enhance trading strategies and market analysis.

Slippage

Order book depth directly influences slippage by determining the available liquidity at each price level, with thin order books causing higher slippage during large trades. Liquidity sweeps aggressively consume multiple price levels across the order book, resulting in sudden and significant slippage due to rapid price impact. Explore more about managing slippage to optimize trading strategies effectively.

Source and External Links

Order Book - Definition, Components, How It Works - An order book is a real-time list of buy and sell orders for a specific security, showing prices and volumes buyers are willing to pay and sellers want to receive, effectively displaying market supply and demand at different price levels for assets like stocks and cryptocurrencies.

What Is an Order Book and How Does It Work? - An order book lists current buy orders (bids) and sell orders (asks) with their prices and quantities, where trades occur when bid and ask prices match, and is often visualized through depth charts to analyze market liquidity and potential price movements.

Order Book overview - TT Help Library - The Order Book widget displays all working orders for a trader, allowing viewing, canceling, modifying, or applying algorithmic strategies to orders, and sorting by criteria such as buy/sell status or submission time.

dowidth.com

dowidth.com