Tape reading focuses on analyzing real-time order flow and volume to gauge market sentiment, while price action studies historical price movements and chart patterns to predict future trends. Traders using tape reading rely on the Time and Sales data to spot large trades and momentum shifts, whereas price action traders interpret candlestick patterns and support-resistance levels for decision-making. Explore the nuances of tape reading versus price action to enhance your trading strategies.

Why it is important

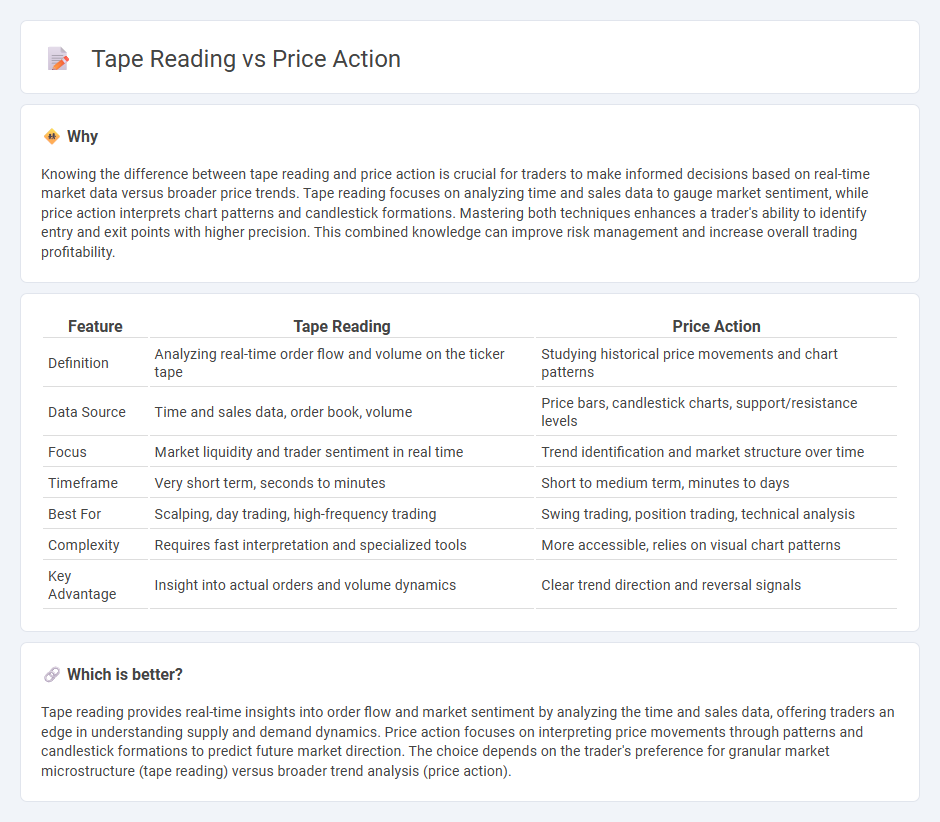

Knowing the difference between tape reading and price action is crucial for traders to make informed decisions based on real-time market data versus broader price trends. Tape reading focuses on analyzing time and sales data to gauge market sentiment, while price action interprets chart patterns and candlestick formations. Mastering both techniques enhances a trader's ability to identify entry and exit points with higher precision. This combined knowledge can improve risk management and increase overall trading profitability.

Comparison Table

| Feature | Tape Reading | Price Action |

|---|---|---|

| Definition | Analyzing real-time order flow and volume on the ticker tape | Studying historical price movements and chart patterns |

| Data Source | Time and sales data, order book, volume | Price bars, candlestick charts, support/resistance levels |

| Focus | Market liquidity and trader sentiment in real time | Trend identification and market structure over time |

| Timeframe | Very short term, seconds to minutes | Short to medium term, minutes to days |

| Best For | Scalping, day trading, high-frequency trading | Swing trading, position trading, technical analysis |

| Complexity | Requires fast interpretation and specialized tools | More accessible, relies on visual chart patterns |

| Key Advantage | Insight into actual orders and volume dynamics | Clear trend direction and reversal signals |

Which is better?

Tape reading provides real-time insights into order flow and market sentiment by analyzing the time and sales data, offering traders an edge in understanding supply and demand dynamics. Price action focuses on interpreting price movements through patterns and candlestick formations to predict future market direction. The choice depends on the trader's preference for granular market microstructure (tape reading) versus broader trend analysis (price action).

Connection

Tape reading provides real-time insight into order flow and volume, allowing traders to gauge market sentiment and detect large buying or selling pressure. Price action reflects these behaviors through candlestick patterns and support/resistance levels, revealing the market's reaction to the underlying tape data. Together, tape reading and price action offer a comprehensive view of market dynamics, enhancing trade timing and decision-making accuracy.

Key Terms

Candlestick Patterns

Candlestick patterns provide visual insights into market sentiment, highlighting potential reversals and continuations in price action with formations like doji, engulfing, and hammer candles. Tape reading complements this by analyzing the flow of actual order transactions, revealing the strength behind these patterns through bid-ask dynamics and volume spikes. Explore how combining candlestick patterns with tape reading can enhance your trading precision and market timing.

Order Flow

Order flow analysis reveals real-time buying and selling pressure by tracking market orders and volume at specific price levels, offering granular insights beyond traditional price action patterns. Tape reading complements this by interpreting the time and sales data, providing a clear understanding of trader intentions and liquidity dynamics. Explore further to master how integrating order flow with tape reading can enhance trading precision and timing.

Time and Sales (Tape)

Time and Sales, commonly known as the Tape, provides real-time transaction data including price, volume, and time, offering traders granular insight into market dynamics beyond traditional price action charts. Price action focuses on patterns formed by historical price movements on candlestick or bar charts, while tape reading emphasizes the flow of actual trade prints to gauge buying and selling pressure. Explore advanced strategies to master Time and Sales analysis and elevate your trading precision.

Source and External Links

What is Price Action? (2025) A Complete Trader's Guide - Price action is the analysis of raw price movements over time to interpret market sentiment, predict future trends, and gauge the strength of movements, helping traders make informed decisions without relying on derivative indicators.

What Is Price Action? - Price Action Trading Introduction - Price action trading is a methodology focusing solely on the analysis of a market's price history over time, ignoring fundamental influences and secondary indicators to predict future price direction.

Price Action Trading Explained - Learn To Trade The Market - Price action trading involves making decisions based only on "naked" price charts without lagging indicators, as price charts reflect all market variables including economic and news events, enabling traders to develop high-probability trading strategies.

dowidth.com

dowidth.com