Funding rate arbitrage exploits differences in perpetual futures funding fees across exchanges to generate low-risk profits by simultaneously holding long and short positions. Pairs trading involves identifying two correlated assets and taking opposite positions to profit from temporary divergences in their price relationship. Explore these distinct trading strategies to enhance portfolio diversification and risk management.

Why it is important

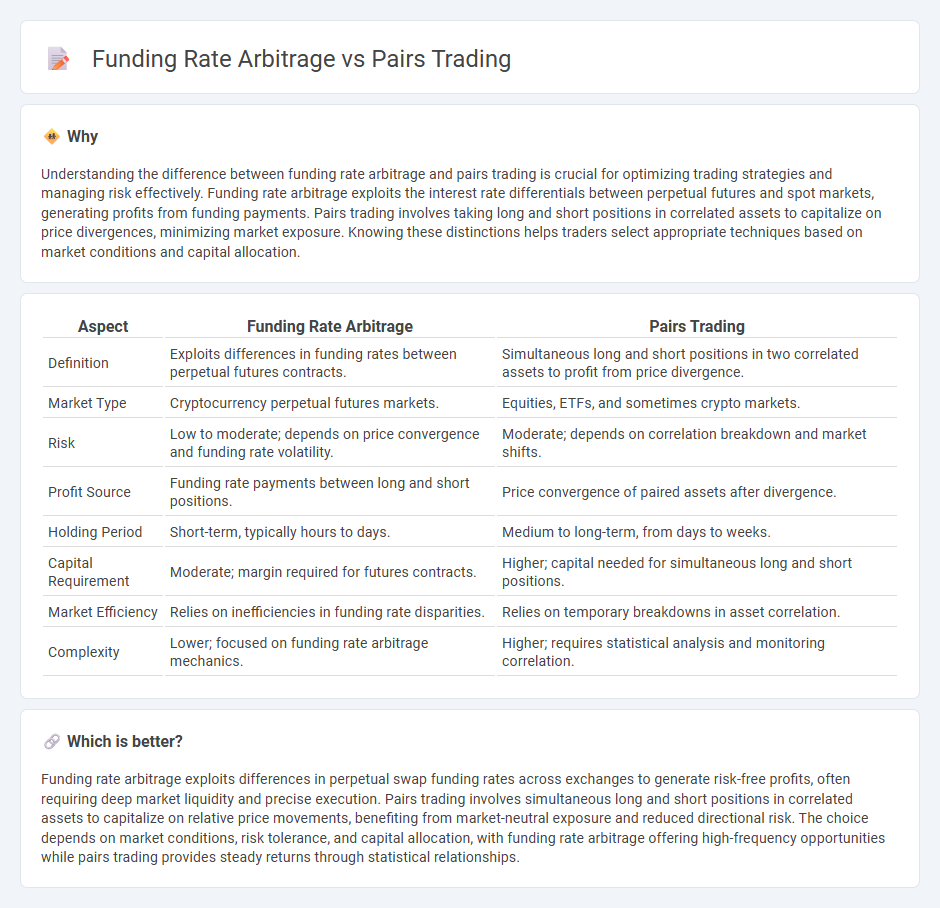

Understanding the difference between funding rate arbitrage and pairs trading is crucial for optimizing trading strategies and managing risk effectively. Funding rate arbitrage exploits the interest rate differentials between perpetual futures and spot markets, generating profits from funding payments. Pairs trading involves taking long and short positions in correlated assets to capitalize on price divergences, minimizing market exposure. Knowing these distinctions helps traders select appropriate techniques based on market conditions and capital allocation.

Comparison Table

| Aspect | Funding Rate Arbitrage | Pairs Trading |

|---|---|---|

| Definition | Exploits differences in funding rates between perpetual futures contracts. | Simultaneous long and short positions in two correlated assets to profit from price divergence. |

| Market Type | Cryptocurrency perpetual futures markets. | Equities, ETFs, and sometimes crypto markets. |

| Risk | Low to moderate; depends on price convergence and funding rate volatility. | Moderate; depends on correlation breakdown and market shifts. |

| Profit Source | Funding rate payments between long and short positions. | Price convergence of paired assets after divergence. |

| Holding Period | Short-term, typically hours to days. | Medium to long-term, from days to weeks. |

| Capital Requirement | Moderate; margin required for futures contracts. | Higher; capital needed for simultaneous long and short positions. |

| Market Efficiency | Relies on inefficiencies in funding rate disparities. | Relies on temporary breakdowns in asset correlation. |

| Complexity | Lower; focused on funding rate arbitrage mechanics. | Higher; requires statistical analysis and monitoring correlation. |

Which is better?

Funding rate arbitrage exploits differences in perpetual swap funding rates across exchanges to generate risk-free profits, often requiring deep market liquidity and precise execution. Pairs trading involves simultaneous long and short positions in correlated assets to capitalize on relative price movements, benefiting from market-neutral exposure and reduced directional risk. The choice depends on market conditions, risk tolerance, and capital allocation, with funding rate arbitrage offering high-frequency opportunities while pairs trading provides steady returns through statistical relationships.

Connection

Funding rate arbitrage exploits differences in perpetual futures funding rates across exchanges to generate risk-free profits, while pairs trading involves simultaneous long and short positions in correlated assets to capitalize on price divergences. Both strategies rely on identifying inefficiencies in market pricing and require precise execution to capture arbitrage opportunities. By combining funding rate arbitrage with pairs trading, traders can hedge exposure and enhance returns through optimized capital allocation across correlated derivatives.

Key Terms

Pairs Trading:

Pairs trading involves identifying two historically correlated assets and executing simultaneous long and short positions to capitalize on price convergence or divergence. This market-neutral strategy reduces exposure to overall market risk by profiting from relative price movements, often applied in equities, forex, or cryptocurrencies. Explore how pairs trading can enhance your portfolio's risk-adjusted returns and improve market efficiency.

Cointegration

Pairs trading relies on the statistical concept of cointegration to identify and exploit mean-reverting price relationships between two correlated assets, enabling traders to profit from temporary deviations. Funding rate arbitrage involves capturing differences in perpetual swap funding fees to generate profit without directly depending on price cointegration. Explore the nuances of cointegration in pairs trading and its contrast with funding rate strategies to deepen your understanding of quantitative arbitrage approaches.

Spread

Pairs trading involves exploiting price divergences between two correlated assets by taking simultaneous long and short positions to profit from spread convergence. Funding rate arbitrage capitalizes on the difference in perpetual contract funding rates between exchanges by holding offsetting positions, aiming to earn yield from spread discrepancies without directional exposure. Explore further to understand how spread dynamics uniquely influence profitability in each strategy.

Source and External Links

What Is Pairs Trading? - Fidelity Investments - Pairs trading is a non-directional, relative value investment strategy that uses statistical analysis to capitalize on market imbalances between two correlated financial instruments by trading the spread when it diverges from the norm.

The Comprehensive Introduction to Pairs Trading - Hudson & Thames - Pairs trading involves taking a long position in one co-moving asset and shorting the other, betting on price convergence and exploiting mispricing without needing to forecast market direction.

Pairs Trading for Beginners: Correlation, Cointegration, Examples ... - A core element of pairs trading is identifying cointegrated pairs using statistical tests like the Augmented-Dickey Fuller Test, allowing traders to hedge positions by going long on the underperformer and short on the outperformer to reduce risk and aim for steady returns.

dowidth.com

dowidth.com