Degen trading involves high-risk, rapid trades often driven by market hype and short-term price movements, aimed at maximizing quick profits in volatile environments like cryptocurrency markets. Swing trading, on the other hand, focuses on capturing medium-term price trends by holding positions for several days to weeks, leveraging technical analysis and market momentum to optimize entry and exit points. Discover more strategies and insights to refine your trading approach.

Why it is important

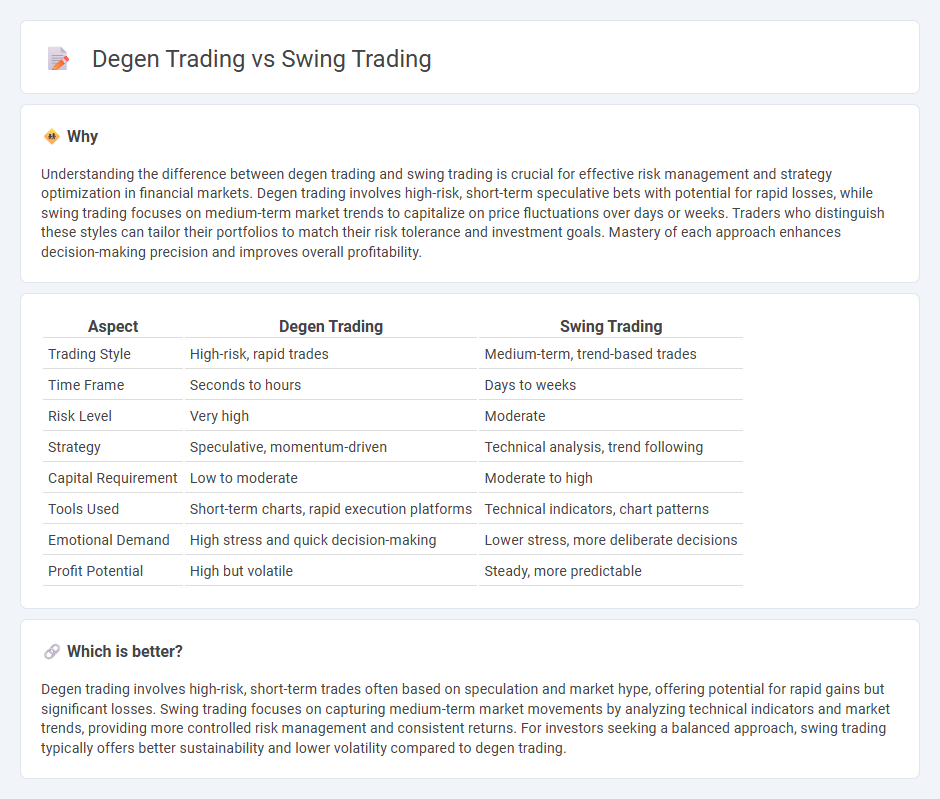

Understanding the difference between degen trading and swing trading is crucial for effective risk management and strategy optimization in financial markets. Degen trading involves high-risk, short-term speculative bets with potential for rapid losses, while swing trading focuses on medium-term market trends to capitalize on price fluctuations over days or weeks. Traders who distinguish these styles can tailor their portfolios to match their risk tolerance and investment goals. Mastery of each approach enhances decision-making precision and improves overall profitability.

Comparison Table

| Aspect | Degen Trading | Swing Trading |

|---|---|---|

| Trading Style | High-risk, rapid trades | Medium-term, trend-based trades |

| Time Frame | Seconds to hours | Days to weeks |

| Risk Level | Very high | Moderate |

| Strategy | Speculative, momentum-driven | Technical analysis, trend following |

| Capital Requirement | Low to moderate | Moderate to high |

| Tools Used | Short-term charts, rapid execution platforms | Technical indicators, chart patterns |

| Emotional Demand | High stress and quick decision-making | Lower stress, more deliberate decisions |

| Profit Potential | High but volatile | Steady, more predictable |

Which is better?

Degen trading involves high-risk, short-term trades often based on speculation and market hype, offering potential for rapid gains but significant losses. Swing trading focuses on capturing medium-term market movements by analyzing technical indicators and market trends, providing more controlled risk management and consistent returns. For investors seeking a balanced approach, swing trading typically offers better sustainability and lower volatility compared to degen trading.

Connection

Degen trading and swing trading both involve strategies aimed at capitalizing on short- to mid-term market movements, with degen trading focusing on high-risk, high-reward trades often in volatile or low-liquidity assets. Swing trading relies on technical analysis and market trends to hold positions over several days or weeks, contrasting with the rapid, speculative nature of degen trading. Traders sometimes combine degen tactics within swing trading frameworks to exploit market momentum while managing risk through longer-term holding periods.

Key Terms

Holding Period

Swing trading involves holding positions typically from several days to weeks, aiming to capture medium-term market trends by analyzing price patterns and technical indicators. Degen trading, or degenerate trading, features a much shorter holding period, often seconds to minutes, driven by high-risk, high-reward trades on volatile assets or leveraged instruments. Discover the key differences in strategy and risk management between these trading styles to optimize your approach.

Risk Management

Swing trading emphasizes disciplined risk management by setting stop-loss orders and analyzing market trends over days to weeks, minimizing potential losses while aiming for steady gains. Degen trading involves high-risk, short-term trades with little to no risk controls, often driven by speculation and market hype, resulting in substantial volatility and potential for significant losses. Explore detailed risk strategies to understand how each trading style impacts portfolio stability and returns.

Trade Strategy

Swing trading involves holding positions for several days to weeks, capitalizing on medium-term price fluctuations using technical analysis and trend patterns. Degen trading, often characterized by high-risk and high-frequency trades, relies on speculative and momentum-driven strategies with less emphasis on traditional risk management. Explore further to understand which trade strategy aligns best with your investment goals and risk tolerance.

Source and External Links

Swing trading - Wikipedia - Swing trading is a speculative strategy where assets are held from one day to several days to profit from price changes, using techniques like technical analysis and trading algorithms with rules for entry and exit.

What is swing trading & how does it work? - Saxo Bank - Swing trading seeks to capitalize on short-term price swings via strategies such as breakout trading and trend trading, using technical indicators like moving averages and volume-weighted averages to time entries and exits.

Swing trading: A complete guide for investors | TD Direct Investing - Swing trading appeals to traders comfortable with moving in and out of positions over days or weeks, aiming to profit from short-term volatility through technical and fundamental analysis, distinct from day trading's shorter holds and trend trading's longer holds.

dowidth.com

dowidth.com