Quantitative backtesting employs algorithmic models to simulate trades on historical data, enabling traders to evaluate strategy performance under diverse market conditions. Historical replay involves reviewing past market events in real-time or accelerated time to observe strategy behavior in actual market scenarios. Explore the distinct advantages of both methods to enhance your trading strategy development.

Why it is important

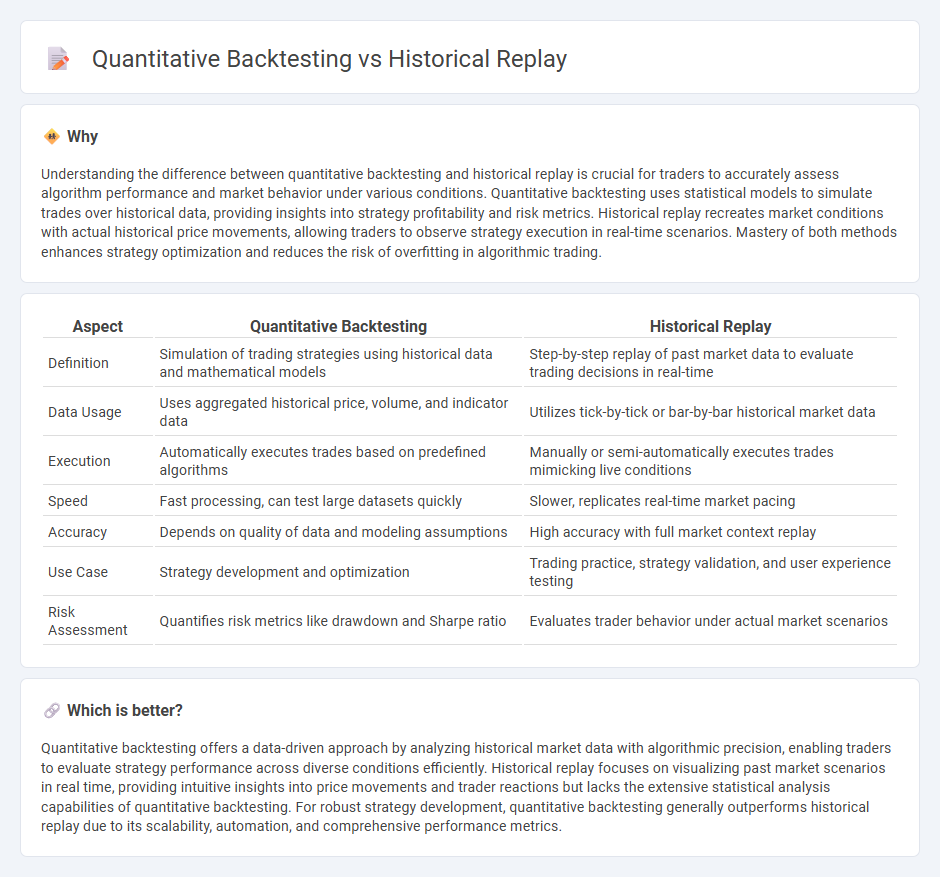

Understanding the difference between quantitative backtesting and historical replay is crucial for traders to accurately assess algorithm performance and market behavior under various conditions. Quantitative backtesting uses statistical models to simulate trades over historical data, providing insights into strategy profitability and risk metrics. Historical replay recreates market conditions with actual historical price movements, allowing traders to observe strategy execution in real-time scenarios. Mastery of both methods enhances strategy optimization and reduces the risk of overfitting in algorithmic trading.

Comparison Table

| Aspect | Quantitative Backtesting | Historical Replay |

|---|---|---|

| Definition | Simulation of trading strategies using historical data and mathematical models | Step-by-step replay of past market data to evaluate trading decisions in real-time |

| Data Usage | Uses aggregated historical price, volume, and indicator data | Utilizes tick-by-tick or bar-by-bar historical market data |

| Execution | Automatically executes trades based on predefined algorithms | Manually or semi-automatically executes trades mimicking live conditions |

| Speed | Fast processing, can test large datasets quickly | Slower, replicates real-time market pacing |

| Accuracy | Depends on quality of data and modeling assumptions | High accuracy with full market context replay |

| Use Case | Strategy development and optimization | Trading practice, strategy validation, and user experience testing |

| Risk Assessment | Quantifies risk metrics like drawdown and Sharpe ratio | Evaluates trader behavior under actual market scenarios |

Which is better?

Quantitative backtesting offers a data-driven approach by analyzing historical market data with algorithmic precision, enabling traders to evaluate strategy performance across diverse conditions efficiently. Historical replay focuses on visualizing past market scenarios in real time, providing intuitive insights into price movements and trader reactions but lacks the extensive statistical analysis capabilities of quantitative backtesting. For robust strategy development, quantitative backtesting generally outperforms historical replay due to its scalability, automation, and comprehensive performance metrics.

Connection

Quantitative backtesting uses historical market data to simulate trading strategies, enabling traders to evaluate performance metrics such as profitability and risk before actual deployment. Historical replay complements this by providing a dynamic, visual reconstruction of past market conditions, allowing traders to observe strategy behavior in real-time scenarios. Together, these methods enhance the robustness of trading systems by combining statistical accuracy with practical insight.

Key Terms

Data Fidelity

Historical replay provides a high level of data fidelity by using actual market price movements and order flow, enabling traders to observe real-world trading behavior and market dynamics. Quantitative backtesting relies on aggregated historical data and algorithmic models, which can introduce discrepancies due to data smoothing or missing tick-level granularity. Explore the nuances of data fidelity to enhance your trading model's reliability and predictive power.

Realism (Simulation Accuracy)

Historical replay offers high realism by simulating market conditions with actual past data, capturing nuances like order flow and volatility spikes that quantitative backtesting models may overlook. Quantitative backtesting prioritizes speed and scalability but often simplifies market dynamics using assumptions that can reduce simulation accuracy. Explore detailed comparisons to understand which method best fits your trading strategy's realism requirements.

Strategy Evaluation

Historical replay offers granular insights by allowing traders to visually analyze market reactions during specific periods, enhancing intuitive understanding of strategy behavior under real-time conditions. Quantitative backtesting systematically evaluates trading algorithms against large datasets, generating statistically significant performance metrics such as Sharpe ratio, drawdown, and win rate to validate robustness. Explore our detailed comparison to optimize your strategy evaluation methodology effectively.

Source and External Links

Historical Data Replay - QuestDB - Historical data replay simulates real-time market conditions by sequentially processing recorded financial data, essential for testing trading systems, analyzing market behavior, and developing trading strategies in a controlled environment.

Bar Replay: how and why to test a strategy in the past - TradingView - Bar Replay is a tool to simulate past price movements for strategy testing, enabling traders to refine and practice trading strategies in a risk-free, interactive way based on historical market data.

LaserStream Historical Replay: Backfill Missing Data - Helius Docs - Historical Replay in LaserStream allows replaying recent blockchain data from the past to backfill missing data, bootstrap applications, analyze past events, and test application behavior with real historical blockchain data.

dowidth.com

dowidth.com