Microstructure modeling examines the detailed mechanisms of how trades are executed within a market, focusing on price formation, liquidity, and the impact of trading strategies at the granular level. Order flow analysis studies the sequence and volume of orders to predict price movements and assess market sentiment, providing insights into supply and demand dynamics. Explore our in-depth comparison to understand how these approaches enhance trading strategies and market efficiency.

Why it is important

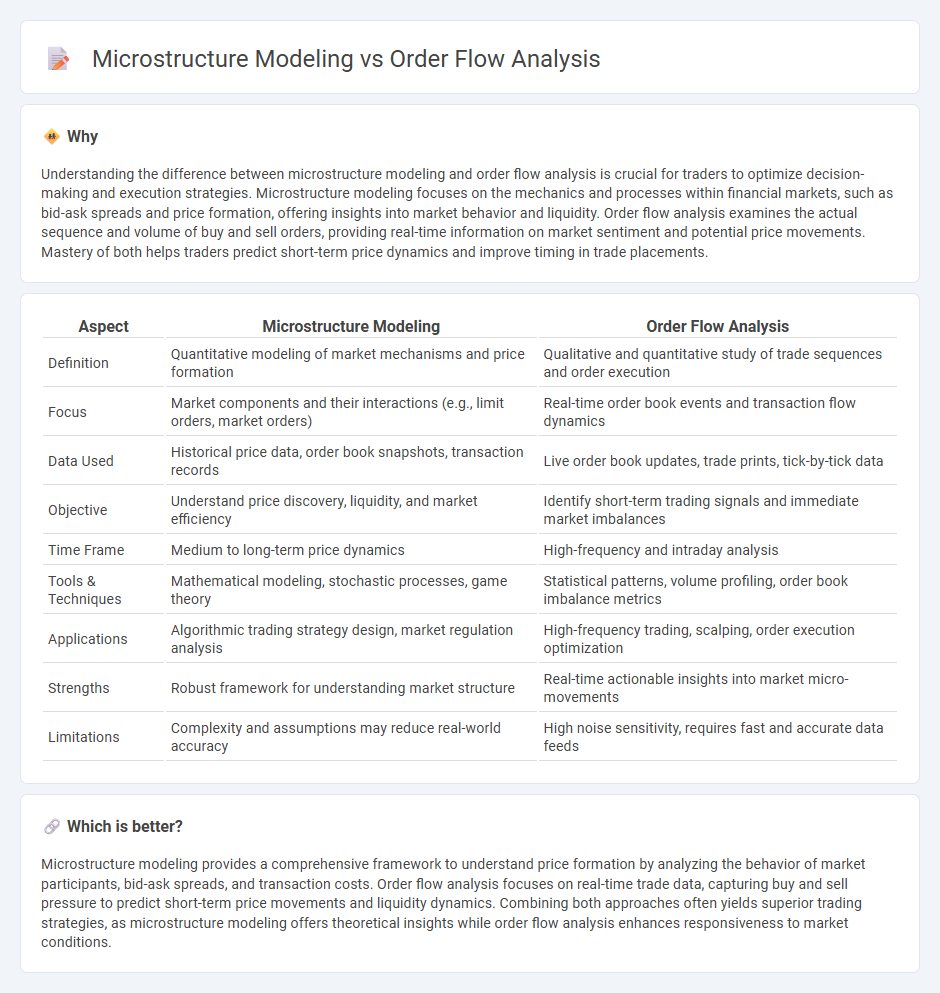

Understanding the difference between microstructure modeling and order flow analysis is crucial for traders to optimize decision-making and execution strategies. Microstructure modeling focuses on the mechanics and processes within financial markets, such as bid-ask spreads and price formation, offering insights into market behavior and liquidity. Order flow analysis examines the actual sequence and volume of buy and sell orders, providing real-time information on market sentiment and potential price movements. Mastery of both helps traders predict short-term price dynamics and improve timing in trade placements.

Comparison Table

| Aspect | Microstructure Modeling | Order Flow Analysis |

|---|---|---|

| Definition | Quantitative modeling of market mechanisms and price formation | Qualitative and quantitative study of trade sequences and order execution |

| Focus | Market components and their interactions (e.g., limit orders, market orders) | Real-time order book events and transaction flow dynamics |

| Data Used | Historical price data, order book snapshots, transaction records | Live order book updates, trade prints, tick-by-tick data |

| Objective | Understand price discovery, liquidity, and market efficiency | Identify short-term trading signals and immediate market imbalances |

| Time Frame | Medium to long-term price dynamics | High-frequency and intraday analysis |

| Tools & Techniques | Mathematical modeling, stochastic processes, game theory | Statistical patterns, volume profiling, order book imbalance metrics |

| Applications | Algorithmic trading strategy design, market regulation analysis | High-frequency trading, scalping, order execution optimization |

| Strengths | Robust framework for understanding market structure | Real-time actionable insights into market micro-movements |

| Limitations | Complexity and assumptions may reduce real-world accuracy | High noise sensitivity, requires fast and accurate data feeds |

Which is better?

Microstructure modeling provides a comprehensive framework to understand price formation by analyzing the behavior of market participants, bid-ask spreads, and transaction costs. Order flow analysis focuses on real-time trade data, capturing buy and sell pressure to predict short-term price movements and liquidity dynamics. Combining both approaches often yields superior trading strategies, as microstructure modeling offers theoretical insights while order flow analysis enhances responsiveness to market conditions.

Connection

Microstructure modeling examines the mechanics of trading processes, capturing the behavior of order flows, bid-ask spreads, and price formation within financial markets. Order flow analysis provides empirical data on the sequences and volumes of trades, which are essential inputs for microstructure models to simulate market dynamics accurately. Integrating order flow insights into microstructure modeling enhances the understanding of liquidity, volatility, and price discovery mechanisms in trading environments.

Key Terms

Order Flow Analysis:

Order flow analysis examines real-time transaction data to identify buying and selling pressure, providing traders with actionable insights into market dynamics and liquidity. This method leverages detailed trade and order book information to detect imbalances and potential price movements more precisely than traditional indicators. Explore how order flow analysis can enhance trading strategies and improve market prediction accuracy.

Trade Prints

Order flow analysis examines real-time Trade Prints to capture buyer and seller intentions, revealing market sentiment through volume, price, and timing patterns. Microstructure modeling employs statistical and econometric techniques to understand the underlying mechanisms influencing order execution and price formation at a granular level. Explore detailed comparisons to optimize trading strategies and enhance market prediction accuracy.

Limit Order Book

Order flow analysis examines the real-time transactions and order placements within the Limit Order Book (LOB) to identify patterns influencing price movements, while microstructure modeling mathematically represents the LOB dynamics to predict market behavior and liquidity. The LOB captures buy and sell orders at various price levels, making it central to both approaches in understanding supply-demand imbalances and execution strategies. Explore further to understand how combining these techniques enhances trading algorithms and risk management.

Source and External Links

Technical Analysis vs. Order Flow: Techniques and Tools for Traders - Order flow analysis involves observing real-time buy and sell orders, including their size and aggressiveness, to predict price movements by reading the order book and analyzing volume clusters at specific price levels as support or resistance zones.

Order Flow Trading Strategy That Pros Are Using In 2024 - Order flow trading is a form of technical analysis that examines the flow of market orders and their impact on price, using indicators like volume profile, order book imbalance, and cumulative delta to identify potential support and resistance and inform entry and exit decisions.

Order Flow Trading & Volumetric Bars | NinjaTrader - Order flow trading tools visualize buying and selling pressure with features like volumetric bars, volume profile, VWAP, and cumulative delta to help traders identify market trends, pressure imbalances, and key price levels for more informed trading decisions.

dowidth.com

dowidth.com