Dark pool prints represent large, non-public trades executed off traditional exchanges, often reflecting institutional trading activity hidden from the broader market. Time and sales data provide a detailed, real-time log of executed trades, including price, size, and time, essential for analyzing market liquidity and order flow. Explore deeper to understand how combining dark pool prints with time and sales data can enhance trading strategies and market insights.

Why it is important

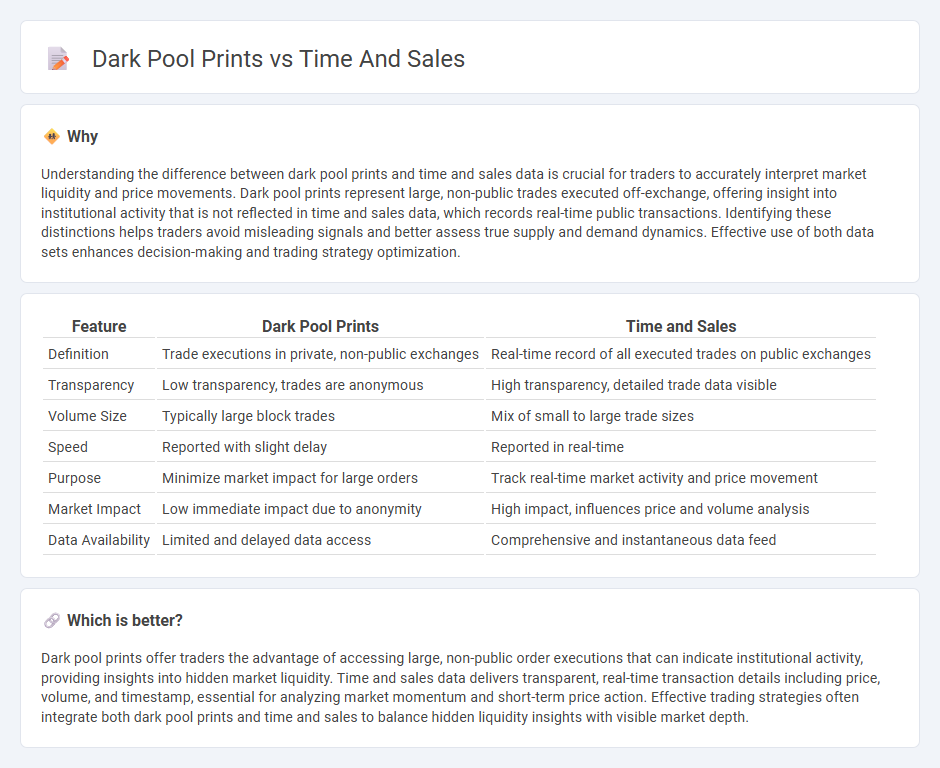

Understanding the difference between dark pool prints and time and sales data is crucial for traders to accurately interpret market liquidity and price movements. Dark pool prints represent large, non-public trades executed off-exchange, offering insight into institutional activity that is not reflected in time and sales data, which records real-time public transactions. Identifying these distinctions helps traders avoid misleading signals and better assess true supply and demand dynamics. Effective use of both data sets enhances decision-making and trading strategy optimization.

Comparison Table

| Feature | Dark Pool Prints | Time and Sales |

|---|---|---|

| Definition | Trade executions in private, non-public exchanges | Real-time record of all executed trades on public exchanges |

| Transparency | Low transparency, trades are anonymous | High transparency, detailed trade data visible |

| Volume Size | Typically large block trades | Mix of small to large trade sizes |

| Speed | Reported with slight delay | Reported in real-time |

| Purpose | Minimize market impact for large orders | Track real-time market activity and price movement |

| Market Impact | Low immediate impact due to anonymity | High impact, influences price and volume analysis |

| Data Availability | Limited and delayed data access | Comprehensive and instantaneous data feed |

Which is better?

Dark pool prints offer traders the advantage of accessing large, non-public order executions that can indicate institutional activity, providing insights into hidden market liquidity. Time and sales data delivers transparent, real-time transaction details including price, volume, and timestamp, essential for analyzing market momentum and short-term price action. Effective trading strategies often integrate both dark pool prints and time and sales to balance hidden liquidity insights with visible market depth.

Connection

Dark pool prints represent large, anonymous trades executed off public exchanges, which often appear in time and sales data as sudden volume spikes without corresponding price changes. Time and sales data reflect real-time trade information, including price, volume, and time, helping traders identify these hidden liquidity events. Understanding the interplay between dark pool prints and time and sales allows traders to detect potential market manipulation and improve trade execution strategies.

Key Terms

Tape (Time and Sales)

Time and Sales, also known as the Tape, provides real-time data on each executed trade including price, size, and time, offering transparent and immediate market activity insights. Dark pool prints represent large block trades executed off-exchange, typically hidden from the public order book, which can signal institutional activity but lack real-time transparency. Understanding the distinction between Tape and dark pool prints enhances trading strategy accuracy; explore further to master market microstructure nuances.

Block Trades (Dark Pool Prints)

Time and sales data provide real-time transaction details, including price, volume, and time of each trade, essential for understanding market momentum. Dark pool prints, representing block trades executed away from public exchanges, offer insights into large institutional orders that may influence price movements discreetly. Explore how analyzing block trades within dark pool prints can enhance your market strategy and trading decisions.

Liquidity

Time and sales data provides real-time transaction details including price, volume, and time, offering transparency in market liquidity and order flow. Dark pool prints reveal block trades executed anonymously off-exchange, indicating hidden liquidity that can influence price movements without public order book impact. Explore the nuances of market liquidity through time and sales and dark pool analysis to enhance your trading strategy.

Source and External Links

Time and Sales: How to Read the Tape Like a Pro - Warrior Trading - Time and sales, also known as "the tape," is a record of all stock transactions during the trading day, showing trade size, price, and time, helping traders identify supply and demand shifts in the market.

Time and Sales for Traders - The Complete Guide - Time and sales is a real-time feed of all executed trades for a security, used by traders to gauge demand by observing trade prices relative to bid and ask and speed of order flow for potential price changes.

Time & Sales Overview - TT Help Library - Trading Technologies - The Time & Sales widget shows real-time and historical trade data with details such as date, time, price, quantity, and trade aggressor, with color coding to indicate buying or selling pressure.

dowidth.com

dowidth.com