Tape reading focuses on analyzing real-time price and volume data to understand market sentiment and predict short-term price movements, offering traders immediate insights into supply and demand dynamics. Fundamental analysis evaluates a company's financial health, economic indicators, and industry conditions to determine intrinsic value and long-term investment potential. Explore these contrasting strategies to enhance your trading approach and market understanding.

Why it is important

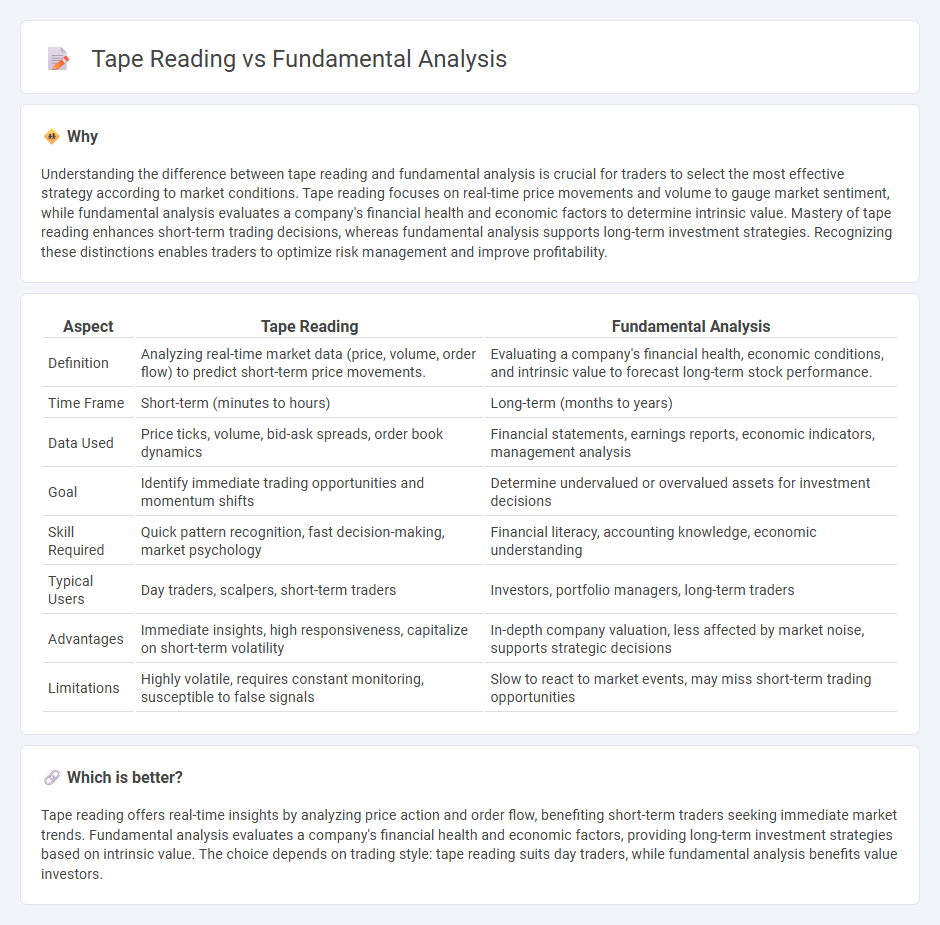

Understanding the difference between tape reading and fundamental analysis is crucial for traders to select the most effective strategy according to market conditions. Tape reading focuses on real-time price movements and volume to gauge market sentiment, while fundamental analysis evaluates a company's financial health and economic factors to determine intrinsic value. Mastery of tape reading enhances short-term trading decisions, whereas fundamental analysis supports long-term investment strategies. Recognizing these distinctions enables traders to optimize risk management and improve profitability.

Comparison Table

| Aspect | Tape Reading | Fundamental Analysis |

|---|---|---|

| Definition | Analyzing real-time market data (price, volume, order flow) to predict short-term price movements. | Evaluating a company's financial health, economic conditions, and intrinsic value to forecast long-term stock performance. |

| Time Frame | Short-term (minutes to hours) | Long-term (months to years) |

| Data Used | Price ticks, volume, bid-ask spreads, order book dynamics | Financial statements, earnings reports, economic indicators, management analysis |

| Goal | Identify immediate trading opportunities and momentum shifts | Determine undervalued or overvalued assets for investment decisions |

| Skill Required | Quick pattern recognition, fast decision-making, market psychology | Financial literacy, accounting knowledge, economic understanding |

| Typical Users | Day traders, scalpers, short-term traders | Investors, portfolio managers, long-term traders |

| Advantages | Immediate insights, high responsiveness, capitalize on short-term volatility | In-depth company valuation, less affected by market noise, supports strategic decisions |

| Limitations | Highly volatile, requires constant monitoring, susceptible to false signals | Slow to react to market events, may miss short-term trading opportunities |

Which is better?

Tape reading offers real-time insights by analyzing price action and order flow, benefiting short-term traders seeking immediate market trends. Fundamental analysis evaluates a company's financial health and economic factors, providing long-term investment strategies based on intrinsic value. The choice depends on trading style: tape reading suits day traders, while fundamental analysis benefits value investors.

Connection

Tape reading provides real-time market data by analyzing price and volume fluctuations on the ticker tape, which supports fundamental analysis by confirming or questioning the intrinsic value indicated by economic and financial reports. Combining tape reading with fundamental analysis allows traders to assess market sentiment and momentum alongside company earnings, revenue growth, and macroeconomic factors. This integrated approach helps identify entry and exit points with greater precision, improving the timing of trades based on both quantitative data and market psychology.

Key Terms

**Fundamental Analysis:**

Fundamental analysis evaluates a company's intrinsic value by examining financial statements, revenue growth, profit margins, and macroeconomic factors. This approach helps investors identify undervalued stocks and assess long-term growth potential compared to market prices. Discover how fundamental analysis can guide your investment decisions and improve portfolio outcomes.

Earnings

Fundamental analysis evaluates a company's intrinsic value by examining earnings reports, revenue growth, profit margins, and overall financial health to determine investment potential. Tape reading, on the other hand, focuses on real-time market transactions and order flow to gauge short-term price movements influenced by earnings announcements. Explore deeper insights into how earnings impact both strategies to enhance your trading approach.

Balance Sheet

Balance sheet analysis in fundamental analysis focuses on evaluating a company's assets, liabilities, and equity to determine its financial health and intrinsic value. Tape reading, however, prioritizes real-time price and volume data, offering insights into market sentiment without direct reference to the balance sheet. Explore how integrating balance sheet insights with tape reading can enhance your investment strategy.

Source and External Links

Fundamental Analysis - Corporate Finance Institute - Fundamental analysis is a method of determining the intrinsic value of a security by evaluating macroeconomic and microeconomic factors to inform investment decisions, aiming to identify whether a security is overvalued, undervalued, or fairly valued.

What is fundamental analysis? How to assess value in trading | Saxo - Fundamental analysis assesses an asset's intrinsic value by focusing on its core characteristics and industry environment, disregarding market sentiment and price movements to determine if the asset is over or undervalued.

Fundamental analysis - Wikipedia - Fundamental analysis involves analyzing economic, industry, and company data to estimate a stock's intrinsic value, guiding buy, hold, or sell decisions based on comparisons with the market price.

dowidth.com

dowidth.com