Airdrop farming involves collecting free cryptocurrency tokens distributed by blockchain projects to incentivize user participation, often requiring minimal initial investment. Options trading in crypto entails buying and selling derivative contracts that provide the right, but not the obligation, to buy or sell assets at predetermined prices, offering strategic opportunities for risk management and profit. Explore these trading methods to understand which aligns better with your investment goals and risk tolerance.

Why it is important

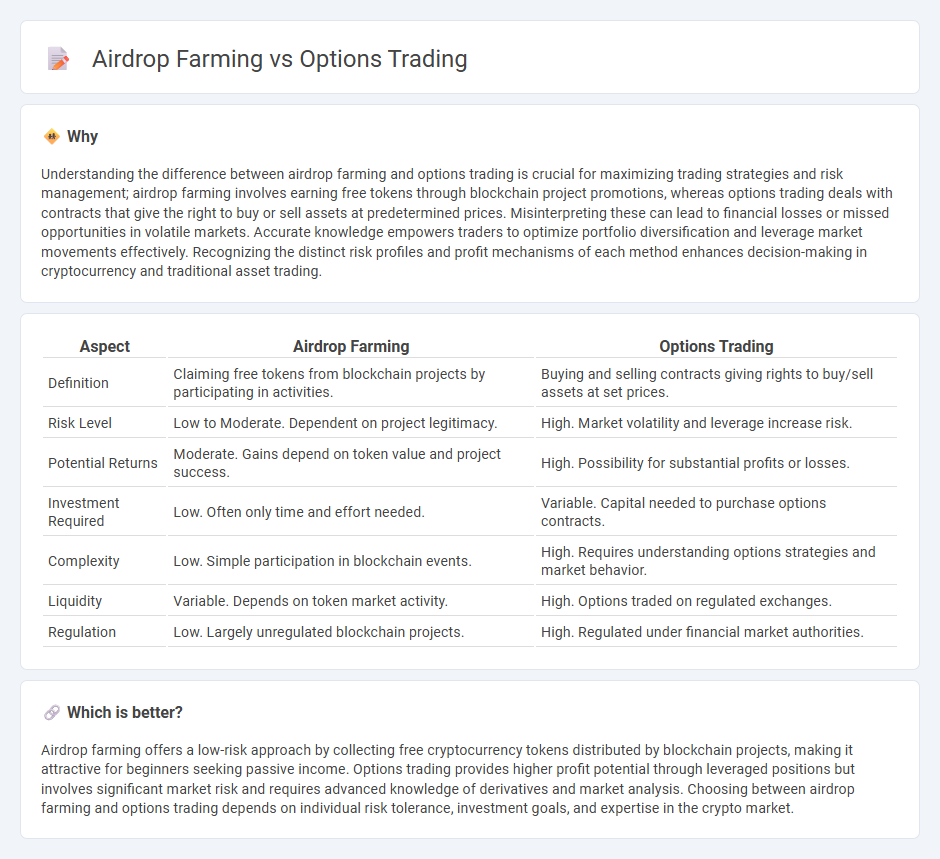

Understanding the difference between airdrop farming and options trading is crucial for maximizing trading strategies and risk management; airdrop farming involves earning free tokens through blockchain project promotions, whereas options trading deals with contracts that give the right to buy or sell assets at predetermined prices. Misinterpreting these can lead to financial losses or missed opportunities in volatile markets. Accurate knowledge empowers traders to optimize portfolio diversification and leverage market movements effectively. Recognizing the distinct risk profiles and profit mechanisms of each method enhances decision-making in cryptocurrency and traditional asset trading.

Comparison Table

| Aspect | Airdrop Farming | Options Trading |

|---|---|---|

| Definition | Claiming free tokens from blockchain projects by participating in activities. | Buying and selling contracts giving rights to buy/sell assets at set prices. |

| Risk Level | Low to Moderate. Dependent on project legitimacy. | High. Market volatility and leverage increase risk. |

| Potential Returns | Moderate. Gains depend on token value and project success. | High. Possibility for substantial profits or losses. |

| Investment Required | Low. Often only time and effort needed. | Variable. Capital needed to purchase options contracts. |

| Complexity | Low. Simple participation in blockchain events. | High. Requires understanding options strategies and market behavior. |

| Liquidity | Variable. Depends on token market activity. | High. Options traded on regulated exchanges. |

| Regulation | Low. Largely unregulated blockchain projects. | High. Regulated under financial market authorities. |

Which is better?

Airdrop farming offers a low-risk approach by collecting free cryptocurrency tokens distributed by blockchain projects, making it attractive for beginners seeking passive income. Options trading provides higher profit potential through leveraged positions but involves significant market risk and requires advanced knowledge of derivatives and market analysis. Choosing between airdrop farming and options trading depends on individual risk tolerance, investment goals, and expertise in the crypto market.

Connection

Airdrop farming leverages token distribution events to accumulate assets with potential value, creating opportunities for strategic entry into options trading. Options traders use these acquired tokens to hedge positions or speculate on price movements, enhancing portfolio flexibility and risk management. The synergy between airdrop farming and options trading increases liquidity and market participation in decentralized finance ecosystems.

Key Terms

**Options Trading:**

Options trading involves buying and selling contracts that grant the right to buy or sell an asset at a predetermined price within a set timeframe, offering leveraged exposure and risk management opportunities in financial markets. Key factors in options trading include strike prices, expiration dates, premiums, and volatility, which collectively influence potential profits and losses. Explore detailed strategies and market insights to optimize your options trading approach.

Strike Price

In options trading, the strike price is a critical factor determining the potential profitability and risk of a contract, influencing whether an option is exercised based on underlying asset prices. Airdrop farming, in contrast, involves acquiring tokens through promotional distributions without direct impact from strike prices, focusing more on token eligibility and distribution criteria. Explore the nuances of strike prices in options trading versus token acquisition strategies in airdrop farming to optimize your investment approach.

Expiration Date

Options trading involves contracts with specified expiration dates, requiring traders to strategize around time decay and market volatility before the option expires. Airdrop farming, by contrast, often lacks fixed expiration, relying on blockchain project timelines and token distribution events to claim rewards. Explore further to understand how the expiration date fundamentally influences risk and opportunity in these two strategies.

Source and External Links

Options | FINRA.org - Options are contracts offering the right to buy or sell an underlying asset at a specific price, allowing investors to profit from changes in the asset's value without owning it, involving buying or selling calls or puts initiated by opening purchase or sale trades.

Options Trading: Step-by-Step Guide for Beginners - Options trading involves buying or selling contracts that give the right to buy or sell stocks at predetermined strike prices by set dates, allowing profit opportunities through exercising or reselling these contracts depending on stock price movements.

Option (finance) - Wikipedia - An option is a financial contract giving the holder the right, but not the obligation, to buy or sell an asset at a set price on or before expiration, with common strategies including buying calls when expecting price rises and limiting losses to the premium paid.

dowidth.com

dowidth.com