Market microstructure examines the mechanisms and rules that govern how trades are executed, focusing on the behavior of market participants and the structure of trading venues. Order flow analysis centers on the real-time buying and selling pressure, providing insights into supply and demand dynamics through order book data. Explore the nuances of market microstructure and order flow to enhance your trading strategies and market understanding.

Why it is important

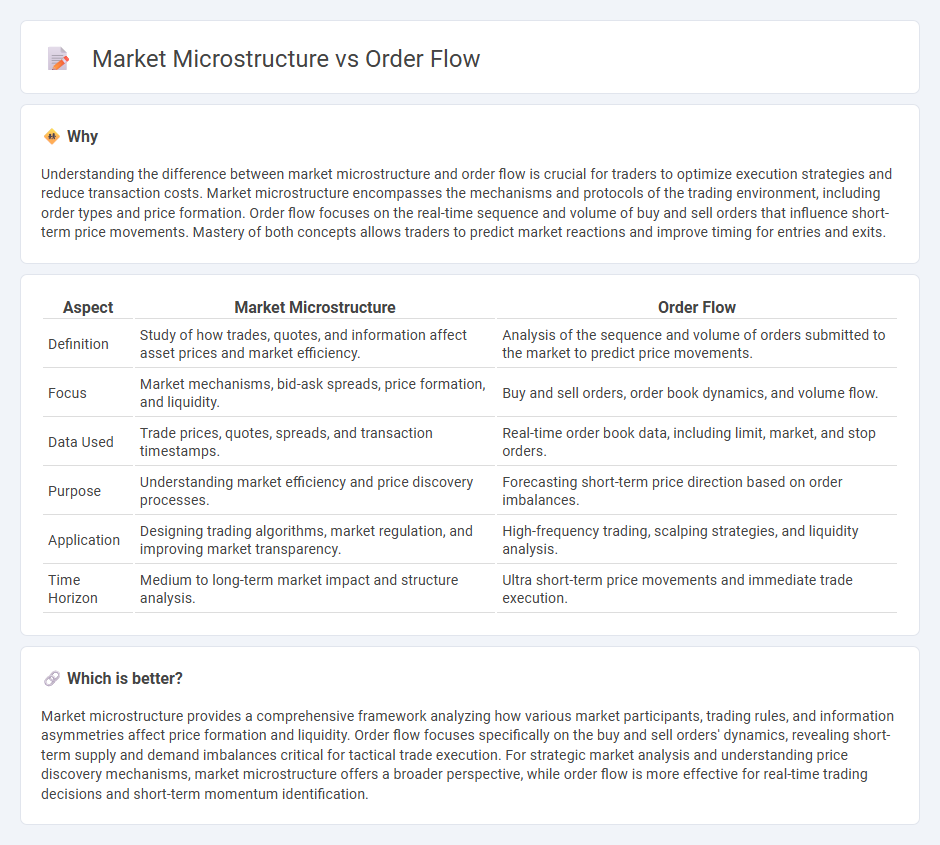

Understanding the difference between market microstructure and order flow is crucial for traders to optimize execution strategies and reduce transaction costs. Market microstructure encompasses the mechanisms and protocols of the trading environment, including order types and price formation. Order flow focuses on the real-time sequence and volume of buy and sell orders that influence short-term price movements. Mastery of both concepts allows traders to predict market reactions and improve timing for entries and exits.

Comparison Table

| Aspect | Market Microstructure | Order Flow |

|---|---|---|

| Definition | Study of how trades, quotes, and information affect asset prices and market efficiency. | Analysis of the sequence and volume of orders submitted to the market to predict price movements. |

| Focus | Market mechanisms, bid-ask spreads, price formation, and liquidity. | Buy and sell orders, order book dynamics, and volume flow. |

| Data Used | Trade prices, quotes, spreads, and transaction timestamps. | Real-time order book data, including limit, market, and stop orders. |

| Purpose | Understanding market efficiency and price discovery processes. | Forecasting short-term price direction based on order imbalances. |

| Application | Designing trading algorithms, market regulation, and improving market transparency. | High-frequency trading, scalping strategies, and liquidity analysis. |

| Time Horizon | Medium to long-term market impact and structure analysis. | Ultra short-term price movements and immediate trade execution. |

Which is better?

Market microstructure provides a comprehensive framework analyzing how various market participants, trading rules, and information asymmetries affect price formation and liquidity. Order flow focuses specifically on the buy and sell orders' dynamics, revealing short-term supply and demand imbalances critical for tactical trade execution. For strategic market analysis and understanding price discovery mechanisms, market microstructure offers a broader perspective, while order flow is more effective for real-time trading decisions and short-term momentum identification.

Connection

Market microstructure examines the processes and mechanisms through which trades are executed, directly influencing order flow dynamics by determining how buy and sell orders interact within the trading environment. Order flow provides critical real-time data on transaction sequences, liquidity, and price formation, reflecting the underlying market microstructure's impact on trader behavior and market efficiency. Understanding their connection enhances strategies for optimizing trade execution and minimizing market impact costs.

Key Terms

Liquidity

Order flow reveals the direct sequence of buy and sell orders impacting liquidity across various price levels in real-time, providing traders with actionable insights into supply and demand dynamics. Market microstructure studies the mechanisms and rules governing trade execution, bid-ask spreads, and order book depth, highlighting how liquidity is formed and maintained. Explore detailed analyses to understand how order flow and market microstructure jointly influence liquidity conditions in financial markets.

Order Book

Order flow examines the sequence and volume of trades to gauge market demand, while market microstructure delves into the mechanisms and protocols governing how orders are processed within the order book. The order book reflects real-time buy and sell interest, revealing liquidity, bid-ask spreads, and potential price movements crucial for high-frequency trading and price discovery. Explore the intricacies of order flow and market microstructure to enhance your trading strategy and market insight.

Trade Execution

Order flow provides real-time data on buy and sell orders, influencing trade execution strategies by revealing the immediate market demand and supply. Market microstructure examines the mechanisms and rules governing how orders are matched and trades are executed, including factors like bid-ask spreads, order types, and market depth. Explore further to understand how integrating order flow insights with market microstructure analysis can optimize execution efficiency and reduce trading costs.

Source and External Links

Technical Analysis vs. Order Flow: Techniques and Tools for Traders - Order flow analysis involves observing and interpreting the real-time flow of buy and sell orders, including their size and aggressiveness, to predict price movements by strategies such as reading the order book and volume analysis.

Lesson 1 - The Basics of Order Flow - Jigsaw Trading - Order flow analysis studies how market and limit orders interact, with price movement determined by the consumption of bids or offers, providing insight into buying and selling pressure in the market.

Order Flow Trading & Volumetric Bars | NinjaTrader - Order flow trading uses visual tools like volumetric bars, volume profile, and cumulative delta to track buying vs. selling pressure, confirm trends, identify support/resistance, and analyze market momentum in real time.

dowidth.com

dowidth.com