Trading with a prop firm involves managing real capital under strict risk controls, drastically differing from the risk-free environment of paper trading where no actual money is at stake. Prop firms require traders to consistently demonstrate profitability and discipline to mitigate losses, whereas paper trading primarily focuses on strategy development and skill-building without emotional pressure. Explore the key challenges and strategies to transition successfully from paper trading to prop firm trading.

Why it is important

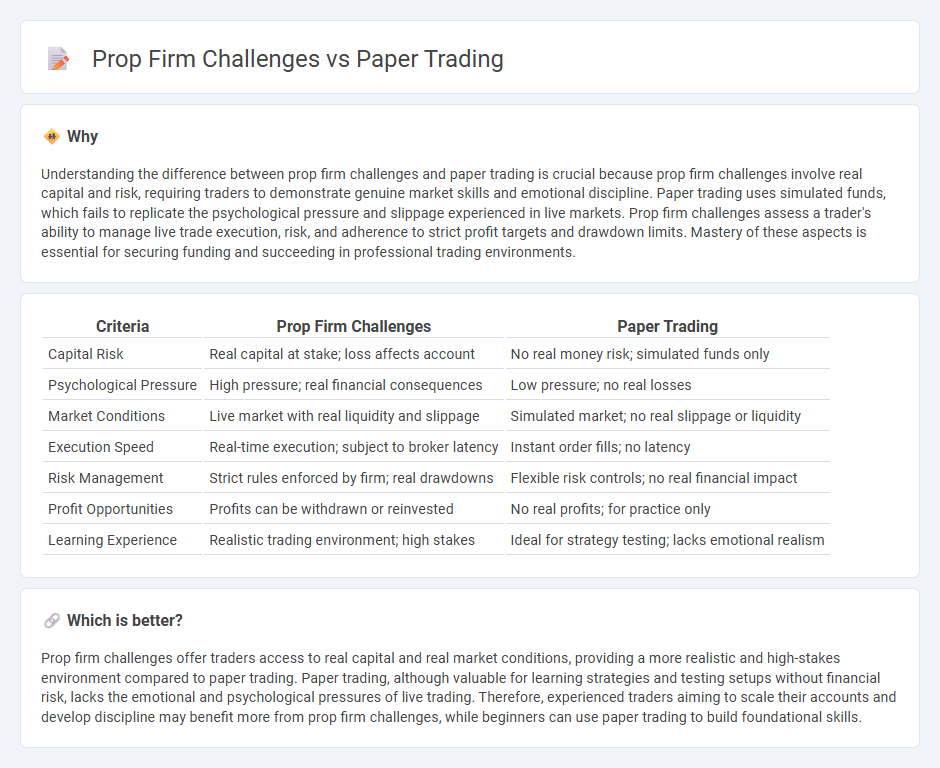

Understanding the difference between prop firm challenges and paper trading is crucial because prop firm challenges involve real capital and risk, requiring traders to demonstrate genuine market skills and emotional discipline. Paper trading uses simulated funds, which fails to replicate the psychological pressure and slippage experienced in live markets. Prop firm challenges assess a trader's ability to manage live trade execution, risk, and adherence to strict profit targets and drawdown limits. Mastery of these aspects is essential for securing funding and succeeding in professional trading environments.

Comparison Table

| Criteria | Prop Firm Challenges | Paper Trading |

|---|---|---|

| Capital Risk | Real capital at stake; loss affects account | No real money risk; simulated funds only |

| Psychological Pressure | High pressure; real financial consequences | Low pressure; no real losses |

| Market Conditions | Live market with real liquidity and slippage | Simulated market; no real slippage or liquidity |

| Execution Speed | Real-time execution; subject to broker latency | Instant order fills; no latency |

| Risk Management | Strict rules enforced by firm; real drawdowns | Flexible risk controls; no real financial impact |

| Profit Opportunities | Profits can be withdrawn or reinvested | No real profits; for practice only |

| Learning Experience | Realistic trading environment; high stakes | Ideal for strategy testing; lacks emotional realism |

Which is better?

Prop firm challenges offer traders access to real capital and real market conditions, providing a more realistic and high-stakes environment compared to paper trading. Paper trading, although valuable for learning strategies and testing setups without financial risk, lacks the emotional and psychological pressures of live trading. Therefore, experienced traders aiming to scale their accounts and develop discipline may benefit more from prop firm challenges, while beginners can use paper trading to build foundational skills.

Connection

Prop firm challenges simulate real-market conditions, allowing traders to demonstrate consistent profitability and risk management skills before accessing firm capital. Paper trading offers a risk-free environment to refine strategies and build discipline by replicating trading scenarios without financial exposure. Both methods emphasize skill development and performance validation essential for succeeding in professional trading environments.

Key Terms

Simulated Trading

Simulated trading in paper trading environments allows traders to practice strategies without risking real capital, providing a risk-free platform to hone skills and test market behaviors. Prop firm challenges often rely on simulated trading phases to evaluate a trader's performance under realistic conditions before offering funded accounts, demanding strict adherence to profit targets and risk rules. Explore the nuances of simulated trading in prop firm challenges to enhance your approach and increase your chances of success.

Evaluation Phase

Paper trading allows traders to practice strategies in a risk-free environment, but it lacks the psychological pressure inherent in prop firm challenges during the Evaluation Phase, where traders must meet strict profit targets and risk management rules. Prop firm evaluations simulate real market conditions with real money at stake, requiring consistent performance and discipline over a set period. Discover detailed strategies to successfully navigate the Evaluation Phase and advance in prop trading programs.

Funded Account

Paper trading allows traders to practice strategies without financial risk, using simulated market conditions for skill development. Funded accounts from prop firms provide real capital and access to professional trading platforms, but require passing stringent challenges that test risk management, consistency, and profitability. Explore how these differences impact your readiness to succeed in funded prop trading environments.

Source and External Links

Paper Trading At TradeZero: 100% Risk Free - TradeZero offers a free one-month paper trading account with real-time NASDAQ Basic market data and full platform features, allowing practice of buying and selling without real money risk.

Paper Trading -- main functionality - TradingView - TradingView provides a risk-free paper trading simulator with a $100,000 virtual balance, flexible leverage options, and the ability to reset or create multiple accounts for strategy testing.

Paper Trading | Charles Schwab - Schwab's paperMoney(r) on thinkorswim offers virtual trading with $100,000 buying power, real-time market data, and tools for equities, options, futures, and forex to practice and refine trading strategies without financial risk.

dowidth.com

dowidth.com