High frequency trading (HFT) bots execute thousands of trades per second, leveraging algorithms to capitalize on minute price discrepancies across markets, resulting in rapid profit accumulation. Swing trading bots adopt a longer-term strategy, holding positions for days or weeks to benefit from market momentum and price swings influenced by technical indicators. Explore the unique advantages and risks associated with each bot type to enhance your trading strategy.

Why it is important

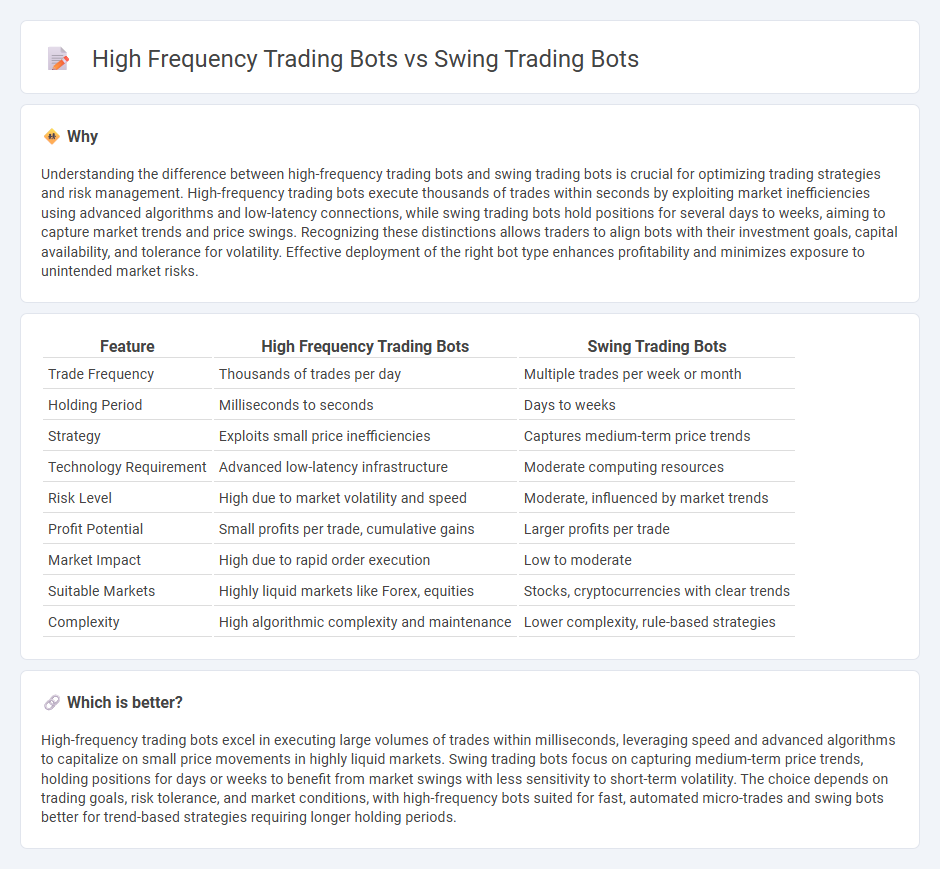

Understanding the difference between high-frequency trading bots and swing trading bots is crucial for optimizing trading strategies and risk management. High-frequency trading bots execute thousands of trades within seconds by exploiting market inefficiencies using advanced algorithms and low-latency connections, while swing trading bots hold positions for several days to weeks, aiming to capture market trends and price swings. Recognizing these distinctions allows traders to align bots with their investment goals, capital availability, and tolerance for volatility. Effective deployment of the right bot type enhances profitability and minimizes exposure to unintended market risks.

Comparison Table

| Feature | High Frequency Trading Bots | Swing Trading Bots |

|---|---|---|

| Trade Frequency | Thousands of trades per day | Multiple trades per week or month |

| Holding Period | Milliseconds to seconds | Days to weeks |

| Strategy | Exploits small price inefficiencies | Captures medium-term price trends |

| Technology Requirement | Advanced low-latency infrastructure | Moderate computing resources |

| Risk Level | High due to market volatility and speed | Moderate, influenced by market trends |

| Profit Potential | Small profits per trade, cumulative gains | Larger profits per trade |

| Market Impact | High due to rapid order execution | Low to moderate |

| Suitable Markets | Highly liquid markets like Forex, equities | Stocks, cryptocurrencies with clear trends |

| Complexity | High algorithmic complexity and maintenance | Lower complexity, rule-based strategies |

Which is better?

High-frequency trading bots excel in executing large volumes of trades within milliseconds, leveraging speed and advanced algorithms to capitalize on small price movements in highly liquid markets. Swing trading bots focus on capturing medium-term price trends, holding positions for days or weeks to benefit from market swings with less sensitivity to short-term volatility. The choice depends on trading goals, risk tolerance, and market conditions, with high-frequency bots suited for fast, automated micro-trades and swing bots better for trend-based strategies requiring longer holding periods.

Connection

High frequency trading (HFT) bots and swing trading bots both leverage algorithmic strategies to optimize trade execution, but they operate on different time scales and market signals. HFT bots execute thousands of trades per second by exploiting minor price discrepancies, while swing trading bots analyze technical indicators and market trends to hold positions for days or weeks. Their connection lies in the use of automated algorithms and data-driven decision-making processes to enhance trading efficiency and profitability.

Key Terms

Trade Frequency

Swing trading bots execute trades over several days to weeks, capitalizing on medium-term market trends with lower trade frequency. High frequency trading bots perform thousands of trades per second, exploiting small price discrepancies through rapid execution and algorithmic precision. Explore the distinct advantages and applications of both trading bot types to optimize your trading strategy.

Holding Period

Swing trading bots typically maintain positions from several days to weeks, capitalizing on medium-term market trends by analyzing price momentum and technical indicators. High frequency trading (HFT) bots execute trades within milliseconds to seconds, focusing on exploiting small price discrepancies through rapid order execution and market making. Discover more about how holding period impacts strategy effectiveness in automated trading.

Execution Speed

Swing trading bots operate over longer time frames, analyzing price trends and holding positions from days to weeks, prioritizing strategy accuracy over execution speed. High frequency trading (HFT) bots execute thousands of trades per second, leveraging ultra-low latency infrastructure to capitalize on micro price discrepancies in milliseconds. Explore the technical and strategic nuances between swing trading and HFT bots to enhance your algorithmic trading approach.

Source and External Links

Swing Trading Tool for Crypto | Automate Market Swings - Swing trading bots hold trades for days targeting larger price shifts by automating smart entries and exits using indicators like RSI and MACD, managing positions with scaling, trailing stops, and take profits, thereby reducing emotional trading and manual oversight.

SwingTradeBot - Your Stock Trading Assistant ... - SwingTradeBot scans NYSE, NASDAQ, and AMEX stocks in real time to provide automated alerts, technical analysis, and trade signals to help traders identify key setups and manage routine trades efficiently.

How an Automated Swing Trading Bot Can Transform Your Trading Strategy - Automated swing trading bots analyze real-time data to execute trades automatically, eliminate emotional bias, enable 24/7 monitoring, backtest strategies, and adapt via AI to improve accuracy and consistency in swing trading.

dowidth.com

dowidth.com